Your Ultimate Guide to Sourcing Cu Metal

Introduction: Navigating the Global Market for cu metal

In an era where technological advancement and global connectivity drive industrial growth, copper (cu) metal emerges as a vital component across numerous sectors. Its unparalleled conductivity, malleability, and resistance to corrosion make it indispensable in industries ranging from electronics and renewable energy to construction and automotive manufacturing. For B2B buyers operating in diverse markets—particularly in Africa, South America, the Middle East, and Europe—understanding the intricacies of sourcing copper is essential for optimizing operations and ensuring project success.

This guide serves as a comprehensive resource, addressing critical aspects of sourcing cu metal. It explores various types of copper products, including raw copper, alloys, and fabricated components, while delving into manufacturing processes and quality control standards that guarantee product reliability. Furthermore, it outlines strategies for evaluating and selecting suppliers, considering factors such as regional market dynamics, logistics, and compliance with international standards.

By equipping buyers with actionable insights on cost structures, market trends, and common FAQs, this guide empowers informed decision-making and strategic sourcing. With a focus on mitigating risks and maximizing value, international buyers will find the tools they need to navigate the complexities of the global copper market effectively. Whether you are sourcing for a new project or optimizing existing supply chains, understanding the nuances of cu metal will provide a competitive edge in today’s fast-paced industrial landscape.

Understanding cu metal Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Copper (Cu) | High electrical and thermal conductivity | Electrical wiring, plumbing, roofing | Excellent conductivity; susceptible to corrosion |

| Copper Alloys | Combinations with other metals for enhanced properties | Aerospace, automotive, marine | Improved strength and corrosion resistance; more expensive than pure copper |

| Electrolytic Copper | Highly purified copper used in electrical applications | Electronics, power generation | Superior conductivity; higher cost due to purity |

| Copper Tubing | Hollow copper pipes for various applications | HVAC systems, refrigeration | Lightweight and durable; potential for leaks if not properly joined |

| Copper Foil | Thin sheets of copper used in flexible applications | Electronics, batteries, shielding | Flexible and conductive; limited structural strength |

Copper (Cu)

Copper is renowned for its exceptional electrical and thermal conductivity, making it a preferred material in industries such as electrical wiring, plumbing, and roofing. Buyers should consider the purity of the copper, as higher purity often translates to better performance in electrical applications. However, copper is also susceptible to corrosion, which may necessitate protective coatings or additional treatments for certain applications, especially in humid or corrosive environments.

Copper Alloys

Copper alloys, which combine copper with elements like zinc (brass) or tin (bronze), enhance the metal’s strength and resistance to wear and corrosion. These alloys are widely used in aerospace, automotive, and marine applications, where durability and performance are critical. When sourcing copper alloys, buyers should assess the specific alloy composition and its suitability for their intended application, as the properties can vary significantly. Cost is also a factor, as alloys can be more expensive than pure copper.

Electrolytic Copper

Electrolytic copper is a high-purity form of copper produced through an electrolysis process, making it ideal for applications requiring superior conductivity, such as electronics and power generation. Buyers should prioritize suppliers that can guarantee the purity levels required for their projects, as this directly affects performance. Although the cost of electrolytic copper is higher, its advantages in efficiency and reliability often justify the investment, particularly in high-performance applications.

Copper Tubing

Copper tubing is widely utilized in HVAC systems and refrigeration due to its lightweight and durable properties. This type of copper is easily formed and joined, making it ideal for applications requiring a reliable flow of fluids. Buyers should ensure that the tubing meets relevant standards for pressure and temperature ratings, as improper specifications can lead to leaks and system failures. Cost considerations also include potential installation expenses, as specialized skills may be required for proper joining techniques.

Copper Foil

Copper foil is a thin sheet of copper that finds applications in electronics, batteries, and shielding. Its flexibility and conductivity make it suitable for a variety of uses, particularly in the manufacturing of circuit boards and other electronic components. Buyers should evaluate the thickness and quality of the foil, as these factors influence performance in specific applications. While copper foil offers excellent conductivity, its limited structural strength means it may not be suitable for high-stress environments.

Related Video: What Makes Large Language Models Expensive?

Key Industrial Applications of cu metal

| Industry/Sector | Specific Application of cu metal | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Electrical & Electronics | Wiring and electrical connectors | High conductivity and reliability enhance performance | Compliance with international standards (e.g., IEC, UL) |

| Construction & Infrastructure | Plumbing and roofing materials | Corrosion resistance ensures longevity and reliability | Local regulations, availability of alloys, and finishes |

| Renewable Energy | Solar panel connectors and inverters | Efficient energy transfer increases system performance | Supplier’s experience with renewable energy applications |

| Automotive | Radiators and heat exchangers | Improved thermal conductivity enhances engine efficiency | Quality certifications and compatibility with OEM standards |

| Aerospace & Defense | Aircraft components and wiring | Lightweight yet strong properties reduce weight and improve fuel efficiency | Adherence to strict aerospace quality and safety standards |

Electrical & Electronics

In the electrical and electronics sector, copper is essential for wiring and connectors due to its exceptional conductivity. B2B buyers must ensure that suppliers can provide high-purity copper that meets international standards such as IEC and UL. Additionally, assessing the supplier’s ability to deliver customized solutions, including varying gauge sizes and specialized coatings, can significantly impact project timelines and overall performance.

Construction & Infrastructure

Copper’s corrosion resistance makes it a popular choice for plumbing and roofing materials in construction and infrastructure projects. Its durability ensures long-term performance and reduces maintenance costs. International buyers should consider local regulations regarding material use and environmental impact, as well as the availability of specific copper alloys and finishes that may be required for compliance with regional building codes.

Renewable Energy

In renewable energy applications, particularly solar energy, copper is used in connectors and inverters due to its superior conductivity and reliability. This enhances energy transfer efficiency, vital for maximizing system performance. Buyers should prioritize suppliers with experience in renewable energy projects, ensuring they can meet the specific technical requirements and quality standards necessary for this rapidly evolving sector.

Automotive

Copper plays a critical role in automotive applications, particularly in radiators and heat exchangers, where its thermal conductivity is vital for engine efficiency. Buyers in this sector must focus on sourcing from suppliers who hold quality certifications and can guarantee compatibility with OEM standards. Understanding the supplier’s production capabilities and lead times is essential to avoid disruptions in the supply chain.

Aerospace & Defense

In the aerospace and defense industries, copper is utilized in wiring and various components due to its lightweight yet strong characteristics. This quality helps reduce overall aircraft weight, enhancing fuel efficiency. B2B buyers must ensure that suppliers adhere to stringent aerospace quality and safety standards, such as AS9100, to mitigate risks associated with compliance and performance in critical applications.

Related Video: Metal Organic Frameworks (MOFs) Preparation and their Applications- University of Arkansas

Strategic Material Selection Guide for cu metal

When selecting materials for copper (Cu) metal applications, international B2B buyers must consider various factors that influence performance, cost, and compliance. Below is an analysis of four common materials used in conjunction with copper, focusing on their properties, advantages, disadvantages, and specific considerations for buyers from Africa, South America, the Middle East, and Europe.

Copper Alloys

Copper alloys, such as bronze (copper-tin) and brass (copper-zinc), are widely used in various applications due to their enhanced properties compared to pure copper.

- Key Properties: These alloys exhibit improved strength, corrosion resistance, and wear resistance. They can withstand moderate to high temperatures, making them suitable for applications in automotive and marine industries.

- Pros & Cons: The main advantage of copper alloys is their superior mechanical properties and aesthetic appeal. However, they can be more expensive than pure copper and may require more complex manufacturing processes.

- Impact on Application: Copper alloys are compatible with various media, including seawater and industrial chemicals, making them suitable for plumbing, electrical connectors, and decorative items.

- Considerations for Buyers: Compliance with international standards such as ASTM and DIN is crucial. Buyers should also consider the alloy’s specific properties to ensure suitability for their applications, especially in regions with varying environmental conditions.

Copper-Nickel Alloys

Copper-nickel alloys (Cu-Ni) are known for their excellent corrosion resistance, particularly in marine environments.

- Key Properties: These alloys can handle high pressures and temperatures while offering exceptional resistance to biofouling and corrosion from seawater.

- Pros & Cons: The primary advantage is their durability in harsh environments, making them ideal for marine applications. However, they are relatively costly and may require specialized welding techniques.

- Impact on Application: Ideal for shipbuilding, heat exchangers, and offshore platforms, copper-nickel alloys ensure longevity and reliability in saltwater applications.

- Considerations for Buyers: Buyers must ensure compliance with marine standards and specifications, which can vary by region. Understanding local regulations regarding material sourcing is also vital.

Copper-Titanium Alloys

Copper-titanium alloys are emerging materials that combine the best properties of both metals.

- Key Properties: These alloys exhibit high strength, excellent fatigue resistance, and good electrical conductivity. They can operate effectively at elevated temperatures.

- Pros & Cons: The key advantage is their ability to maintain performance under stress, making them suitable for high-performance applications. However, they can be challenging to machine and may have higher initial costs.

- Impact on Application: These alloys are particularly useful in aerospace and high-tech industries, where reliability and performance are critical.

- Considerations for Buyers: International buyers should be aware of the specific machining requirements and ensure that their suppliers have the capability to work with these advanced materials. Compliance with aerospace standards is also essential.

Pure Copper

Pure copper remains a popular choice for many applications due to its excellent electrical and thermal conductivity.

- Key Properties: It has a high melting point, good ductility, and resistance to corrosion, especially in non-oxidizing environments.

- Pros & Cons: The main advantage is its superior conductivity, making it ideal for electrical applications. However, pure copper is softer and less durable than alloys, which can limit its use in high-stress applications.

- Impact on Application: Commonly used in electrical wiring, plumbing, and heat exchangers, pure copper is well-suited for applications requiring high conductivity.

- Considerations for Buyers: Buyers must ensure that the copper meets international standards such as ASTM B170. Additionally, they should consider the local availability of pure copper and its price volatility, especially in regions with fluctuating market conditions.

Summary Table

| Material | Typical Use Case for cu metal | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Copper Alloys | Plumbing, electrical connectors | Superior mechanical properties | Higher cost than pure copper | Medium |

| Copper-Nickel Alloys | Marine applications, heat exchangers | Excellent corrosion resistance | Relatively costly | High |

| Copper-Titanium Alloys | Aerospace, high-tech industries | High strength and fatigue resistance | Challenging to machine | High |

| Pure Copper | Electrical wiring, plumbing | Superior electrical conductivity | Softer and less durable | Low |

This guide provides essential insights for international B2B buyers in selecting the appropriate copper materials for their specific applications, ensuring they make informed decisions that align with their operational requirements and compliance standards.

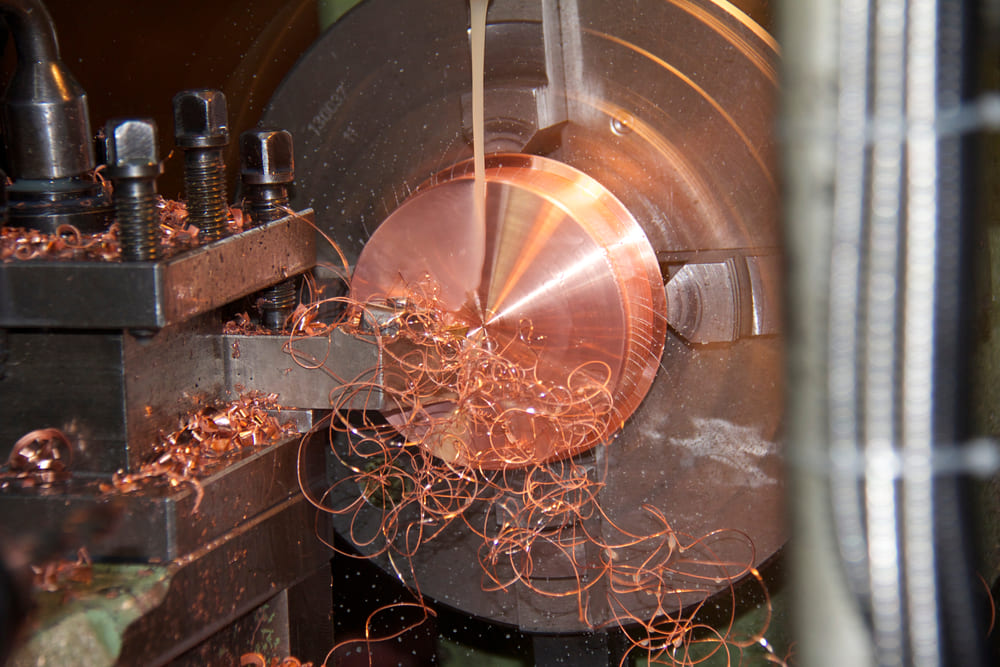

In-depth Look: Manufacturing Processes and Quality Assurance for cu metal

When sourcing cu metal (copper metal), understanding the manufacturing processes and quality assurance protocols is crucial for B2B buyers. This knowledge not only aids in selecting the right suppliers but also ensures that the end products meet the required specifications and standards. Below is an in-depth exploration of the typical manufacturing stages, key techniques involved, and essential quality assurance measures relevant to international buyers, particularly those from Africa, South America, the Middle East, and Europe.

Manufacturing Processes for Cu Metal

The manufacturing process of cu metal can be divided into several main stages:

1. Material Preparation

The first step involves sourcing high-quality raw copper, which can be in the form of cathodes, billets, or sheets. The purity of the copper is vital, as higher purity levels lead to better electrical and thermal conductivity. Buyers should ensure that suppliers provide material certifications, detailing the chemical composition and purity levels.

Key Techniques:

– Melting and Refining: Copper is melted in a furnace and refined to remove impurities. This process can include processes such as electrolysis for further purification.

– Casting: The molten copper is cast into desired shapes, such as ingots or billets, which can later be processed into final products.

2. Forming

Once the copper is prepared, it undergoes various forming processes to achieve the required shapes and dimensions. This can include:

- Rolling: Copper sheets are produced through hot or cold rolling. Hot rolling involves processing at high temperatures, while cold rolling is done at room temperature, enhancing surface finish and dimensional accuracy.

- Extrusion: In this process, copper is forced through a die to create specific cross-sectional profiles, ideal for tubing and rods.

- Stamping and Forging: These methods are employed for creating complex shapes and components, often used in electrical connectors and automotive parts.

3. Assembly

After forming, components may need to be assembled into final products. This can involve:

- Welding: Different copper components can be welded together using techniques such as TIG (Tungsten Inert Gas) or MIG (Metal Inert Gas) welding, ensuring strong and durable joints.

- Soldering: For electrical applications, soldering is often employed to join copper parts without compromising their conductivity.

4. Finishing

The final stage includes finishing processes that enhance the surface properties of the copper components. This may involve:

- Plating: Applying a thin layer of another metal to improve corrosion resistance or enhance electrical conductivity.

- Coating: Protective coatings can be applied to prevent oxidation and enhance durability.

- Polishing: This step is crucial for aesthetic purposes, especially for decorative applications.

Quality Assurance (QA) for Cu Metal

Quality assurance is vital in ensuring that the final products meet industry standards and customer expectations. Here are the key components of a robust QA process:

International Standards

B2B buyers should look for suppliers that comply with relevant international standards, such as:

- ISO 9001: This standard outlines requirements for a quality management system, focusing on customer satisfaction and continuous improvement.

- CE Marking: For products sold in Europe, CE marking indicates conformity with health, safety, and environmental protection standards.

- API Standards: For applications in the oil and gas industry, adherence to American Petroleum Institute (API) specifications is critical.

Quality Control Checkpoints

Quality control is typically structured around several checkpoints:

- Incoming Quality Control (IQC): This involves inspecting raw materials upon arrival to ensure they meet specified standards.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing processes to identify and rectify any deviations from quality standards.

- Final Quality Control (FQC): A thorough inspection of the finished products, including dimensional checks and performance testing.

Common Testing Methods

Several testing methods are employed to ensure quality, including:

- Non-Destructive Testing (NDT): Techniques such as ultrasonic testing, radiographic testing, and eddy current testing are used to detect internal defects without damaging the product.

- Mechanical Testing: This includes tensile tests, hardness tests, and impact tests to assess the physical properties of the copper components.

- Chemical Analysis: To verify the composition and purity of the copper, spectrometric analysis and other chemical tests are commonly used.

Verifying Supplier Quality Control

B2B buyers can take several steps to verify the quality assurance practices of their suppliers:

- Audits: Conduct regular audits of suppliers to assess their quality management systems and adherence to standards. This can include on-site visits and reviews of documentation.

- Requesting Quality Reports: Suppliers should be able to provide detailed quality reports that outline their processes, testing results, and compliance with standards.

- Third-Party Inspections: Engaging third-party inspection agencies can provide an unbiased evaluation of the supplier’s quality control measures and product compliance.

Regional Considerations for International Buyers

Buyers from diverse regions such as Africa, South America, the Middle East, and Europe should be aware of specific nuances in quality assurance:

- Cultural and Regulatory Differences: Understanding local regulations and cultural expectations regarding quality can influence sourcing decisions. For instance, buyers in Europe may have stricter compliance requirements compared to those in other regions.

- Logistics and Transportation: The logistics involved in transporting cu metal can impact quality, particularly in terms of damage during transit. Buyers should ensure that suppliers have robust packaging and shipping protocols to safeguard products.

By comprehensively understanding the manufacturing processes and quality assurance standards associated with cu metal, B2B buyers can make informed decisions, ensuring that they select reliable suppliers capable of delivering high-quality products that meet their specific needs.

Related Video: Inspection and Quality control in Manufacturing

Comprehensive Cost and Pricing Analysis for cu metal Sourcing

In the realm of sourcing copper (cu) metal, understanding the comprehensive cost structure and pricing dynamics is essential for international B2B buyers. This knowledge aids in making informed procurement decisions that can significantly impact the bottom line, especially in diverse markets across Africa, South America, the Middle East, and Europe.

Cost Components

-

Materials: The primary cost driver in cu metal sourcing is the price of copper itself, which can fluctuate based on global market trends, supply and demand dynamics, and geopolitical factors. Buyers should monitor copper price indices and consider the purity and form of the copper (e.g., cathodes, rods) as these influence costs.

-

Labor: Labor costs vary widely depending on the region and the complexity of the manufacturing processes involved. For instance, advanced machining or custom fabrication may require skilled labor, which can increase costs. Understanding local labor markets can help buyers negotiate better terms.

-

Manufacturing Overhead: This includes expenses related to utilities, maintenance of machinery, and factory space. Efficient operations can lead to lower overhead costs, which can be passed on to buyers. Buyers should inquire about a supplier’s operational efficiency and capacity utilization.

-

Tooling: Custom tooling for specific applications can represent a significant upfront investment. Buyers must assess whether the tooling costs are justified by the expected volume and lifecycle of the product. A well-structured tooling strategy can lead to long-term savings.

-

Quality Control (QC): Ensuring that the cu metal meets industry standards and certifications (e.g., ISO, ASTM) is crucial. QC processes add to manufacturing costs but are essential for maintaining product integrity and compliance. Buyers should evaluate suppliers’ QC protocols and certifications to mitigate risks.

Illustrative Image (Source: Google Search)

-

Logistics: Shipping and handling costs can vary significantly based on distance, mode of transport, and the Incoterms agreed upon. For international buyers, understanding these costs is vital to calculating the total cost of ownership (TCO).

-

Margin: Suppliers typically add a margin to cover their risks and ensure profitability. This margin can vary based on market conditions, supplier reputation, and the buyer’s negotiation power.

Price Influencers

Several factors influence pricing in the cu metal market:

-

Volume/MOQ: Larger orders often lead to discounts due to economies of scale. Buyers should negotiate minimum order quantities (MOQs) that align with their purchasing capabilities.

-

Specifications/Customization: Custom specifications can increase costs due to additional processing requirements. Clear communication of requirements can help manage these costs effectively.

-

Material Quality/Certifications: Higher quality materials and relevant certifications can command premium prices. Buyers should weigh the benefits of quality against their budget constraints.

-

Supplier Factors: The supplier’s reliability, reputation, and financial stability can affect pricing. Conducting thorough due diligence can help in selecting a cost-effective and trustworthy supplier.

-

Incoterms: The choice of Incoterms impacts logistics costs and responsibilities. For example, choosing DDP (Delivered Duty Paid) may simplify the process for buyers but could increase costs.

Buyer Tips

To maximize cost efficiency in cu metal sourcing, consider the following strategies:

-

Negotiate Effectively: Leverage volume commitments and long-term relationships to negotiate better prices. Building rapport with suppliers can yield favorable terms.

-

Focus on Total Cost of Ownership (TCO): Assess not only the purchase price but also logistics, maintenance, and potential risks associated with sourcing from specific suppliers. This holistic view can reveal hidden costs.

-

Stay Informed on Market Trends: Regularly monitor global copper prices and market conditions. Being proactive can help buyers time their purchases to secure better pricing.

-

Understand Pricing Nuances: Be aware of seasonal fluctuations in copper prices and potential geopolitical impacts. This knowledge can aid in making informed purchasing decisions.

Disclaimer

Prices for cu metal fluctuate frequently and can vary significantly based on the factors outlined above. It is advisable for buyers to conduct their own market research and consult multiple suppliers to obtain the most accurate and competitive pricing.

Spotlight on Potential cu metal Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘cu metal’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for cu metal

Key Technical Properties of Cu Metal

Understanding the technical properties of copper (Cu) metal is crucial for B2B buyers, as these specifications directly impact the performance, reliability, and cost-effectiveness of the materials being sourced. Here are some essential properties to consider:

- Material Grade

Material grades for copper are standardized (e.g., C11000, C10200) and indicate the metal’s purity and properties. Higher-grade copper typically exhibits better conductivity and corrosion resistance. Buyers should verify that the chosen grade meets their project requirements to avoid costly replacements or failures.

Illustrative Image (Source: Google Search)

-

Tolerance

Tolerance refers to the allowable deviation from specified dimensions in fabricated parts. For copper components, tight tolerances (e.g., +/- 0.005 inches) are often necessary for applications in electronics and precision engineering. Understanding tolerance requirements ensures compatibility with other components and reduces the risk of assembly issues. -

Conductivity

Copper is renowned for its excellent electrical and thermal conductivity. Measured in percentage IACS (International Annealed Copper Standard), conductivity affects the efficiency of electrical components. Buyers in sectors like electronics and telecommunications should prioritize suppliers who provide high-conductivity copper to enhance performance and reduce energy loss. -

Corrosion Resistance

Copper’s ability to resist corrosion is vital for applications exposed to harsh environments, such as plumbing and marine applications. Buyers should assess the corrosion resistance of different copper alloys, particularly when sourcing materials for long-term projects, to ensure durability and reduce maintenance costs. -

Mechanical Properties

Key mechanical properties include tensile strength, yield strength, and elongation. These properties determine how well copper can withstand stress and deformation. Understanding these characteristics helps buyers select the appropriate copper alloy for their specific application, balancing strength and malleability. -

Finish

The surface finish of copper components can affect both aesthetics and performance. Various finishes (e.g., polished, plated, oxidized) can enhance corrosion resistance or improve conductivity. Buyers should communicate their finish requirements clearly to suppliers to ensure the final product meets both functional and aesthetic standards.

Common Trade Terms in Cu Metal Sourcing

Familiarity with industry terminology is essential for navigating the B2B procurement landscape effectively. Here are several common terms that buyers should understand:

-

OEM (Original Equipment Manufacturer)

An OEM refers to a company that produces parts or equipment that may be marketed by another manufacturer. When sourcing copper components, identifying reputable OEMs ensures quality and compatibility with existing systems. -

MOQ (Minimum Order Quantity)

MOQ is the smallest amount of a product that a supplier is willing to sell. Understanding MOQ is crucial for budgeting and inventory management, as ordering below this threshold may result in higher costs or unavailability. -

RFQ (Request for Quotation)

An RFQ is a document sent to suppliers requesting pricing and other details for specific products or services. Crafting a clear and detailed RFQ helps buyers receive accurate quotes and facilitates better negotiation outcomes. -

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers in international trade, including shipping costs, risk, and delivery points. Familiarity with these terms ensures that buyers understand their obligations and can avoid unexpected charges or disputes. -

Lead Time

Lead time refers to the time it takes from placing an order to receiving the goods. Understanding lead times is essential for project planning and inventory management, especially in industries with tight deadlines. -

Certification

Certifications (e.g., ISO, ASTM) indicate compliance with specific industry standards. Buyers should prioritize suppliers who can provide relevant certifications for their copper products, ensuring quality and regulatory compliance.

By grasping these technical properties and trade terms, international B2B buyers can make informed sourcing decisions, ultimately enhancing project success and supplier relationships.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the cu metal Sector

Market Overview & Key Trends

The global copper metal (cu metal) market is experiencing dynamic changes driven by several key factors. First, the increasing demand for copper in renewable energy technologies, such as solar panels and electric vehicles, is propelling market growth. This shift towards sustainable energy sources is particularly pronounced in Europe and North America, but also gaining traction in emerging markets across Africa and South America. Additionally, the rise of smart technologies, including IoT devices and electric grids, is further intensifying the demand for high-quality copper.

From a sourcing perspective, international B2B buyers must stay attuned to the evolving landscape of supplier capabilities and emerging technologies. The adoption of digital procurement tools, such as AI-driven analytics and blockchain for supply chain transparency, is becoming commonplace. These technologies enhance supplier selection processes, improve risk management, and ensure compliance with international standards. Buyers from regions like the Middle East are also increasingly focusing on local sourcing to mitigate transportation costs and supply chain disruptions.

Moreover, geopolitical factors are affecting copper pricing and availability. Trade policies, tariffs, and environmental regulations play a critical role in shaping sourcing strategies. International buyers should be proactive in monitoring these developments to make informed purchasing decisions and negotiate favorable contracts.

Sustainability & Ethical Sourcing in B2B

Sustainability has emerged as a central theme in the copper metal sector. The environmental impact of mining and processing copper is significant, prompting a shift towards more sustainable practices. B2B buyers are increasingly prioritizing suppliers that adhere to green certifications and use environmentally friendly methods for extraction and production. Certifications such as ISO 14001 (Environmental Management) and the Responsible Minerals Initiative (RMI) are becoming critical benchmarks for assessing supplier sustainability.

Ethical sourcing is equally important, as buyers seek to ensure that their supply chains are free from human rights abuses and environmental degradation. This includes evaluating the entire supply chain—from raw material extraction to end-product delivery. Engaging with suppliers who demonstrate a commitment to ethical practices not only enhances a company’s reputation but also aligns with growing consumer and regulatory expectations.

Buyers should also consider the benefits of recycled copper, which presents a sustainable alternative to newly mined copper. Using recycled materials significantly reduces the environmental footprint and often results in cost savings. By integrating sustainability into their sourcing strategies, B2B buyers can contribute to a more responsible copper market while ensuring long-term viability.

Brief Evolution/History

The use of copper dates back thousands of years, with evidence of its use in tools and ornaments as early as 10,000 BC. The metal’s excellent conductivity and malleability made it a preferred choice for various applications, from electrical wiring to plumbing. In the 20th century, the advent of electricity and telecommunications catalyzed a surge in copper demand, solidifying its status as a critical industrial metal.

In recent decades, the focus has shifted towards sustainable practices in copper sourcing and production. The rise of environmental awareness and regulatory frameworks has led to significant advancements in mining technologies and recycling processes. Today, the copper industry is at a crossroads, balancing traditional practices with the urgent need for sustainable development, making it essential for international B2B buyers to stay informed about historical and current trends to navigate the market effectively.

Related Video: Made in the world: Better understanding global trade flows

Frequently Asked Questions (FAQs) for B2B Buyers of cu metal

-

What should I consider when vetting suppliers for cu metal?

When vetting suppliers for cu metal, focus on their experience and track record in the industry. Verify their certifications, such as ISO 9001, which demonstrates quality management. Request references from previous clients, especially those in your region, to gauge reliability. Additionally, assess their production capabilities and technology used, ensuring they can meet your specifications and quality standards. Engaging in a site visit, if feasible, can also provide insights into their operations and quality control processes. -

Can I customize cu metal products to meet specific needs?

Yes, many suppliers offer customization options for cu metal products, including varying shapes, sizes, and finishes. When discussing customization, clearly outline your requirements, including technical specifications and tolerances. Ensure the supplier has the necessary equipment and expertise to handle your requests. It’s advisable to request prototypes or samples before committing to larger orders, as this allows you to evaluate the quality and suitability of the customized product. -

What are typical minimum order quantities (MOQ) and lead times for cu metal?

Minimum order quantities (MOQ) for cu metal can vary significantly among suppliers, often depending on the complexity of the product and production methods. For standard items, MOQs can range from a few hundred to several thousand units. Lead times typically depend on the order size, customization level, and supplier capacity, usually ranging from a few weeks to several months. Always clarify these details upfront to align your project timelines and avoid delays. -

How can I ensure quality assurance and certifications from suppliers?

To ensure quality assurance, inquire about the supplier’s quality management systems and processes. Request documentation for any relevant certifications, such as ISO 9001 or industry-specific standards. It’s beneficial to discuss their quality control measures, including testing protocols and inspection processes. Consider implementing regular audits or third-party inspections, especially for critical components, to maintain consistent quality throughout the production cycle. -

What logistics considerations should I keep in mind when sourcing cu metal?

When sourcing cu metal, consider the logistics of shipping, including transportation modes, costs, and delivery times. Assess the supplier’s ability to manage international shipping and customs clearance, especially for buyers in Africa, South America, the Middle East, and Europe. Understanding packaging requirements and any potential tariffs or duties is crucial. Collaborating with a logistics provider experienced in international trade can streamline the process and mitigate risks associated with shipping delays. -

How should I handle disputes with suppliers?

To effectively handle disputes with suppliers, establish clear communication channels and maintain documentation of all agreements and transactions. In case of a disagreement, attempt to resolve the issue amicably through dialogue. If necessary, refer to the terms outlined in your contract, including any dispute resolution mechanisms. It may also be helpful to engage a neutral third party for mediation. Ensuring a good working relationship can facilitate smoother negotiations should issues arise. -

What payment methods are commonly used in international B2B transactions for cu metal?

Common payment methods in international B2B transactions for cu metal include letters of credit (LC), wire transfers, and escrow services. Letters of credit provide security for both parties, ensuring that payment is made only upon fulfillment of specific conditions. Wire transfers are often faster but may carry higher risks. Escrow services can also be a safe option, holding funds until both parties confirm that the terms of the transaction have been met. Always discuss payment terms upfront and consider using secure methods that protect your interests. -

What are the best practices for ongoing supplier relationships?

Building and maintaining strong supplier relationships involves regular communication, feedback, and collaboration. Schedule periodic meetings to discuss performance, quality issues, and upcoming projects. Establishing a clear understanding of expectations and mutual goals can enhance trust and cooperation. Additionally, consider providing feedback on their services and products, as this encourages continuous improvement. Recognizing and rewarding good performance can also strengthen the partnership, leading to more favorable terms and collaboration in the future.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for cu metal

In the evolving landscape of international metal sourcing, particularly for cu metal, understanding the nuances of strategic sourcing is paramount for success. Key takeaways emphasize the importance of thorough supplier evaluations, adherence to quality standards, and the need for flexibility in sourcing strategies to adapt to market fluctuations. Buyers should prioritize establishing strong relationships with reliable suppliers who can offer both cost-effectiveness and high-quality products.

As businesses navigate the complexities of global supply chains, leveraging data analytics and market insights can unlock opportunities for better pricing and risk management. Moreover, fostering collaboration among stakeholders will enhance transparency and streamline procurement processes.

Looking ahead, international B2B buyers in Africa, South America, the Middle East, and Europe are encouraged to remain proactive in their sourcing strategies. By embracing technological advancements and staying informed about market trends, businesses can not only mitigate risks but also seize new growth opportunities. Engage with suppliers who understand the local market dynamics and can cater to your specific needs. The future of sourcing cu metal lies in strategic partnerships and an agile approach to navigating the global marketplace.