Mastering Diaphragm Valve Sourcing: Key Insights for B2B

Introduction: Navigating the Global Market for diaphragm valve

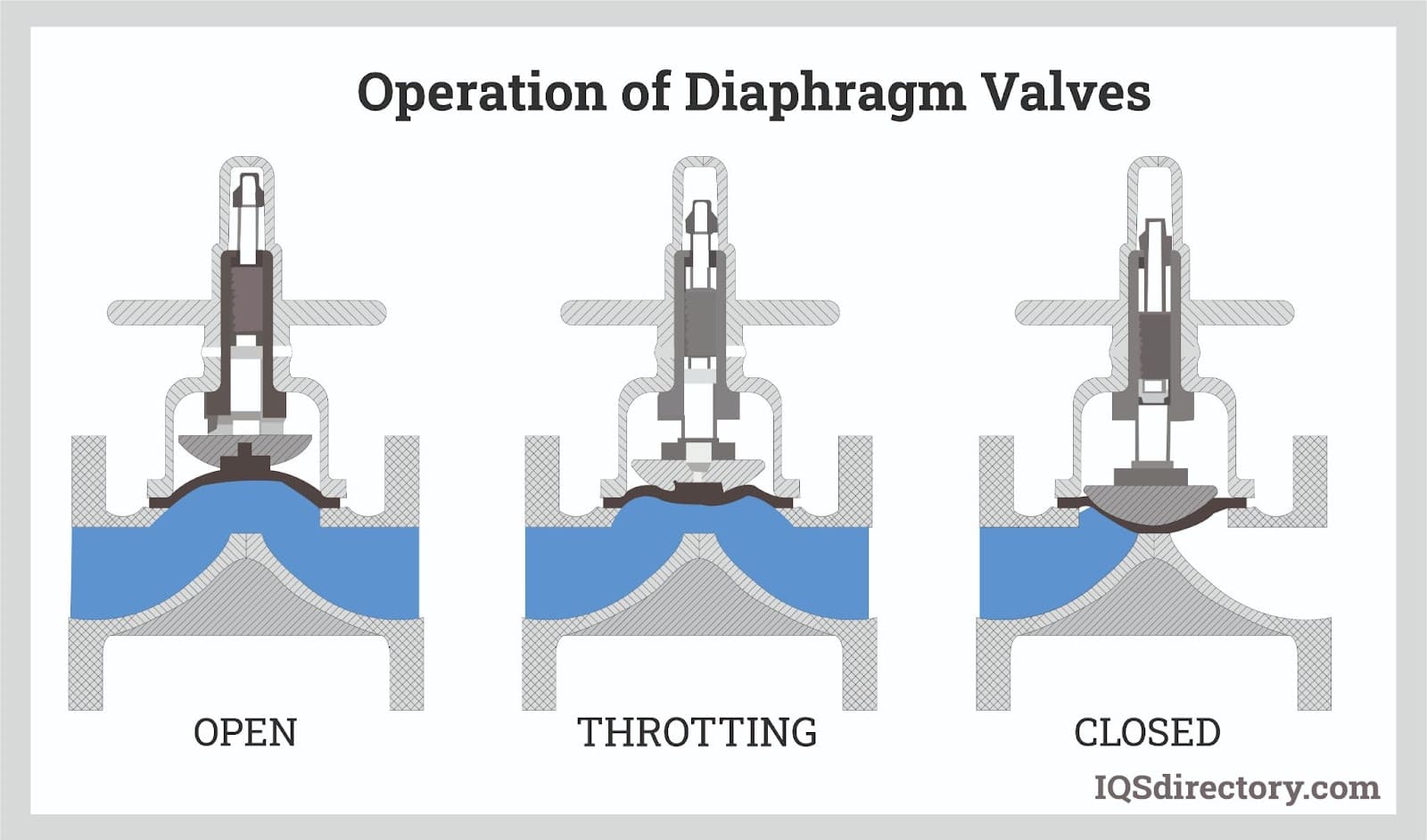

In today’s interconnected industrial landscape, diaphragm valves stand out as a critical component for precise fluid control across diverse applications. These valves, renowned for their reliability and versatility, are pivotal in sectors ranging from food and pharmaceuticals to wastewater management and electronics manufacturing. Their unique design minimizes contamination risks and ensures a tight seal, making them indispensable for maintaining operational integrity.

This guide offers a comprehensive exploration of diaphragm valves, addressing essential factors that international B2B buyers must consider. Key topics include the various types of diaphragm valves—weir and full port—each suited for specific fluid dynamics; a breakdown of materials that enhance durability and performance; and insights into manufacturing and quality control standards that guarantee reliability. Additionally, we will discuss supplier selection, cost considerations, and emerging market trends that can impact sourcing decisions.

For B2B buyers in Africa, South America, the Middle East, and Europe, including regions like Vietnam and France, this guide serves as an invaluable resource. It empowers buyers with actionable insights to navigate the complexities of the global market, enabling informed sourcing decisions that align with their operational needs. By leveraging this information, companies can optimize their procurement strategies, ensuring they select the right diaphragm valves that enhance efficiency and compliance in their respective industries.

Understanding diaphragm valve Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Weir Diaphragm Valve | Raised ridge (weir) for sealing, suitable for throttling | Food processing, pharmaceuticals, wastewater treatment | Pros: Effective for low flow rates, long diaphragm life. Cons: Higher pressure drops; sediment build-up possible. |

| Full Port Diaphragm Valve | Flat-bottomed valve seat allowing straight-through flow | Slurry handling, mining, chemical processing | Pros: Lower pressure drop, suitable for high flow rates. Cons: More frequent diaphragm replacements required. |

| Electric Actuated Diaphragm Valve | Automated operation with electric actuators | Automation in manufacturing, water treatment | Pros: Enhanced control, remote operation capability. Cons: Higher initial cost, potential for electrical issues. |

| Pneumatic Diaphragm Valve | Operated by compressed air, ideal for rapid actuation | Oil & gas, chemical processing | Pros: Quick response time, suitable for harsh environments. Cons: Requires air supply; potential leaks in pneumatic lines. |

| Sanitary Diaphragm Valve | Designed for easy cleaning, compliant with sanitary standards | Food and beverage, biotechnology | Pros: Prevents contamination, easy maintenance. Cons: Higher cost due to specialized materials. |

Weir Diaphragm Valve

Weir diaphragm valves feature a raised ridge in their design, allowing for effective sealing and regulation of flow. This design minimizes diaphragm travel distance, making it suitable for both low and high flow rates. Industries such as food processing and pharmaceuticals benefit from their ability to handle clean and corrosive fluids. Buyers should consider the potential for pressure drops and sediment build-up, which may affect performance over time.

Full Port Diaphragm Valve

Characterized by a flat-bottomed valve seat, full port diaphragm valves enable a straight path for fluid flow, resulting in lower pressure drops. This design is particularly advantageous for applications requiring high flow rates, such as slurry handling in mining and chemical processing. However, the flexibility required for sealing means these valves may need more frequent diaphragm replacements, which is a key consideration for cost management.

Electric Actuated Diaphragm Valve

Electric actuated diaphragm valves offer automated operation, providing precise control and the ability to be managed remotely. This is particularly beneficial in manufacturing and water treatment applications where consistent performance is essential. While these valves enhance operational efficiency, buyers should weigh the initial investment and the potential for electrical malfunctions against the operational benefits.

Pneumatic Diaphragm Valve

Pneumatic diaphragm valves are driven by compressed air, making them ideal for applications that require rapid actuation, such as in the oil and gas sector. Their quick response times are a significant advantage, especially in dynamic environments. However, buyers must ensure a reliable air supply and be aware of the potential for leaks in pneumatic lines, which can impact efficiency.

Sanitary Diaphragm Valve

Designed with hygiene in mind, sanitary diaphragm valves are essential in the food, beverage, and biotechnology industries. These valves are constructed to prevent contamination and facilitate easy cleaning, ensuring compliance with strict sanitary standards. Although they come with a higher price tag due to the specialized materials used, their long-term benefits in maintaining product integrity make them a worthwhile investment for B2B buyers in these sectors.

Related Video: Diaphragm valve working animation | Types of valve | Flow control | Fluid echanics

Key Industrial Applications of diaphragm valve

| Industry/Sector | Specific Application of Diaphragm Valve | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Pharmaceuticals | Regulating the flow of sterile liquids in production lines | Ensures contamination-free operations and compliance with regulations | Sourcing materials that meet FDA standards and certifications |

| Food Processing | Controlling the flow of ingredients and additives | Maintains product quality and safety, preventing contamination | Look for valves with self-draining features and easy cleaning |

| Water Treatment | Managing the flow of chemicals in wastewater treatment | Enhances efficiency in treatment processes and environmental compliance | Consider valves that can handle corrosive chemicals and high pressures |

| Chemical Manufacturing | Regulating the flow of corrosive or hazardous materials | Reduces risk of leaks and enhances safety in production processes | Ensure compatibility with various chemicals and high-temperature applications |

| Mining | Controlling slurry and viscous fluid flow in processing plants | Improves operational efficiency and minimizes downtime | Evaluate durability and maintenance needs for harsh environments |

Pharmaceutical Industry

In the pharmaceutical sector, diaphragm valves play a critical role in regulating the flow of sterile liquids during production. These valves ensure that the manufacturing process remains contamination-free, which is essential for compliance with stringent health regulations. International buyers must prioritize sourcing valves made from materials that meet FDA standards, as non-compliance can lead to costly penalties and product recalls.

Food Processing

Diaphragm valves are extensively used in food processing to control the flow of various ingredients and additives. Their design minimizes the risk of contamination, which is vital for maintaining product quality and safety. Buyers should look for valves with features such as self-draining capabilities and materials that are easy to clean, ensuring compliance with food safety standards and regulations across different regions.

Water Treatment

In water treatment facilities, diaphragm valves manage the flow of chemicals used in wastewater treatment processes. These valves enhance the efficiency of treatment operations, ensuring that facilities comply with environmental regulations. For international buyers, it is crucial to consider valves that can withstand corrosive chemicals and high-pressure conditions, as these factors can significantly affect the longevity and reliability of the valves in harsh environments.

Chemical Manufacturing

Diaphragm valves are essential in chemical manufacturing for regulating the flow of corrosive or hazardous materials. Their ability to prevent leaks and ensure safe handling of dangerous substances is critical for maintaining workplace safety and operational efficiency. Buyers should ensure that the valves sourced are compatible with various chemicals and capable of withstanding high-temperature applications, especially in markets where chemical processing is prevalent.

Mining Industry

In the mining sector, diaphragm valves are used to control the flow of slurries and viscous fluids in processing plants. Their robust design improves operational efficiency and minimizes downtime, which is essential for maintaining productivity in this industry. Buyers in this sector should evaluate the durability and maintenance requirements of diaphragm valves to ensure they can withstand the harsh conditions typical of mining operations, thereby reducing long-term operational costs.

Related Video: Diaphragm Valve Operation Demonstration

Strategic Material Selection Guide for diaphragm valve

When selecting materials for diaphragm valves, international B2B buyers must consider various factors that influence performance, compatibility, and overall cost-effectiveness. Below is an analysis of four common materials used in diaphragm valves, focusing on their properties, advantages, disadvantages, and specific considerations for buyers from Africa, South America, the Middle East, and Europe.

1. EPDM (Ethylene Propylene Diene Monomer)

Key Properties:

EPDM is known for its excellent temperature resistance, typically ranging from -40°C to 120°C. It has good resistance to ozone, UV radiation, and weathering, making it suitable for outdoor applications.

Pros & Cons:

EPDM is durable and cost-effective, with a low manufacturing complexity. However, it has limited chemical resistance, particularly to hydrocarbons and certain solvents, which can restrict its use in specific applications.

Impact on Application:

EPDM is ideal for water and steam applications but may not be suitable for oil or chemical services. Buyers must ensure that the media being handled is compatible with EPDM.

Considerations for International Buyers:

Buyers should check compliance with local standards such as ASTM and DIN. EPDM is widely used in various industries, making it easily accessible in global markets.

2. PTFE (Polytetrafluoroethylene)

Key Properties:

PTFE exhibits exceptional chemical resistance and can withstand temperatures up to 260°C. Its low friction coefficient allows for smooth operation and minimal wear.

Pros & Cons:

PTFE is highly durable and suitable for aggressive chemicals, making it ideal for the pharmaceutical and chemical industries. However, it is more expensive than other materials and may require specialized manufacturing processes.

Impact on Application:

PTFE is compatible with a wide range of media, including corrosive substances. This versatility makes it a preferred choice for applications requiring high purity and chemical resistance.

Considerations for International Buyers:

PTFE must meet stringent compliance standards, especially in food and pharmaceutical applications. Buyers should verify certifications and ensure that suppliers can meet local regulatory requirements.

3. NBR (Nitrile Butadiene Rubber)

Key Properties:

NBR offers excellent resistance to oils and fuels, with a temperature range of -30°C to 100°C. It also provides good mechanical properties and wear resistance.

Pros & Cons:

NBR is relatively inexpensive and easy to manufacture, making it a cost-effective choice for many applications. However, it has limited resistance to heat and ozone, which can affect its longevity in harsh environments.

Impact on Application:

NBR is suitable for oil and gas applications but may not be appropriate for high-temperature or ozone-rich environments. Buyers should assess the specific media and conditions to ensure compatibility.

Considerations for International Buyers:

NBR’s popularity in the automotive and oil sectors means it is readily available. Buyers should ensure that the material meets local and international standards for safety and performance.

4. Silicone

Key Properties:

Silicone can withstand temperatures from -60°C to 200°C and is known for its flexibility and resilience. It is also resistant to UV light and ozone.

Pros & Cons:

Silicone is highly versatile and can be used in a variety of applications, including food and medical. However, it is generally more expensive than other elastomers and may have limited chemical resistance.

Impact on Application:

Silicone is ideal for applications requiring high purity and flexibility, such as food processing and pharmaceuticals. Buyers must ensure that the specific silicone grade used is compatible with the intended media.

Considerations for International Buyers:

Silicone materials often require compliance with specific regulations, particularly in food and medical applications. Buyers should verify certifications and ensure that suppliers can provide compliant materials.

Summary Table

| Material | Typical Use Case for diaphragm valve | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| EPDM | Water and steam applications | Excellent temperature resistance | Limited chemical resistance | Medium |

| PTFE | Chemical and pharmaceutical industries | Exceptional chemical resistance | Higher cost and manufacturing complexity | High |

| NBR | Oil and gas applications | Good oil resistance | Limited heat and ozone resistance | Low |

| Silicone | Food processing and medical applications | High purity and flexibility | Higher cost, limited chemical resistance | High |

This strategic material selection guide provides valuable insights for international B2B buyers looking to optimize diaphragm valve performance while ensuring compliance with local standards and media compatibility.

In-depth Look: Manufacturing Processes and Quality Assurance for diaphragm valve

Diaphragm valves are critical components in various industrial applications, and understanding their manufacturing processes and quality assurance protocols is vital for B2B buyers looking to source these products effectively. This section provides a detailed overview of the typical manufacturing stages, key techniques involved, and the quality assurance measures that should be considered when evaluating potential suppliers.

Manufacturing Processes for Diaphragm Valves

The manufacturing of diaphragm valves involves several key stages, each critical to ensuring the final product’s functionality and reliability. The primary stages include:

1. Material Preparation

The initial stage involves selecting and preparing the appropriate materials for different components of the diaphragm valve. Common materials include:

- Body Materials: Typically made from brass, stainless steel, or plastic, depending on the application.

- Diaphragm Materials: Elastomers such as EPDM, PTFE, or rubber, chosen based on chemical compatibility and temperature resistance.

Material preparation includes processes like cutting, molding, and surface treatment to ensure that the materials meet the necessary specifications.

2. Forming

In this stage, the various components of the diaphragm valve are formed. Techniques employed can vary based on the material and design requirements:

- Injection Molding: Commonly used for plastic components, this method ensures precision and repeatability.

- Machining: Metal components may undergo machining processes such as turning and milling to achieve the desired dimensions and tolerances.

- Stamping: Used for producing metal parts like the diaphragm and valve bodies, ensuring uniformity in shape and size.

3. Assembly

The assembly stage is where the individual components come together to form the complete diaphragm valve. Key steps include:

- Component Fitting: Each part, including the actuator, stem, diaphragm, and valve body, is carefully fitted together.

- Sealing and Fastening: Components are sealed using gaskets or O-rings, and fastened with screws or bolts to ensure durability and prevent leaks.

Automated assembly lines may be used to enhance efficiency and precision, especially in large-scale production.

4. Finishing

The finishing process involves several steps that enhance the valve’s performance and appearance:

- Surface Treatment: Techniques such as anodizing or powder coating may be applied to prevent corrosion and improve aesthetics.

- Quality Inspection: Each valve undergoes rigorous inspections to check for defects and ensure compliance with specifications.

Quality Assurance for Diaphragm Valves

Quality assurance is a critical aspect of diaphragm valve manufacturing, ensuring that products meet international standards and customer expectations. Relevant quality assurance measures include:

International Standards

B2B buyers should ensure that suppliers adhere to recognized international quality standards, such as:

- ISO 9001: This standard focuses on quality management systems and is crucial for ensuring consistent quality in manufacturing processes.

- CE Marking: This certification indicates compliance with EU safety, health, and environmental protection standards.

- API Standards: For valves used in the oil and gas industry, adherence to American Petroleum Institute (API) standards is essential.

Quality Control Checkpoints

Quality control (QC) checkpoints are strategically placed throughout the manufacturing process to ensure that quality standards are met:

- Incoming Quality Control (IQC): This involves inspecting raw materials upon arrival to ensure they meet specifications.

- In-Process Quality Control (IPQC): Continuous monitoring during the manufacturing process helps identify defects early, reducing waste and rework.

- Final Quality Control (FQC): The finished product undergoes thorough testing and inspection before shipment to ensure it meets all specifications.

Common Testing Methods

Various testing methods are employed to verify the quality and performance of diaphragm valves:

- Pressure Testing: Checks the valve’s ability to withstand pressure without leaking.

- Leak Testing: Ensures that there are no leaks in the valve assembly, which could compromise functionality.

- Functional Testing: Validates that the valve operates correctly under expected conditions.

Verifying Supplier Quality Control

For B2B buyers, especially those from Africa, South America, the Middle East, and Europe, verifying a supplier’s quality control processes is crucial. Here are some actionable steps:

- Supplier Audits: Conducting regular audits of potential suppliers can provide insights into their manufacturing processes and quality assurance practices. Look for documentation that demonstrates compliance with international standards.

- Request Quality Reports: Suppliers should be willing to share quality control reports, including data from IQC, IPQC, and FQC stages. This transparency helps buyers assess reliability.

- Third-Party Inspections: Engaging third-party inspection services can provide an unbiased evaluation of the supplier’s quality practices and product compliance.

Quality Control Considerations for International Buyers

International buyers need to be aware of specific nuances in quality control that may vary by region:

- Regulatory Compliance: Ensure that the products comply with local regulations in the purchasing country, which may differ from the supplier’s country.

- Cultural Differences: Understanding cultural attitudes towards quality and manufacturing can help in establishing effective communication and expectations with suppliers.

- Logistical Challenges: Consider the logistical implications of sourcing from different regions, including shipping times and potential delays in quality inspections.

Conclusion

Understanding the manufacturing processes and quality assurance practices associated with diaphragm valves is essential for international B2B buyers. By focusing on material preparation, forming, assembly, finishing, and implementing robust quality control measures, buyers can ensure they are sourcing high-quality products that meet their operational needs. By verifying supplier quality through audits, reports, and third-party inspections, buyers can mitigate risks and establish long-term, reliable supplier relationships.

Related Video: Process Techonology: Diaphragm Valves

Comprehensive Cost and Pricing Analysis for diaphragm valve Sourcing

Understanding the cost structure and pricing dynamics of diaphragm valves is crucial for international B2B buyers, especially in regions like Africa, South America, the Middle East, and Europe. This section provides actionable insights into the components that influence costs and pricing strategies.

Cost Components of Diaphragm Valves

-

Materials: The primary cost driver is the materials used in diaphragm valve production. High-quality elastomers or plastics for diaphragms, along with robust metals for the valve body, can significantly affect pricing. Suppliers often offer various grades of materials, which can influence both the initial cost and the valve’s longevity.

-

Labor: Labor costs vary widely by region and can impact overall production costs. In regions with higher wages, such as parts of Europe, the labor component may be more substantial compared to manufacturers in Africa or South America. Consideration of local labor laws and skill availability is essential for sourcing decisions.

-

Manufacturing Overhead: This includes utilities, facility maintenance, and administrative costs. Efficient manufacturing processes can minimize overhead, allowing suppliers to offer competitive pricing.

-

Tooling: The cost of tooling is significant, especially for custom valve designs. Initial investments in molds and specialized machinery can be substantial but are amortized over production runs. Buyers should consider the tooling costs when evaluating suppliers for custom or specialized diaphragm valves.

-

Quality Control (QC): Implementing stringent QC measures ensures that the valves meet industry standards and certifications. While this adds to the cost, it is crucial for sectors like food and pharmaceuticals where compliance is non-negotiable.

-

Logistics: Shipping and handling costs can vary based on the supplier’s location and the buyer’s destination. Incoterms chosen (such as FOB, CIF) will also impact the total landed cost. Consideration of local logistics infrastructure can lead to cost efficiencies.

-

Margin: Supplier margins can vary based on market dynamics, competition, and supplier reputation. Understanding the typical margins in your region can aid in negotiations.

Price Influencers

-

Volume/MOQ: Bulk orders often lead to lower unit prices. Understanding a supplier’s minimum order quantity (MOQ) can help in negotiating better rates.

-

Specifications/Customization: Customized valves tailored to specific applications will typically cost more than standard models. Buyers should clearly define requirements to avoid unexpected costs.

-

Quality and Certifications: Valves that meet international standards or have specific certifications (like ISO, FDA) usually command a premium. Buyers must assess whether these certifications are necessary for their applications.

Illustrative Image (Source: Google Search)

-

Supplier Factors: The reputation and reliability of a supplier can impact pricing. Established suppliers may charge more due to their experience and warranty offerings, while newer entrants may offer lower prices to build market share.

-

Incoterms: Understanding the implications of chosen Incoterms on shipping costs and risk management is vital for international transactions.

Buyer Tips

-

Negotiation: Engage in discussions with multiple suppliers to leverage pricing. Be prepared to negotiate based on volume and long-term partnerships.

-

Cost-Efficiency: Evaluate the Total Cost of Ownership (TCO), which includes purchase price, maintenance, and operational costs over the valve’s life. Lower initial costs may lead to higher maintenance expenses.

-

Pricing Nuances: Be aware of local market conditions that may affect pricing, such as tariffs, currency fluctuations, and regional supply chain disruptions.

-

Supplier Relationships: Building strong relationships with suppliers can lead to better pricing agreements and priority service, especially for urgent needs.

Disclaimer

Prices for diaphragm valves can vary significantly based on the aforementioned factors and should be considered indicative. Buyers are encouraged to conduct thorough market research and obtain multiple quotes to ensure competitive pricing.

By understanding these cost components and pricing influencers, international B2B buyers can make informed decisions when sourcing diaphragm valves, ultimately leading to better procurement outcomes.

Spotlight on Potential diaphragm valve Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘diaphragm valve’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for diaphragm valve

Diaphragm valves are critical components in various industrial applications, and understanding their technical properties and trade terminology is essential for international B2B buyers. Below are key specifications and terms that will help in making informed purchasing decisions.

Key Technical Properties of Diaphragm Valves

-

Material Grade

The material of the diaphragm valve is crucial for its performance and longevity. Common materials include PVC, CPVC, PTFE, and various elastomers. Each material has specific resistance to chemicals, temperature, and pressure, making it essential to choose the right one based on the application. For instance, PTFE is ideal for corrosive fluids, while elastomers may be suited for food-grade applications. -

Pressure Rating

This specification indicates the maximum pressure the valve can handle safely. It is typically measured in PSI (pounds per square inch) or bar. Understanding the pressure requirements of your system is vital to prevent leaks or valve failures, which can lead to costly downtime and safety hazards. -

Flow Coefficient (Cv)

The flow coefficient quantifies the valve’s capacity to allow fluid flow. A higher Cv indicates a valve that can handle larger volumes of fluid with less resistance. For B2B buyers, selecting the appropriate Cv ensures that the valve meets the operational needs without overloading the system, thereby improving efficiency. -

Temperature Range

The operational temperature range specifies the extremes of temperature within which the valve can function effectively. This is particularly important in industries like pharmaceuticals and food processing, where precise temperature control is critical. Buyers must ensure that the chosen diaphragm valve can operate within the temperature limits of their specific applications. -

End Connection Types

Diaphragm valves can have various types of end connections, such as threaded, flanged, or welded. The choice of connection type affects installation, maintenance, and compatibility with existing piping systems. Buyers should consider the existing infrastructure to select a valve that integrates seamlessly. -

Actuation Type

Diaphragm valves can be manually operated or automated using pneumatic or electric actuators. The choice of actuation impacts control precision and operational efficiency. For automated processes, selecting the right actuator is crucial for ensuring timely and accurate fluid management.

Common Trade Terminology

-

OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts and equipment that may be marketed by another manufacturer. Understanding OEM relationships can provide insights into product quality and compatibility, as well as warranty and support options. -

MOQ (Minimum Order Quantity)

MOQ indicates the smallest quantity a supplier is willing to sell. This is an essential consideration for buyers, especially in regions like Africa and South America, where bulk purchasing might be limited. Understanding MOQ can help in budgeting and inventory management. -

RFQ (Request for Quotation)

An RFQ is a standard business process where buyers request pricing and terms from suppliers for specific products. Utilizing RFQs allows buyers to compare offers from multiple suppliers, ensuring competitive pricing and favorable terms. -

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers in international trade. They clarify who pays for shipping, insurance, and tariffs, thus helping buyers from different regions understand the total cost of acquiring diaphragm valves. -

Lead Time

Lead time refers to the time taken from placing an order until its delivery. Understanding lead times is critical for project planning and inventory management, especially in industries where delays can disrupt operations. -

P&ID (Piping and Instrumentation Diagram)

P&ID is a detailed graphical representation of a process system, showing piping, equipment, and instrumentation. Familiarity with P&ID symbols for diaphragm valves helps buyers understand their integration within larger systems, aiding in effective project planning and execution.

By grasping these technical properties and trade terms, B2B buyers can make informed decisions when sourcing diaphragm valves, ensuring they meet their specific operational needs and regulatory requirements.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the diaphragm valve Sector

Market Overview & Key Trends

The diaphragm valve market is witnessing significant growth driven by increasing demand for precise fluid control across various industries, including pharmaceuticals, food processing, water treatment, and chemicals. As global industries expand, particularly in regions like Africa, South America, the Middle East, and Europe, B2B buyers are focusing on sourcing valves that provide durability and adaptability to handle diverse media, including corrosive substances and slurries.

Emerging technologies are reshaping the diaphragm valve landscape. Automation and smart valve technologies are becoming prevalent, enabling remote monitoring and control, which enhances operational efficiency. Additionally, the integration of IoT in valve systems allows for predictive maintenance, reducing downtime and operational costs. B2B buyers are advised to consider suppliers that offer these advanced technologies to maintain competitiveness in their respective markets.

Sourcing trends indicate a shift towards local suppliers to mitigate supply chain disruptions, especially post-pandemic. Buyers are increasingly prioritizing suppliers who can guarantee shorter lead times and reliable delivery schedules. Furthermore, there’s a growing emphasis on suppliers that maintain transparency in their manufacturing processes, as buyers seek to align with ethical and sustainable practices.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a pivotal consideration for B2B buyers in the diaphragm valve sector. The environmental impact of manufacturing processes and the materials used in diaphragm valves is under scrutiny. Buyers are encouraged to seek suppliers who utilize eco-friendly materials, such as recycled plastics and sustainably sourced elastomers, which not only reduce waste but also enhance the overall lifecycle of the product.

Ethical sourcing is equally critical. Establishing supply chains that prioritize fair labor practices and transparency can foster trust and long-term partnerships. Buyers should look for certifications such as ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety), which indicate a commitment to sustainable and ethical practices. Additionally, opting for suppliers who adhere to green certifications ensures that the diaphragm valves produced have a reduced environmental footprint.

As sustainability becomes a regulatory requirement in many regions, buyers who prioritize these factors will not only comply with regulations but also appeal to environmentally conscious customers and stakeholders.

Brief Evolution/History

Diaphragm valves have evolved significantly since their introduction in the early 20th century. Initially designed for simple flow control, advancements in materials and manufacturing processes have enhanced their performance and reliability. The introduction of elastomeric materials has allowed diaphragm valves to effectively manage a wide range of media, from gases to viscous slurries.

Over the decades, diaphragm valves have been adopted across various sectors, particularly in industries requiring stringent hygiene standards, such as food and pharmaceuticals. The integration of automation technologies in recent years marks a significant evolution, reflecting the industry’s shift towards more efficient and precise control systems. As the market continues to evolve, diaphragm valves are set to play a critical role in enhancing operational efficiencies and sustainability across numerous applications.

Related Video: The Inside Story of the Ship That Broke Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of diaphragm valve

-

What should I consider when vetting suppliers for diaphragm valves?

When vetting suppliers, assess their industry experience, reputation, and certifications. Request references and case studies to understand their performance and reliability. Check if they comply with international standards relevant to your industry, such as ISO or API certifications. Additionally, evaluate their production capacity, lead times, and after-sales support. Engaging in direct communication can also provide insights into their responsiveness and willingness to collaborate on custom solutions. -

Can diaphragm valves be customized to meet specific requirements?

Yes, many suppliers offer customization options for diaphragm valves, including variations in materials, sizes, and actuator types. When discussing customization, be clear about your operational requirements, such as pressure ratings, media compatibility, and installation space. Ensure that the supplier has the capability and experience to deliver customized solutions. It is also beneficial to request prototypes or samples for testing before committing to larger orders. -

What are the typical minimum order quantities (MOQ) and lead times for diaphragm valves?

MOQs can vary significantly among suppliers, often ranging from 10 to 100 units, depending on the customization and materials used. Standard lead times typically range from 4 to 12 weeks, influenced by factors such as production schedules, shipping logistics, and the complexity of the order. Discuss your project timelines with suppliers upfront to ensure their capabilities align with your needs, especially for urgent projects. -

What payment options are generally available when purchasing diaphragm valves?

Payment terms may vary by supplier, but common options include wire transfers, letters of credit, and payment upon delivery. Some suppliers may offer flexible terms for established relationships. Always clarify payment schedules, including any deposits required upfront and the timeline for full payment upon delivery. Be cautious of suppliers requiring full payment before production, as this may pose a risk if they lack a solid track record. -

What quality assurance measures should I expect from suppliers?

Reputable suppliers will have stringent quality assurance (QA) processes in place, including testing and inspection protocols for their diaphragm valves. Request documentation of their QA procedures and any relevant certifications, such as ISO 9001. Inquire about their testing methods, including pressure testing and material verification, to ensure that the products meet your specifications and industry standards. Regular audits and inspections can also be beneficial in maintaining quality. -

How can I ensure compliance with international shipping regulations when sourcing diaphragm valves?

Familiarize yourself with the import regulations specific to your country and the country of the supplier. Ensure that the supplier provides all necessary documentation, such as customs declarations and certificates of origin. Work with logistics partners experienced in international trade to facilitate smooth shipping and customs clearance. Additionally, consider purchasing insurance for your shipment to mitigate risks associated with international transport. -

What steps can I take to resolve disputes with suppliers?

Establish clear communication channels and a written contract outlining expectations, delivery timelines, and quality standards to minimize disputes. If a disagreement arises, initiate a dialogue with the supplier to address concerns directly. If necessary, refer to the contract terms regarding dispute resolution, which may include mediation or arbitration. Keeping a record of all communications can be helpful in resolving issues effectively. -

What certifications should diaphragm valves have to ensure safety and reliability?

Look for diaphragm valves that have certifications relevant to your industry, such as CE marking for European markets, ANSI or API certifications for oil and gas applications, and FDA approval for food-grade valves. These certifications indicate that the valves have been tested for safety, reliability, and performance. Always request documentation proving compliance with these standards to ensure that the products meet necessary regulations for your specific applications.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for diaphragm valve

In conclusion, the strategic sourcing of diaphragm valves is essential for international B2B buyers aiming to enhance operational efficiency and product reliability across various industries. Key takeaways include the importance of selecting the right type of diaphragm valve—whether weir or full port—based on specific application needs, such as flow rate, media type, and pressure requirements. Furthermore, understanding the components and functionality of diaphragm valves can lead to better maintenance practices and reduced downtime.

Illustrative Image (Source: Google Search)

As markets in Africa, South America, the Middle East, and Europe continue to evolve, the demand for high-quality diaphragm valves is expected to grow. Buyers should prioritize suppliers who offer comprehensive support, including product customization, technical expertise, and reliable after-sales service.

Looking ahead, investing in strategic partnerships with reputable manufacturers will not only ensure access to cutting-edge technology but also foster resilience against market fluctuations. Take the next step in optimizing your operations—evaluate your diaphragm valve sourcing strategies today and align them with your long-term business goals.