Master Sourcing High-Quality Capacitive Touchscreen

Introduction: Navigating the Global Market for capacitive touchscreen

The capacitive touchscreen market is rapidly evolving, driven by the growing demand for intuitive user interfaces across diverse industries. From consumer electronics to automotive applications, capacitive touchscreens have become indispensable, offering superior responsiveness, clarity, and durability compared to traditional resistive screens. For B2B buyers navigating this dynamic landscape, understanding the intricacies of capacitive touchscreen technology is crucial for making informed sourcing decisions.

This comprehensive guide will delve into various aspects of capacitive touchscreens, including the different types and materials used, the manufacturing processes and quality control measures, as well as insights into leading suppliers. Additionally, we will explore cost considerations and provide an analysis of the market trends shaping the future of capacitive touchscreens.

As international B2B buyers from regions such as Africa, South America, the Middle East, and Europe (including Australia and Turkey) look to enhance their product offerings, this guide serves as a vital resource. It empowers you to make strategic decisions by providing actionable insights that help you identify reliable suppliers and evaluate the best options for your specific needs. By leveraging this information, you can navigate the global market effectively and capitalize on the growing opportunities within the capacitive touchscreen sector.

Understanding capacitive touchscreen Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

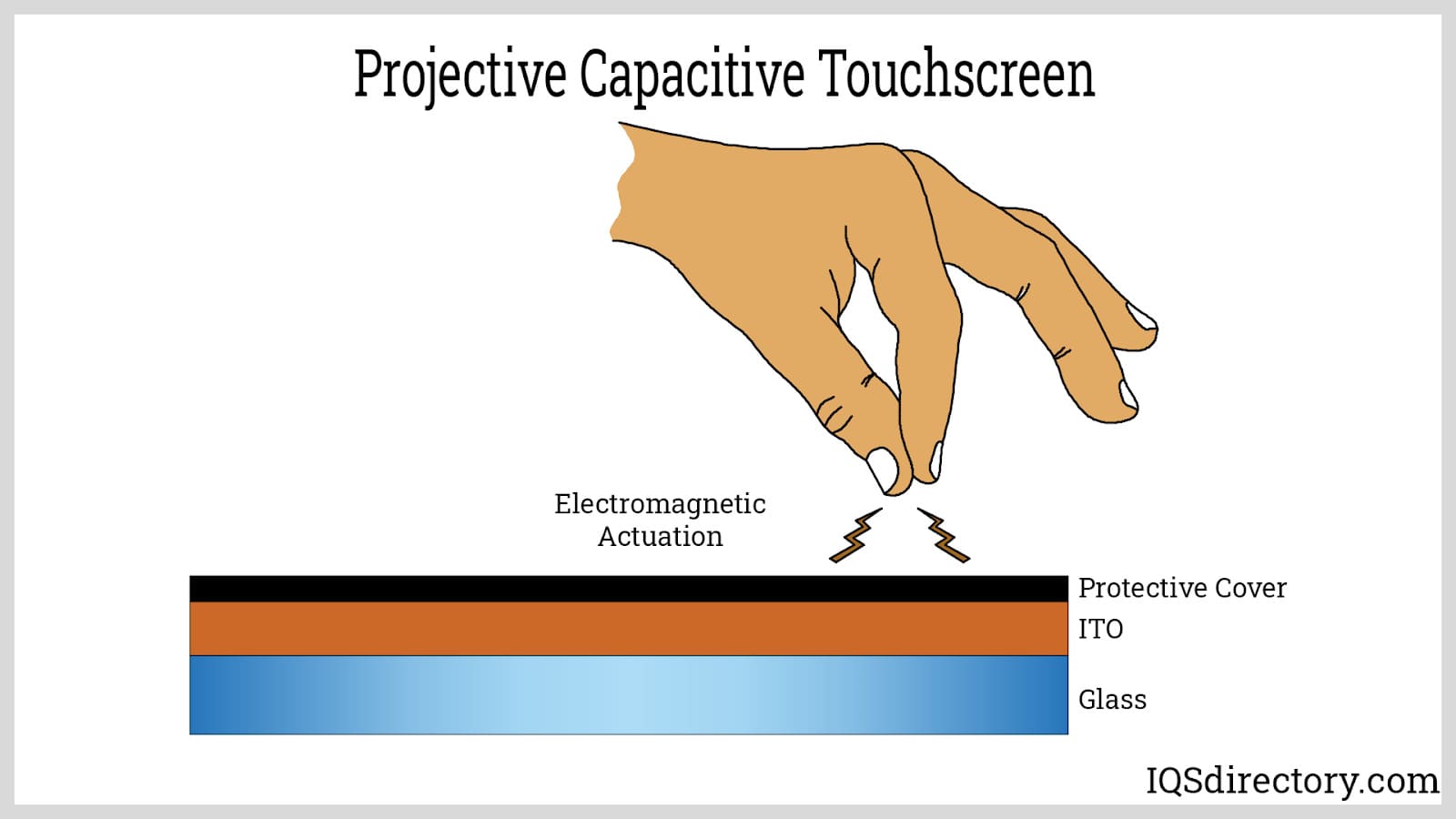

| Projected Capacitive | Supports multi-touch, high sensitivity, and durability | Smartphones, tablets, kiosks | Pros: Excellent clarity, responsive; Cons: Higher cost compared to resistive screens. |

| Surface Capacitive | Uses a conductive layer on the surface for touch detection | Retail displays, industrial equipment | Pros: Cost-effective, robust; Cons: Limited multi-touch capabilities. |

| Self-Capacitance | Measures capacitance at individual touch points | Wearable devices, small electronics | Pros: Compact design, low power consumption; Cons: Less sensitivity with gloves. |

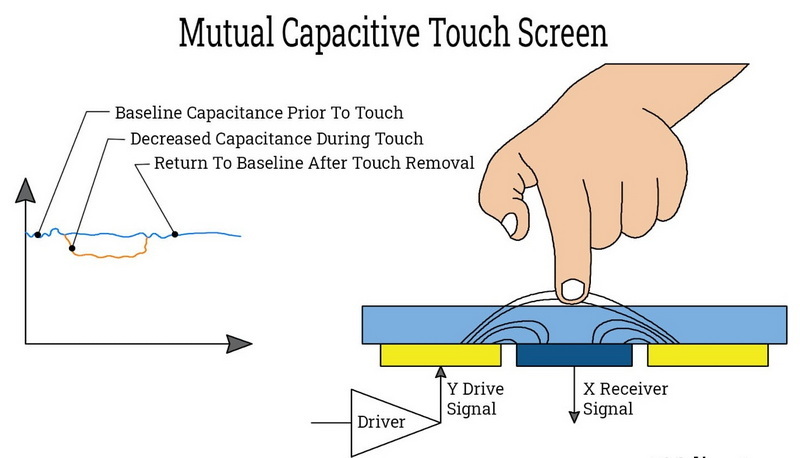

| Mutual Capacitance | Detects touch through a grid of electrodes | Automotive interfaces, interactive displays | Pros: Supports multi-touch, high precision; Cons: Complex manufacturing process. |

| Glass-Overlay Capacitive | Incorporates a glass layer for enhanced durability | Medical devices, high-end consumer electronics | Pros: Enhanced durability, aesthetic appeal; Cons: Heavier, potential for glare. |

Projected Capacitive Touchscreens

Projected capacitive touchscreens are widely recognized for their ability to detect multiple touch points simultaneously, making them ideal for smartphones, tablets, and interactive kiosks. These screens utilize a grid of electrodes to create a 3D electrostatic field, allowing for precise touch detection. B2B buyers should consider the higher costs associated with these screens, but their superior clarity and responsiveness often justify the investment, especially in consumer-facing applications.

Surface Capacitive Touchscreens

Surface capacitive touchscreens utilize a conductive layer on the glass surface to detect touch. They are typically more cost-effective than projected capacitive screens and are suitable for applications such as retail displays and industrial equipment. While they offer durability and ease of use, buyers should note that these screens may not support multi-touch functionality, which could be a limitation in certain interactive environments.

Self-Capacitance Touchscreens

Self-capacitance touchscreens measure the capacitance at individual touch points, making them suitable for compact devices like wearables and small electronics. Their low power consumption is a significant advantage, particularly for battery-operated devices. However, B2B buyers should consider that these screens may exhibit reduced sensitivity when used with gloves, which can be a critical factor in industrial or outdoor applications.

Mutual Capacitance Touchscreens

Mutual capacitance touchscreens are designed with a grid of electrodes that detect touch through changes in capacitance. They are commonly used in automotive interfaces and interactive displays due to their ability to support multiple simultaneous touches. While they offer high precision and responsiveness, the complex manufacturing process can lead to higher costs. Buyers should weigh the benefits of advanced features against the investment required.

Glass-Overlay Capacitive Touchscreens

Glass-overlay capacitive touchscreens feature a glass layer that enhances durability and aesthetic appeal, making them popular in medical devices and high-end consumer electronics. These screens provide excellent protection against scratches and environmental factors. However, their added weight and potential for glare may be drawbacks in certain applications. B2B buyers should evaluate the balance between durability and usability when considering these options for their products.

Related Video: What Makes Large Language Models Expensive?

Key Industrial Applications of capacitive touchscreen

| Industry/Sector | Specific Application of capacitive touchscreen | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Healthcare | Medical Equipment Displays | Enhanced patient interaction and data accuracy | Compliance with medical standards, durability, and hygiene |

| Automotive | Infotainment Systems | Improved user experience and safety features | Robustness to environmental factors, integration capabilities |

| Retail | Interactive Kiosks and Point-of-Sale Systems | Increased customer engagement and sales efficiency | Customization options, ease of integration, and support |

| Industrial Automation | Control Panels and Machinery Interfaces | Streamlined operations and reduced training time | Resistance to industrial conditions, reliability, and service support |

| Consumer Electronics | Smartphones and Tablets | Superior touch responsiveness and user satisfaction | Supply chain reliability, quality assurance, and design flexibility |

Healthcare

In the healthcare sector, capacitive touchscreens are integrated into medical equipment displays, enabling healthcare professionals to interact with patient data swiftly and accurately. These touchscreens enhance user interfaces, allowing for quick access to vital information, thus improving patient outcomes. For international buyers, it is crucial to ensure that the touchscreens comply with medical regulations and standards, are easy to clean, and have a high level of durability to withstand frequent use in clinical environments.

Automotive

Capacitive touchscreens are increasingly found in automotive infotainment systems, providing drivers with intuitive controls for navigation, entertainment, and vehicle settings. This technology improves the overall user experience and can enhance safety by minimizing distractions. Buyers in the automotive industry should consider sourcing touchscreens that are designed to withstand extreme temperatures and vibrations, ensuring reliability in diverse driving conditions, particularly in regions with varying climates such as Africa and South America.

Retail

In retail, capacitive touchscreens are utilized in interactive kiosks and point-of-sale systems, facilitating engaging customer interactions. These systems not only streamline checkout processes but also provide valuable data analytics on consumer behavior. For B2B buyers in this sector, sourcing touchscreens that allow for customization in design and functionality is essential, as well as ensuring they can be easily integrated with existing retail management systems.

Industrial Automation

Capacitive touchscreens play a vital role in control panels and machinery interfaces within industrial automation. They allow operators to monitor and control machinery with greater precision, leading to increased efficiency and reduced training time for new employees. Buyers in the industrial sector should prioritize sourcing screens that are resistant to dust, moisture, and other harsh conditions, ensuring long-term reliability and performance in demanding environments.

Consumer Electronics

In the consumer electronics market, capacitive touchscreens are a staple in smartphones and tablets, offering enhanced touch responsiveness and a seamless user experience. The demand for high-quality touchscreens in this sector is driven by consumer expectations for speed and accuracy. B2B buyers should focus on sourcing touchscreens that provide high resolution, durability, and are backed by strong supply chain logistics to avoid disruptions, especially in competitive markets across Europe and the Middle East.

Related Video: Capacitive Sensor Explained | Different Types and Applications

Strategic Material Selection Guide for capacitive touchscreen

When selecting materials for capacitive touchscreens, international B2B buyers must consider several factors that influence performance, durability, and cost. Below are analyses of four common materials used in capacitive touchscreen manufacturing, highlighting their properties, advantages, disadvantages, and specific considerations for buyers from diverse regions.

1. Glass

Key Properties:

Glass is a primary material for capacitive touchscreens due to its excellent transparency and hardness. It typically offers good temperature resistance (up to 300°C) and is chemically stable, making it resistant to corrosion from various environmental factors.

Pros & Cons:

Glass is highly durable and scratch-resistant, which enhances the longevity of the touchscreen. However, it can be brittle, leading to potential breakage upon impact. The manufacturing process can be complex, especially for specialized coatings like anti-glare or anti-fingerprint, which can increase costs.

Impact on Application:

Glass is compatible with a wide range of media, including styluses and fingers, making it versatile for different user interfaces. However, its weight can be a drawback in portable devices.

Considerations for International Buyers:

Buyers should ensure that the glass meets regional standards such as ASTM for the U.S. and DIN for Europe. Understanding local regulations regarding glass safety and recycling can also be crucial.

2. Indium Tin Oxide (ITO)

Key Properties:

ITO is a conductive coating applied to glass or plastic substrates. It has excellent electrical conductivity and optical transparency, making it ideal for touch sensor applications.

Pros & Cons:

The main advantage of ITO is its ability to maintain transparency while providing effective touch sensitivity. However, it is relatively expensive and can be brittle, which may limit its application in flexible touchscreens.

Impact on Application:

ITO is essential for applications requiring high clarity and responsiveness, such as smartphones and tablets. Its compatibility with various touchscreen technologies makes it a preferred choice.

Considerations for International Buyers:

Buyers should be aware of the sourcing and environmental impact of ITO, as indium mining can raise sustainability concerns. Compliance with international standards for material sourcing and waste management is essential.

3. Polyethylene Terephthalate (PET)

Key Properties:

PET is a thermoplastic polymer known for its flexibility, durability, and resistance to moisture and chemicals. It can withstand temperatures up to 120°C, making it suitable for various environments.

Pros & Cons:

The flexibility of PET allows for the production of lightweight and shatter-resistant touchscreens. However, it may not offer the same level of scratch resistance as glass, potentially leading to a shorter lifespan.

Impact on Application:

PET is often used in applications where weight and flexibility are critical, such as wearable devices. Its lower cost compared to glass makes it attractive for budget-sensitive projects.

Considerations for International Buyers:

Buyers should check for compliance with standards like JIS for Japan and ASTM for the U.S. Additionally, understanding the recyclability of PET in local markets can influence purchasing decisions.

4. Conductive Polymers

Key Properties:

Conductive polymers are organic compounds that can conduct electricity. They are lightweight and flexible, offering a unique combination of electrical conductivity and mechanical properties.

Pros & Cons:

These materials are highly adaptable and can be engineered for specific applications, allowing for innovative designs. However, they may not match the conductivity levels of ITO, potentially affecting performance in high-precision applications.

Impact on Application:

Conductive polymers are suitable for flexible touchscreens and emerging technologies, such as wearables. Their versatility can lead to unique product designs that traditional materials cannot achieve.

Considerations for International Buyers:

Buyers should evaluate the long-term performance and stability of conductive polymers, particularly in varying environmental conditions. Compliance with international standards for electronic materials is also important.

Summary Table

| Material | Typical Use Case for capacitive touchscreen | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Glass | Smartphones, tablets, industrial displays | High durability and scratch resistance | Brittle, heavy | High |

| Indium Tin Oxide (ITO) | High-end smartphones, tablets | Excellent transparency and conductivity | Expensive, brittle | High |

| Polyethylene Terephthalate (PET) | Wearable devices, budget-friendly applications | Lightweight and shatter-resistant | Lower scratch resistance | Medium |

| Conductive Polymers | Flexible touchscreens, wearables | Lightweight and customizable | Lower conductivity than ITO | Medium |

This strategic material selection guide aims to equip international B2B buyers with the insights needed to make informed decisions when sourcing materials for capacitive touchscreens, ensuring compliance with regional standards and optimizing product performance.

In-depth Look: Manufacturing Processes and Quality Assurance for capacitive touchscreen

The manufacturing process of capacitive touchscreens is intricate and involves several key stages, each crucial for producing high-quality products that meet international standards. For B2B buyers, especially those from Africa, South America, the Middle East, and Europe, understanding these processes and quality assurance measures can significantly influence procurement decisions.

Manufacturing Process of Capacitive Touchscreens

1. Material Preparation

The journey begins with the selection of high-grade materials, primarily glass sheets and conductive films. The glass sheets must be transparent, durable, and of optimal thickness to ensure accurate touch detection. Manufacturers typically use indium tin oxide (ITO) as the conductive film due to its excellent conductivity and transparency.

- Glass Sheet Selection: Choosing the right glass involves evaluating transparency, durability, and thickness.

- Conductive Film: The conductive film is applied to the glass, forming the foundation for touch sensitivity.

2. Forming

This stage transforms raw materials into functional components through various techniques:

- Etching and Patterning: Microscopic patterns are etched onto the glass surface to create electrodes. These patterns are essential for detecting changes in capacitance when a finger or stylus touches the screen.

- Thin Film Deposition: Layers of ITO are deposited onto the etched glass, establishing the necessary conductivity for touch sensing.

3. Assembly

Once the components are prepared, they undergo assembly:

- Lamination: Multiple layers, including the touchscreen sensor and a protective cover glass, are laminated together using advanced adhesive technologies. This step ensures minimal air bubbles and maintains touch sensitivity.

- Vacuum Technology: This technique is employed during lamination to eliminate air pockets, enhancing the overall performance of the touchscreen.

4. Finishing

The final touches are critical to ensuring a product ready for market:

- Testing and Calibration: Each touchscreen undergoes rigorous testing to ensure responsiveness and accuracy. Calibration is essential to align the touch sensor’s performance with the intended specifications.

- Final Inspection: A comprehensive inspection process checks for defects such as dead spots or inaccuracies in touch detection. Only products meeting quality standards proceed to packaging and shipping.

Quality Assurance in Capacitive Touchscreen Manufacturing

Quality assurance is paramount in the touchscreen manufacturing process, as it directly impacts performance and user experience. Various international standards and industry-specific certifications play a critical role in ensuring quality.

Relevant International Standards

- ISO 9001: This standard outlines the requirements for a quality management system and is essential for manufacturers looking to enhance customer satisfaction and ensure consistent quality.

- CE Marking: This certification is mandatory for products sold in the European Economic Area, indicating compliance with health, safety, and environmental protection standards.

- API Certification: Relevant for manufacturers producing touchscreens for specific industries, such as medical devices, ensuring adherence to stringent industry standards.

Quality Control Checkpoints

Quality control processes typically include several checkpoints to maintain product integrity:

- Incoming Quality Control (IQC): Raw materials are inspected upon arrival to verify their quality before production begins.

- In-Process Quality Control (IPQC): Ongoing checks during the manufacturing process ensure that each stage meets specified standards.

- Final Quality Control (FQC): Comprehensive testing and inspection of the final product before it is shipped to customers.

Common Testing Methods

Manufacturers utilize various testing methods to ensure touchscreens meet performance criteria:

- Functional Testing: Verifies that the touchscreen responds accurately to touch inputs.

- Durability Testing: Assesses the touchscreen’s ability to withstand daily use, including scratch resistance and impact testing.

- Environmental Testing: Evaluates performance under different environmental conditions, such as temperature fluctuations and humidity.

Verifying Supplier Quality Control

For B2B buyers, particularly those in regions like Africa, South America, the Middle East, and Europe, verifying a supplier’s quality control processes is critical to ensuring product reliability. Here are actionable steps buyers can take:

- Supplier Audits: Conducting on-site audits of potential suppliers provides insights into their manufacturing processes and quality control measures. This firsthand evaluation can reveal a supplier’s commitment to quality.

- Requesting Quality Reports: Buyers should request detailed quality reports that outline the supplier’s testing methods, results, and any certifications held.

- Third-Party Inspections: Engaging third-party inspection services can provide an unbiased assessment of a supplier’s quality control processes, ensuring adherence to international standards.

QC and Certification Nuances for International B2B Buyers

International buyers must navigate various nuances regarding quality control and certification:

- Understanding Regional Standards: Different regions may have specific regulations and standards. For example, products destined for the European market must comply with CE marking requirements, while products for North America might need UL certification.

- Cultural Sensitivity: Buyers should consider cultural differences in business practices. Open communication about quality expectations can help bridge gaps and foster strong supplier relationships.

- Logistical Considerations: Ensure that suppliers have the capability to manage logistics effectively, especially if components are sourced from different regions. This includes understanding shipping times, customs regulations, and potential delays.

Conclusion

The manufacturing processes and quality assurance protocols for capacitive touchscreens are complex yet essential for producing high-quality products. By understanding these stages and implementing robust verification methods, B2B buyers can make informed decisions, ensuring they source touchscreens that meet their specific needs and standards.

Related Video: The Most Sophisticated Manufacturing Process In The World Inside The Fab | Intel

Comprehensive Cost and Pricing Analysis for capacitive touchscreen Sourcing

Understanding the costs and pricing associated with sourcing capacitive touchscreens is crucial for international B2B buyers. This analysis will break down the various cost components, price influencers, and offer actionable buyer tips to navigate the complexities of this market, particularly for buyers from Africa, South America, the Middle East, and Europe.

Cost Components

-

Materials: The primary materials include glass substrates, conductive coatings (like indium tin oxide), and various electronic components. The quality and type of materials selected will significantly impact overall costs. High-quality materials enhance performance but can increase the price.

-

Labor: Labor costs vary by region and manufacturing scale. In regions with lower labor costs, such as parts of Asia, manufacturers may offer more competitive pricing. However, labor costs in Europe and the Americas may be higher due to stricter labor laws and higher living standards.

-

Manufacturing Overhead: This includes costs related to facilities, utilities, and indirect labor. Efficient manufacturing processes and facilities can reduce these overhead costs. Buyers should inquire about the manufacturer’s operational efficiencies to understand how these costs affect pricing.

-

Tooling: Initial tooling costs can be significant, especially for custom designs. These costs are usually amortized over production runs, which means higher minimum order quantities (MOQs) can lead to lower per-unit costs.

-

Quality Control (QC): Ensuring quality through rigorous testing and certification processes is essential in the capacitive touchscreen industry. Investments in quality assurance can lead to higher upfront costs but reduce the risk of defects and returns.

-

Logistics: Shipping and handling costs can vary widely based on distance, shipping methods, and Incoterms. International buyers should consider these factors when calculating the total cost of ownership.

-

Margin: Manufacturers typically include a profit margin that can vary based on market competition and brand reputation. Established brands may command higher margins due to perceived quality and reliability.

Price Influencers

-

Volume/MOQ: Bulk orders often lead to significant discounts. Negotiating lower MOQs can also be beneficial for smaller companies that may not have large immediate needs but anticipate growth.

-

Specifications/Customization: Custom features, such as enhanced sensitivity or specialized coatings, can increase costs. Buyers should clearly define specifications to avoid unexpected pricing changes.

-

Materials: The choice of materials directly influences pricing. For instance, using premium glass and advanced conductive films can enhance touchscreen performance but also raise costs.

-

Quality and Certifications: Screens that meet specific industry certifications (such as medical or automotive standards) often carry a premium. Buyers should evaluate the necessary certifications for their applications to avoid overpaying.

-

Supplier Factors: The reputation, reliability, and service level of suppliers can influence pricing. Long-term partnerships with trusted suppliers may lead to better terms and pricing stability.

-

Incoterms: Understanding shipping terms is critical for international transactions. Terms like FOB (Free on Board) or CIF (Cost, Insurance, Freight) can affect the total landed cost of products.

Buyer Tips

-

Negotiation: Always negotiate pricing based on volume and long-term relationships. Establishing a rapport with suppliers can lead to better terms.

-

Cost-Efficiency: Consider the Total Cost of Ownership (TCO), which includes purchase price, shipping, and potential warranty costs. A cheaper unit price may not be cost-effective if quality issues arise.

-

Pricing Nuances for International Buyers: Be aware of currency fluctuations, import duties, and local taxes that may affect the final cost. Buyers from Africa and South America, in particular, should consider local economic conditions and trade agreements that may influence pricing.

-

Quality Assurance: Don’t compromise on quality for price. Investing in reliable suppliers with proven track records can save costs in the long run by reducing failures and returns.

Disclaimer

The prices and cost structures outlined are indicative and can vary based on market conditions, specific supplier negotiations, and evolving technological advancements. It is advisable for buyers to conduct thorough market research and supplier evaluations to determine the most accurate pricing for their specific needs.

Spotlight on Potential capacitive touchscreen Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘capacitive touchscreen’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for capacitive touchscreen

Key Technical Properties of Capacitive Touchscreens

Understanding the essential technical properties of capacitive touchscreens is crucial for B2B buyers, especially when evaluating options for various applications in sectors such as consumer electronics, automotive, and healthcare. Here are some critical specifications:

-

Material Grade

Capacitive touchscreens are often made from glass or plastic substrates. The material grade affects durability, clarity, and sensitivity. High-grade materials, such as Corning Gorilla Glass, provide enhanced scratch resistance and clarity, making them ideal for high-end devices. Buyers should prioritize suppliers that offer screens made from durable materials to ensure longevity and reduce replacement costs. -

Touch Sensitivity

This specification refers to the responsiveness of the touchscreen to user input. Measured in milliamps (mA), higher sensitivity ensures that the screen can detect light touches accurately, which is essential for applications requiring precision, such as medical devices. For B2B buyers, understanding touch sensitivity helps in selecting screens that align with user experience expectations. -

Resolution

The resolution of a capacitive touchscreen is defined by the number of pixels per inch (PPI). Higher resolutions provide clearer images and better touch accuracy. For businesses in sectors like retail or automotive, where visual clarity is paramount, choosing a touchscreen with high resolution can significantly enhance user interaction and satisfaction. -

Operating Temperature Range

Capacitive touchscreens must perform reliably across various environmental conditions. The operating temperature range indicates the temperatures within which the screen can function effectively. For industries operating in extreme climates, selecting screens that can withstand specific temperature ranges is vital to ensure operational reliability and reduce downtime. -

Durability Ratings

Touchscreens are often rated based on their ability to withstand impacts, scratches, and environmental factors. Common ratings include IP (Ingress Protection) ratings, which indicate resistance to dust and moisture. For B2B buyers, understanding these ratings helps in choosing the right products for rugged applications, such as industrial equipment or outdoor kiosks.

Common Trade Terminology

Familiarity with industry jargon is essential for effective communication and negotiation in the capacitive touchscreen market. Here are some common terms:

-

OEM (Original Equipment Manufacturer)

An OEM is a company that produces components that are used in another company’s end product. For B2B buyers, working with reputable OEMs ensures high-quality touchscreens that meet specific standards and requirements. -

MOQ (Minimum Order Quantity)

MOQ refers to the smallest quantity of a product that a supplier is willing to sell. Understanding MOQs helps buyers manage inventory and negotiate better terms with suppliers, ensuring they do not overcommit to large orders that may not be needed.

Illustrative Image (Source: Google Search)

-

RFQ (Request for Quotation)

An RFQ is a document used to solicit price proposals from suppliers. It is essential for B2B buyers to prepare detailed RFQs to receive accurate pricing and terms from manufacturers, allowing for informed decision-making. -

Incoterms (International Commercial Terms)

Incoterms are a set of rules that define the responsibilities of buyers and sellers in international transactions. Familiarity with these terms helps buyers understand shipping responsibilities, costs, and risk management, which is crucial for international procurement. -

Lead Time

Lead time is the amount of time from placing an order to receiving the product. Understanding lead times is essential for B2B buyers to effectively plan their inventory and production schedules, ensuring that they meet customer demands without delays. -

Touch Technology Type

This term refers to the specific technology used in the touchscreen, such as projected capacitive (PCAP) or surface capacitive. Each technology has its advantages and applications, and understanding these differences helps buyers select the most suitable option for their specific needs.

By grasping these technical properties and industry terms, B2B buyers can make informed decisions, enhance their procurement strategies, and ultimately improve their product offerings in an increasingly competitive market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the capacitive touchscreen Sector

Market Overview & Key Trends

The global capacitive touchscreen market is projected to grow significantly, with a forecasted CAGR of 10.8% from 2024 to 2030, reaching an estimated value of US$ 52.6 billion. This growth is largely driven by the increasing demand for interactive displays across various sectors, including consumer electronics, automotive, healthcare, and retail. As international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, it is vital to understand current and emerging trends that are shaping this market.

Illustrative Image (Source: Google Search)

One key trend is the rise in automotive applications. With the shift toward electric vehicles (EVs), capacitive touchscreens are becoming integral for infotainment systems and dashboards, offering enhanced interactivity and user experience. Additionally, the healthcare sector is embracing touchscreens for medical devices and patient interaction systems, driving demand for high-quality, durable displays.

In terms of sourcing, there is a noticeable movement towards localization. Buyers are increasingly seeking suppliers closer to their operational bases to reduce lead times and logistics costs. Furthermore, the adoption of flexible and foldable touch technologies is gaining traction, presenting opportunities for innovative product offerings. B2B buyers should prioritize partnerships with manufacturers who are at the forefront of these technological advancements, ensuring access to the latest products and capabilities.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a critical factor in the capacitive touchscreen market, with buyers demanding more eco-friendly products and practices. The production of touchscreens often involves materials that can have a significant environmental impact, such as rare earth metals and certain plastics. Therefore, sourcing from manufacturers that prioritize sustainable practices is essential.

Buyers should look for green certifications such as ISO 14001 or RoHS compliance, which indicate a commitment to reducing environmental footprints. Additionally, materials like recycled glass and bio-based plastics are gaining popularity in the manufacturing process, contributing to lower overall emissions and waste.

Moreover, ensuring ethical supply chains is crucial. This includes verifying that suppliers adhere to fair labor practices and do not engage in exploitative practices. By choosing suppliers with robust sustainability frameworks and transparent sourcing strategies, B2B buyers can not only meet regulatory requirements but also enhance their brand reputation and appeal to increasingly eco-conscious consumers.

Brief Evolution/History

The capacitive touchscreen technology has evolved significantly since its inception in the 1970s. Initially employed in industrial applications, it gained mainstream attention with the advent of smartphones in the early 2000s, particularly with Apple’s introduction of the iPhone in 2007. This marked a pivotal moment, as the technology transitioned from specialized use to everyday consumer products.

Over the years, advancements in materials and manufacturing processes, such as the introduction of indium tin oxide (ITO) for conductive coatings, have improved touchscreen performance, durability, and responsiveness. As the market continues to evolve, innovations in flexible displays and integration with AI technologies are setting the stage for the next generation of capacitive touchscreens, creating new opportunities for B2B buyers to explore cutting-edge solutions.

In conclusion, understanding market dynamics, sourcing trends, and sustainability practices is essential for international B2B buyers in the capacitive touchscreen sector. By aligning with forward-thinking manufacturers and prioritizing ethical and sustainable practices, companies can leverage the growth of this vibrant market while contributing positively to global challenges.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of capacitive touchscreen

-

How can I effectively vet suppliers for capacitive touchscreens?

When vetting suppliers, focus on their industry experience, production capabilities, and customer reviews. Request case studies or references from other B2B buyers. Verify certifications such as ISO 9001 for quality management and any specific industry standards relevant to your needs (like automotive or medical). Conduct site visits if possible or arrange virtual tours to assess their manufacturing processes and quality control measures. Additionally, ensure they have a responsive communication system to address your inquiries promptly. -

What customization options are available for capacitive touchscreens?

Most manufacturers offer a range of customization options, including size, shape, and functionality. Discuss specific needs such as screen resolution, touch sensitivity, and additional features like anti-glare coatings or enhanced durability for harsh environments. Ensure that the supplier can accommodate your requirements by reviewing their past projects and prototypes. It’s also beneficial to request samples to evaluate the performance of customized screens before making a large order. -

What are the typical minimum order quantities (MOQs) and lead times for capacitive touchscreens?

MOQs can vary significantly based on the supplier and customization level; they typically range from 100 to 1000 units. Standard lead times for production range from 4 to 12 weeks, depending on the complexity of the order and the supplier’s capacity. It’s advisable to confirm these details during negotiations and consider potential delays due to logistics or supply chain disruptions. Establishing a clear timeline and confirming MOQs early can prevent misunderstandings later. -

How should I handle payment terms and conditions with suppliers?

Negotiating payment terms is crucial for managing cash flow. Common practices include a deposit upfront (typically 30-50%) with the balance due upon delivery or after inspection. Consider using letters of credit for larger transactions to provide security for both parties. Ensure that payment methods are secure and that you understand any fees associated with international transactions. Clear documentation of payment terms in the contract can help prevent disputes later. -

What quality assurance measures should I expect from capacitive touchscreen suppliers?

Reputable suppliers should have robust quality assurance (QA) processes in place, including regular testing at various production stages. Expect them to conduct tests for responsiveness, durability, and environmental resistance. Request detailed QA documentation, including test results and compliance certificates with international standards (e.g., RoHS, CE). Additionally, inquire about their return and warranty policies, which can provide insight into their commitment to product quality. -

How can I ensure smooth logistics when sourcing capacitive touchscreens internationally?

Effective logistics planning is essential for timely delivery. Confirm the supplier’s shipping capabilities and options, including freight forwarding and customs handling. Understand the Incoterms (e.g., FOB, CIF) that apply to your order, as these define responsibilities for shipping costs and risks. Additionally, consider potential customs duties and import regulations in your country. Partnering with experienced logistics providers can facilitate smoother operations and mitigate delays. -

What steps can I take to resolve disputes with suppliers?

Establishing a clear contract that outlines terms, responsibilities, and dispute resolution processes is vital. Should a dispute arise, initiate communication with the supplier to understand their perspective. If informal discussions do not resolve the issue, consider mediation or arbitration as alternative dispute resolution methods. Document all communications and agreements to support your position. Having a legal expert familiar with international trade can also provide guidance throughout the process. -

What certifications should I look for when sourcing capacitive touchscreens?

Certifications ensure that the product meets specific quality and safety standards. Look for ISO certifications, particularly ISO 9001 for quality management. Depending on your industry, additional certifications may include CE for European markets, RoHS for hazardous materials compliance, and UL for safety standards. Understanding these certifications can help you assess the reliability of the supplier and ensure that the touchscreens meet the regulatory requirements of your target market.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for capacitive touchscreen

The capacitive touchscreen market is poised for significant growth, presenting lucrative opportunities for international B2B buyers. As industries across Africa, South America, the Middle East, and Europe increasingly adopt capacitive touch technology, strategic sourcing becomes essential. Key takeaways include the importance of selecting reliable manufacturers, understanding the nuances of the production process, and leveraging innovative technologies that enhance user experience.

Investing in high-quality capacitive touchscreens can lead to enhanced product offerings, improved customer satisfaction, and a competitive edge in the market. Buyers should prioritize partnerships with leading manufacturers such as Apple, Samsung, and LG, who are at the forefront of technological advancements and quality assurance. Furthermore, being aware of regional market trends and consumer demands can drive more informed sourcing decisions.

Looking ahead, the capacitive touchscreen market is expected to evolve with advancements in flexibility and integration with emerging technologies. B2B buyers are encouraged to stay proactive in exploring these innovations and to capitalize on the growing market potential. By fostering strategic partnerships and embracing new solutions, businesses can position themselves to thrive in this dynamic landscape.