Master OEM Trade: Your Essential Guide to Effective B2B

Introduction: Navigating the Global Market for oem trade

In today’s interconnected world, navigating the global market for Original Equipment Manufacturer (OEM) trade is essential for businesses seeking to enhance their competitiveness and operational efficiency. As international B2B buyers from regions such as Africa, South America, the Middle East, and Europe (including the UK and Egypt) increasingly seek tailored solutions to meet diverse market demands, understanding the nuances of OEM trade becomes paramount. This guide is designed to empower you with the knowledge needed to make informed sourcing decisions.

The critical importance of OEM trade lies in its ability to facilitate cost-effective production while allowing companies to maintain brand integrity. By leveraging the expertise of OEM partners, businesses can focus on their core competencies, reduce manufacturing costs, and rapidly bring products to market. This guide comprehensively covers various aspects of OEM trade, including types of OEM partnerships, materials used, manufacturing and quality control processes, supplier selection, cost considerations, and market dynamics.

Additionally, we address frequently asked questions to demystify the OEM landscape. With this resource, international buyers will gain actionable insights and strategic advantages, enabling them to forge successful partnerships and optimize their procurement strategies in the ever-evolving global marketplace. Embrace the opportunities that OEM trade presents and position your business for sustainable growth and success.

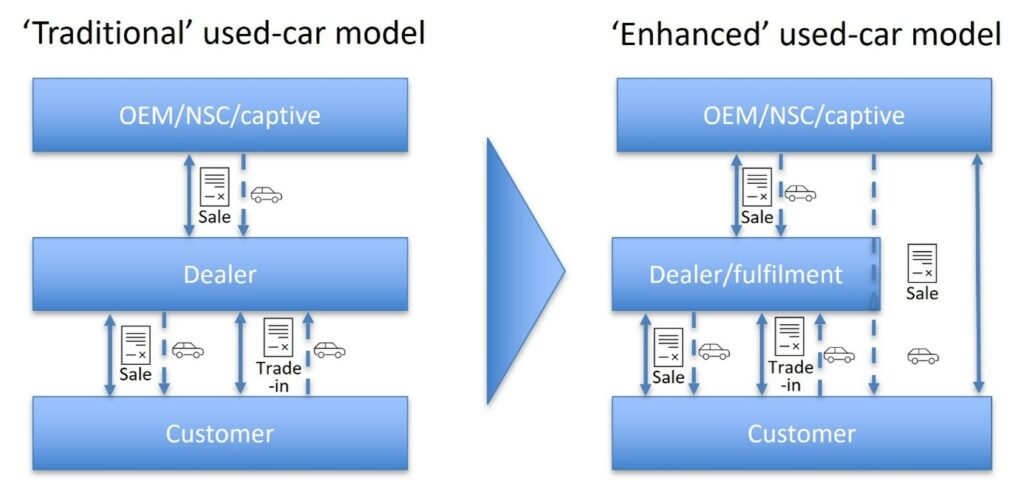

Illustrative Image (Source: Google Search)

Understanding oem trade Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Traditional OEM | Produces products per client specifications and designs. | Electronics, automotive, consumer goods. | Pros: Brand control, customization. Cons: Higher initial investment. |

| Contract OEM | Production based on contract terms, often with lower costs. | Apparel, textiles, and low-tech products. | Pros: Cost-effective, flexibility. Cons: Less design control. |

| Private Label OEM | Products manufactured for sale under a retailer’s brand. | Grocery items, cosmetics, and household goods. | Pros: Quick market entry, brand loyalty. Cons: Limited customization options. |

| Custom OEM | Tailored solutions with unique specifications for each client. | High-end electronics, specialized machinery. | Pros: Unique products, high quality. Cons: Longer lead times, higher costs. |

| Joint Venture OEM | Collaboration between two companies to produce a product. | Automotive, technology sectors. | Pros: Shared resources, innovation. Cons: Complex management, potential conflicts. |

Traditional OEM

Traditional OEMs are characterized by their production of goods based on detailed specifications provided by the purchasing company. This model is particularly suitable for industries such as electronics, automotive, and consumer goods, where brand identity and product quality are paramount. When considering a traditional OEM partnership, B2B buyers should evaluate the OEM’s manufacturing capabilities, quality assurance processes, and ability to meet specific design requirements, as these factors significantly impact product success in the market.

Contract OEM

Contract OEMs operate under a defined agreement that outlines production terms, typically offering lower costs due to economies of scale. This model is often utilized in industries like apparel and textiles, where cost management is crucial. Buyers should assess the flexibility of contract terms, production timelines, and the OEM’s reputation for delivering quality products on time. While this model can provide significant savings, it may come with trade-offs in terms of design input and control.

Private Label OEM

Private label OEMs manufacture products that are sold under another company’s brand name, allowing retailers to offer unique products without the need for extensive R&D. This model is prevalent in grocery, cosmetics, and household goods sectors. B2B buyers should consider market demand, branding strategies, and the OEM’s capability to deliver consistent quality. Although private label products can enhance brand loyalty and customer retention, they may offer limited customization options compared to traditional OEMs.

Custom OEM

Custom OEMs provide highly tailored solutions, creating products that meet specific client needs. This approach is favored in high-end electronics and specialized machinery sectors, where differentiation is key. Buyers engaging with custom OEMs must be prepared for longer lead times and potentially higher costs, but the payoff can be a unique product that stands out in the marketplace. It is essential for buyers to communicate their requirements clearly and ensure the OEM has the necessary expertise and resources.

Joint Venture OEM

Joint venture OEMs involve partnerships between two companies to produce a product, combining resources and expertise. This model is commonly seen in the automotive and technology sectors, where innovation and shared capabilities can lead to superior products. B2B buyers should carefully consider the dynamics of the partnership, including governance structures and conflict resolution mechanisms, as these can significantly impact project success. While joint ventures can foster innovation, they also require effective management to navigate potential complexities.

Related Video: What is E-Commerce? Definition, Types, and Business Models

Key Industrial Applications of oem trade

| Industry/Sector | Specific Application of OEM Trade | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Manufacturing of vehicle components (e.g., engines, brakes) | Cost efficiency, quality assurance, faster time-to-market | Supplier reliability, certifications, and compliance |

| Electronics | Production of consumer electronics (e.g., smartphones, laptops) | Customization options, brand consistency, reduced R&D costs | Intellectual property protection, scalability, lead times |

| Healthcare | Development of medical devices (e.g., diagnostic tools, implants) | High-quality standards, regulatory compliance, innovation | Regulatory certifications, material sourcing, testing protocols |

| Construction & Machinery | Fabrication of construction equipment parts (e.g., engines, hydraulics) | Enhanced durability, reduced production costs, timely delivery | Supplier expertise, material quality, logistical capabilities |

| Renewable Energy | Production of solar panels and wind turbine components | Sustainability, alignment with global trends, cost reduction | Supply chain transparency, ethical sourcing, scalability |

Automotive

In the automotive sector, OEM trade is vital for manufacturing essential vehicle components like engines and braking systems. By partnering with established OEMs, companies can ensure cost efficiency and maintain high-quality standards. International buyers must focus on supplier reliability and necessary certifications to comply with regional regulations. Furthermore, understanding the OEM’s production capabilities and lead times is crucial to meet market demands effectively.

Electronics

The electronics industry leverages OEM trade for the production of consumer devices such as smartphones and laptops. This approach allows businesses to customize products according to market trends while maintaining brand consistency. For B2B buyers, protecting intellectual property is paramount, especially when collaborating with overseas manufacturers. Scalability and lead times are also critical factors, as they influence the speed at which companies can respond to consumer demands.

Healthcare

In healthcare, OEM trade facilitates the development of medical devices, including diagnostic tools and implants. The partnership with OEMs ensures adherence to stringent quality standards and regulatory compliance, which are essential in this sector. Buyers must prioritize suppliers that can demonstrate regulatory certifications and robust testing protocols. Additionally, sourcing high-quality materials is vital to ensure the safety and efficacy of medical devices.

Construction & Machinery

OEM trade in the construction and machinery sector involves the fabrication of parts for equipment such as engines and hydraulic systems. This collaboration enhances durability and reduces production costs, allowing companies to offer competitive pricing. Buyers should consider the expertise of suppliers in specific machinery parts and their ability to deliver quality materials consistently. Furthermore, logistical capabilities play a significant role in ensuring timely project completions.

Renewable Energy

The renewable energy sector increasingly relies on OEM trade for the production of components like solar panels and wind turbine parts. This trend aligns with global sustainability goals and offers businesses a pathway to reduce costs while promoting eco-friendly practices. B2B buyers must ensure supply chain transparency and ethical sourcing when selecting OEM partners. Additionally, evaluating a supplier’s ability to scale production to meet rising demand is essential for long-term collaboration.

Related Video: LBO Model Tutorial: Sources & Uses and Financial Forecast

Strategic Material Selection Guide for oem trade

When selecting materials for OEM trade, international buyers must consider various factors that impact product performance, manufacturing complexity, and compliance with regional standards. Below, we analyze four common materials used in OEM applications, highlighting their properties, advantages, disadvantages, and specific considerations for buyers from Africa, South America, the Middle East, and Europe.

1. Aluminum

Key Properties: Aluminum is lightweight, corrosion-resistant, and possesses excellent thermal and electrical conductivity. It typically has a temperature rating of up to 400°F (204°C) and can withstand moderate pressure.

Pros & Cons: The primary advantage of aluminum is its lightweight nature, which reduces shipping costs and improves energy efficiency in applications like automotive and aerospace. However, its lower strength compared to steel can be a limitation in high-stress applications. Manufacturing complexity can also be higher due to the need for specialized welding techniques.

Impact on Application: Aluminum is suitable for applications requiring good thermal conductivity and corrosion resistance, such as heat exchangers and automotive components. Its compatibility with various media makes it versatile across industries.

Considerations for International Buyers: Buyers should ensure compliance with standards such as ASTM B221 for extruded aluminum products. In regions like Europe, adherence to EU regulations regarding material safety is crucial.

2. Stainless Steel

Key Properties: Stainless steel is known for its high strength, corrosion resistance, and ability to withstand extreme temperatures (up to 1500°F or 815°C). It is available in various grades, each suited for specific applications.

Pros & Cons: The key advantage of stainless steel is its durability and resistance to corrosion, making it ideal for harsh environments. However, it is generally more expensive than aluminum and can be more challenging to machine, increasing manufacturing complexity.

Impact on Application: Stainless steel is commonly used in food processing, medical devices, and construction due to its hygienic properties and strength. Its compatibility with a wide range of media, including corrosive substances, enhances its application scope.

Considerations for International Buyers: Buyers need to be aware of compliance with standards like ASTM A240 for stainless steel sheets. In regions such as the Middle East, where high temperatures and humidity are prevalent, selecting the appropriate grade is vital.

3. Polypropylene (PP)

Key Properties: Polypropylene is a thermoplastic polymer characterized by its chemical resistance, lightweight, and flexibility. It can withstand temperatures up to 210°F (99°C) and has a good tensile strength.

Pros & Cons: The primary advantage of polypropylene is its cost-effectiveness and ease of manufacturing, making it suitable for mass production. However, it has lower strength compared to metals and can deform under high temperatures, limiting its application in high-stress environments.

Impact on Application: Polypropylene is widely used in packaging, automotive parts, and consumer goods due to its lightweight and chemical resistance. It is compatible with a variety of media, including acids and bases.

Considerations for International Buyers: Buyers should ensure compliance with relevant standards such as ASTM D4101 for polypropylene materials. In regions like Africa, where environmental conditions can vary, selecting UV-stabilized grades may be necessary for outdoor applications.

4. Carbon Steel

Key Properties: Carbon steel is known for its high strength and durability, with temperature ratings exceeding 1000°F (538°C) depending on the alloy. It is less resistant to corrosion compared to stainless steel but can be treated for improved performance.

Pros & Cons: The main advantage of carbon steel is its cost-effectiveness and strength, making it ideal for structural applications. However, its susceptibility to rust and corrosion can be a significant drawback, necessitating protective coatings.

Impact on Application: Carbon steel is commonly used in construction, automotive, and machinery applications where strength is paramount. Its compatibility with various media is generally good, but care must be taken with corrosive substances.

Considerations for International Buyers: Compliance with standards such as ASTM A36 for structural steel is essential. Buyers in Europe and the Middle East should also consider local regulations regarding material safety and environmental impact.

Summary Table

| Material | Typical Use Case for OEM Trade | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum | Automotive components, heat exchangers | Lightweight and corrosion-resistant | Lower strength compared to steel | Medium |

| Stainless Steel | Food processing, medical devices | High durability and corrosion resistance | Higher cost and machining complexity | High |

| Polypropylene | Packaging, automotive parts | Cost-effective and easy to manufacture | Lower strength and heat deformation | Low |

| Carbon Steel | Construction, machinery | High strength and cost-effective | Susceptible to rust and corrosion | Medium |

This strategic material selection guide provides international B2B buyers with essential insights into material properties, advantages, and limitations, enabling informed decision-making for OEM trade.

In-depth Look: Manufacturing Processes and Quality Assurance for oem trade

In the competitive landscape of OEM trade, understanding the manufacturing processes and quality assurance protocols is crucial for international B2B buyers. This knowledge not only helps in selecting the right manufacturing partner but also ensures that the products meet the required standards and specifications. Below is a detailed overview of typical manufacturing processes and quality control measures relevant to OEM operations.

Manufacturing Processes

The manufacturing process in OEM trade typically involves several key stages, each critical to ensuring the final product meets the desired specifications.

1. Material Preparation

Material preparation is the first step in the manufacturing process. It involves the selection and preparation of raw materials based on the specifications provided by the purchasing company. This stage may include:

- Material Selection: Choosing the right materials that align with the product requirements, considering factors such as strength, durability, and cost.

- Cutting and Shaping: Raw materials are cut and shaped to the required dimensions, which may involve techniques such as laser cutting, shearing, or machining.

2. Forming

Once materials are prepared, the next stage is forming, where the raw materials are transformed into the desired shapes. Common techniques include:

- Casting: Pouring molten material into molds to create specific shapes.

- Molding: Using molds to form materials, particularly plastics and metals.

- Stamping: Applying pressure to materials to create shapes, often used in sheet metal fabrication.

3. Assembly

The assembly phase combines various components into a finished product. This can be manual or automated, depending on the complexity of the product. Key techniques include:

- Mechanical Assembly: Using screws, bolts, or rivets to join parts.

- Welding: Fusing materials together using heat.

- Adhesive Bonding: Employing glues or adhesives for joining components, particularly in applications where welding is impractical.

4. Finishing

Finishing processes enhance the product’s appearance and performance. Techniques in this stage may include:

- Surface Treatment: Processes like painting, powder coating, or anodizing to improve aesthetics and corrosion resistance.

- Quality Inspection: Conducting quality checks during this stage ensures that the products meet the specifications before they are packaged and shipped.

Quality Assurance

Quality assurance is vital in OEM manufacturing to ensure that products meet both international and industry-specific standards. Here are key elements of quality assurance relevant to B2B buyers.

International Standards

Several international standards govern quality assurance in manufacturing:

- ISO 9001: This standard specifies requirements for a quality management system (QMS) and is applicable to any organization, regardless of size or industry. Compliance indicates a commitment to quality and continuous improvement.

- CE Marking: Required for products sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

- API Standards: Relevant for manufacturers in the oil and gas industry, ensuring products meet specific performance and safety criteria.

Quality Control Checkpoints

Quality control in OEM processes typically involves several checkpoints:

- Incoming Quality Control (IQC): Inspecting raw materials upon arrival to ensure they meet specified standards.

- In-Process Quality Control (IPQC): Conducting inspections during the manufacturing process to catch defects early.

- Final Quality Control (FQC): A thorough inspection of the finished product before packaging and shipment, ensuring it meets all specifications.

Common Testing Methods

To verify product quality, various testing methods are employed, including:

- Dimensional Inspection: Measuring physical dimensions to ensure they meet specifications.

- Functional Testing: Assessing the product’s performance under simulated conditions.

- Durability Testing: Evaluating how well the product withstands stress, wear, and environmental factors.

Verifying Supplier Quality Control

For international B2B buyers, verifying the quality control processes of OEM suppliers is essential. Here are actionable steps to ensure robust supplier QC:

- Conduct Audits: Regular audits of suppliers’ manufacturing facilities can help assess compliance with quality standards and practices.

- Request Quality Reports: Suppliers should provide documentation demonstrating their quality control processes and results from previous inspections.

- Third-Party Inspections: Engaging third-party inspection services can offer an unbiased assessment of the supplier’s quality practices and product quality.

Quality Control Nuances for International Buyers

International buyers, particularly from regions like Africa, South America, the Middle East, and Europe, should be aware of several nuances when dealing with OEM suppliers:

- Cultural Differences: Understanding cultural attitudes towards quality and compliance can impact negotiations and expectations.

- Regulatory Compliance: Buyers must ensure that products comply with local regulations in their markets, which may differ significantly from the supplier’s country.

- Supply Chain Transparency: Maintaining transparency throughout the supply chain can facilitate better communication regarding quality expectations and issues.

In conclusion, a thorough understanding of the manufacturing processes and quality assurance protocols in OEM trade is essential for B2B buyers. By focusing on material preparation, forming, assembly, and finishing, and by ensuring robust quality control measures are in place, buyers can enhance their sourcing strategies and secure high-quality products that meet their specific needs.

Related Video: Top 5 Mass Production Techniques: Manufacturing Process

Comprehensive Cost and Pricing Analysis for oem trade Sourcing

In the context of OEM trade sourcing, understanding the comprehensive cost structure and pricing dynamics is crucial for international B2B buyers. This analysis will delve into key cost components, price influencers, and practical buyer tips tailored specifically for businesses in Africa, South America, the Middle East, and Europe.

Cost Components

When evaluating the costs associated with OEM trade, buyers should consider several critical components:

-

Materials: The cost of raw materials is often the largest expense. Prices can fluctuate based on global market trends, availability, and quality specifications. Buyers should negotiate terms with suppliers to secure favorable rates.

-

Labor: Labor costs vary significantly by region. Countries with lower labor costs can offer competitive pricing, but this may impact quality. It’s essential to assess the skill level of the workforce in the supplier’s location.

-

Manufacturing Overhead: This includes costs related to utilities, rent, and equipment maintenance. Understanding the overhead structure of potential suppliers can provide insights into their pricing strategies.

-

Tooling: Initial tooling costs can be substantial, especially for custom designs. Buyers should inquire about these costs upfront, as they can significantly affect the overall price.

-

Quality Control (QC): Implementing rigorous QC processes is vital to ensure product standards. However, these processes can add to costs. Buyers should assess the QC measures employed by potential suppliers to balance cost and quality.

-

Logistics: Shipping and handling costs must be factored into the total cost. This includes freight charges, customs duties, and insurance. The choice of Incoterms will also influence logistics costs.

-

Margin: Supplier profit margins can vary widely based on their market positioning, competition, and operational efficiencies. Understanding these margins can help buyers negotiate better pricing.

Price Influencers

Several factors can significantly influence the pricing of OEM products:

-

Volume/MOQ (Minimum Order Quantity): Larger order volumes often lead to lower per-unit costs. Buyers should assess their capacity to commit to larger purchases to leverage better pricing.

-

Specifications/Customization: Customized products typically incur higher costs due to additional design and production efforts. Clear communication of specifications can help minimize misunderstandings that lead to cost overruns.

-

Material Quality and Certifications: Higher quality materials and necessary certifications (e.g., ISO standards) may increase costs but are essential for compliance and brand integrity. Buyers should weigh the cost against the potential benefits of higher quality.

-

Supplier Factors: The supplier’s reputation, reliability, and past performance can affect pricing. A well-established supplier may command higher prices due to perceived value and trust.

-

Incoterms: The chosen Incoterms can drastically alter the total cost of ownership. Different terms distribute responsibilities and costs between buyer and seller, impacting final pricing.

Buyer Tips

For international B2B buyers, particularly those from Africa, South America, the Middle East, and Europe, the following tips can enhance cost-efficiency in OEM trade sourcing:

-

Negotiation: Engage in open negotiations with suppliers. Understanding their cost structure can provide leverage for better pricing. Be prepared to discuss volume commitments and long-term partnerships.

-

Cost-Efficiency: Analyze total cost of ownership, not just the purchase price. Consider logistics, tariffs, and potential quality issues that could arise from cheaper options.

-

Pricing Nuances: Be aware of regional pricing strategies and economic conditions affecting suppliers. In emerging markets, for instance, currency fluctuations can impact costs.

-

Supplier Relationships: Building strong relationships with suppliers can lead to more favorable pricing and terms. Consider regular communication and feedback to foster these relationships.

-

Disclaimer for Indicative Prices: Keep in mind that prices can fluctuate based on market conditions, and it’s advisable to request formal quotations for accurate pricing.

By understanding these dynamics, international B2B buyers can make informed decisions that align with their strategic sourcing goals while optimizing costs in the OEM trade landscape.

Spotlight on Potential oem trade Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘oem trade’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for oem trade

Critical Technical Properties in OEM Trade

When engaging in OEM trade, understanding the technical properties that influence product quality and manufacturing efficiency is crucial. Here are some key specifications that international B2B buyers should consider:

-

Material Grade

Material grade refers to the quality and type of raw materials used in manufacturing. It determines the durability, performance, and suitability of a product for specific applications. Buyers must ensure that the material grade meets industry standards to avoid issues related to product failure or non-compliance. -

Tolerance

Tolerance defines the acceptable deviation from a specified dimension or property. It is critical in ensuring parts fit together correctly, particularly in complex assemblies. A well-defined tolerance helps in minimizing production errors and enhances product reliability, which is vital for maintaining customer satisfaction and reducing costs associated with rework. -

Surface Finish

Surface finish pertains to the texture and quality of a product’s surface after manufacturing. It can affect not only aesthetics but also functionality, such as corrosion resistance and wear resistance. Understanding the required surface finish can help buyers select the right OEM partner who can meet their specifications. -

Load Capacity

Load capacity indicates the maximum load a product can safely support. This specification is particularly important in industries like automotive and construction, where safety is paramount. Buyers should assess load capacity to ensure that the products will perform under expected operational conditions. -

Certifications and Compliance

Certifications, such as ISO or CE markings, demonstrate that products meet certain standards of quality and safety. Buyers should look for OEMs that have relevant certifications to ensure compliance with local regulations and international standards, which can help mitigate risks associated with product liability. -

Lead Time

Lead time is the time required to manufacture and deliver products. It is a critical factor in supply chain management, affecting inventory levels and overall project timelines. Understanding lead times helps buyers plan their operations better and manage customer expectations effectively.

Common Trade Terminology in OEM Trade

Familiarity with industry jargon can enhance communication and negotiation with suppliers. Here are essential terms that B2B buyers should know:

-

OEM (Original Equipment Manufacturer)

An OEM is a company that manufactures products or components that are sold under another company’s brand. Understanding the role of OEMs is vital for buyers who want to leverage external manufacturing capabilities while maintaining brand identity. -

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity of a product that a supplier is willing to sell. Buyers must consider MOQ when planning their purchases, as high MOQs can lead to excess inventory and increased costs. Negotiating favorable MOQs can help optimize procurement strategies. -

RFQ (Request for Quotation)

An RFQ is a document sent to suppliers requesting pricing information for specific products or services. It is an essential tool for buyers to gather competitive quotes and assess supplier capabilities. A well-structured RFQ can lead to better pricing and terms. -

Incoterms (International Commercial Terms)

Incoterms are standardized terms that define the responsibilities of buyers and sellers in international trade. Familiarity with these terms helps buyers understand shipping costs, risks, and delivery responsibilities, facilitating smoother transactions. -

Lead Time

As mentioned earlier, lead time is crucial in OEM trade. It affects project timelines and inventory management. Buyers should clarify lead times during negotiations to ensure alignment with their operational needs. -

Quality Assurance (QA)

QA refers to the systematic processes implemented to ensure that products meet specified quality standards. Buyers should emphasize the importance of QA processes with OEMs to avoid defects and ensure product reliability.

Understanding these technical properties and trade terms will empower B2B buyers in Africa, South America, the Middle East, and Europe to make informed decisions, streamline procurement processes, and enhance supplier relationships in the OEM landscape.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the oem trade Sector

Market Overview & Key Trends

The OEM trade sector is currently shaped by several global drivers that influence sourcing decisions for international B2B buyers. A significant factor is the accelerating pace of digital transformation, which has ushered in advanced technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT). These technologies not only enhance operational efficiencies but also provide valuable insights into supply chain management, allowing for more informed sourcing strategies.

Emerging trends indicate a shift towards agile manufacturing and just-in-time (JIT) production models, which enable companies to respond swiftly to market demands while minimizing inventory costs. For buyers in regions like Africa, South America, the Middle East, and Europe, this means that establishing partnerships with OEMs that can adapt to these models is crucial. Additionally, the rise of e-commerce platforms has democratized access to global suppliers, allowing businesses to diversify their sourcing options while enhancing competitive advantage.

Moreover, supply chain resilience has become a priority post-pandemic, driving companies to reevaluate their sourcing strategies and consider nearshoring and reshoring to mitigate risks associated with geopolitical tensions and logistics disruptions. For B2B buyers, understanding these dynamics is essential for making strategic procurement decisions that align with their business goals.

Sustainability & Ethical Sourcing in B2B

As environmental concerns take center stage, sustainability in the OEM trade is no longer just a trend; it has become a necessity. The manufacturing sector significantly impacts the environment, and B2B buyers must prioritize partnerships with OEMs that adhere to sustainable practices. This includes sourcing materials responsibly, reducing carbon footprints, and minimizing waste throughout the production process.

Illustrative Image (Source: Google Search)

Ethical supply chains are increasingly important, as consumers and businesses alike demand transparency and accountability from manufacturers. Buyers should look for OEMs that have established green certifications, such as ISO 14001 (Environmental Management) or certifications for sustainable materials like FSC (Forest Stewardship Council) for wood products or GOTS (Global Organic Textile Standard) for textiles. These certifications not only demonstrate a commitment to sustainability but also provide assurance that products meet high environmental and ethical standards.

Furthermore, integrating sustainable practices into sourcing strategies can lead to long-term cost savings and enhance brand reputation. By choosing OEM partners that prioritize sustainability, buyers can contribute to a more responsible supply chain while aligning with the growing consumer demand for eco-friendly products.

Brief Evolution/History

The OEM trade sector has evolved significantly over the past few decades. Initially dominated by traditional manufacturing processes, the sector has transitioned into a more complex ecosystem driven by globalization and technological advancement. The rise of outsourcing in the late 20th century allowed companies to leverage the manufacturing capabilities of specialized OEMs, particularly in Asia, leading to reduced costs and increased efficiency.

In the 21st century, the focus has shifted towards customization and flexibility, with OEMs adapting to the needs of diverse markets. This evolution has been further accelerated by the digitalization of supply chains, enabling real-time data sharing and collaboration between manufacturers and buyers. As the market continues to evolve, understanding this historical context helps B2B buyers navigate current trends and make informed sourcing decisions.

Related Video: Global trade will never be the same again, says Christine Lagarde | Power & Politics

Frequently Asked Questions (FAQs) for B2B Buyers of oem trade

-

How can I effectively vet potential OEM suppliers?

When vetting OEM suppliers, prioritize their industry experience, certifications, and client references. Conduct due diligence by checking their production capacity and quality assurance processes. Request samples to assess product quality and ensure they can meet your specific requirements. It’s also beneficial to visit their facilities, if possible, or utilize third-party inspection services to gain insights into their operations. Lastly, consider their communication responsiveness and willingness to accommodate your needs, as these are indicators of a reliable partnership. -

What customization options should I expect from OEM suppliers?

OEM suppliers typically offer various customization options, including product design, materials, and branding elements. Discuss your specific needs upfront to ensure the supplier can meet your expectations. Inquire about their design capabilities and whether they can accommodate changes throughout the production process. Additionally, establish clear timelines for customization to avoid delays, and consider signing a formal agreement that outlines the customization requirements to protect your interests. -

What are typical Minimum Order Quantities (MOQs) and lead times?

Minimum Order Quantities (MOQs) vary significantly among OEM suppliers, often influenced by product type, complexity, and production capacity. Generally, MOQs can range from a few hundred to several thousand units. Lead times for production also depend on these factors, typically ranging from 4 to 12 weeks. To ensure smooth operations, discuss MOQs and lead times during initial negotiations and factor in additional time for shipping, customs clearance, and any potential delays. -

How should I handle payment terms with my OEM supplier?

Establishing clear payment terms is crucial in your relationship with OEM suppliers. Common practices include an upfront deposit (often 30-50%) followed by the balance upon delivery or before shipment. Consider using secure payment methods such as letters of credit or escrow services to protect your investment. Always clarify the payment schedule and any associated fees for changes or cancellations. Regular communication regarding payment can help maintain a positive relationship and ensure timely processing. -

What quality assurance practices should I expect from OEM suppliers?

Quality assurance (QA) is vital in OEM partnerships. Suppliers should have robust QA processes in place, including material inspections, in-process quality checks, and final product testing. Request documentation of their QA protocols, certifications (e.g., ISO), and examples of quality control reports. Establish a clear understanding of acceptable quality standards and procedures for handling defective products. Regular audits and open communication about quality expectations can further enhance product reliability. -

What certifications should I look for in an OEM supplier?

Look for certifications that align with your industry standards and regulatory requirements. Common certifications include ISO 9001 for quality management, ISO 14001 for environmental management, and specific industry-related certifications (e.g., CE, RoHS). These certifications demonstrate a supplier’s commitment to maintaining high production standards and compliance with international regulations. Verify the authenticity of these certifications by requesting copies and checking with the issuing bodies. -

How can I manage logistics and shipping with my OEM supplier?

Effective logistics management begins with clear communication with your OEM supplier regarding shipping terms, methods, and responsibilities. Discuss who will handle shipping costs, customs clearance, and insurance. Consider using freight forwarders to streamline the process and mitigate risks associated with international shipping. Track shipments regularly and maintain an open line of communication to address any logistical challenges that may arise, ensuring timely delivery and minimizing disruptions to your supply chain. -

What steps should I take if a dispute arises with my OEM supplier?

In the event of a dispute, start by reviewing your contract and any agreed-upon terms. Openly communicate your concerns with the supplier to seek an amicable resolution. If direct communication fails, consider involving a neutral third party or mediator to facilitate discussions. Document all communications and agreements to support your case if further action is necessary. If the issue remains unresolved, consult legal counsel specializing in international trade to understand your rights and options for pursuing a resolution.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for oem trade

In summary, strategic sourcing in OEM trade is an essential practice that enables businesses to enhance efficiency, control costs, and maintain brand integrity. By understanding the distinctions between OEM and ODM models, international B2B buyers can make informed decisions that align with their specific needs and market conditions. Key takeaways include the importance of choosing the right manufacturing partner, the benefits of customization, and the potential for cost savings through outsourcing.

For buyers in Africa, South America, the Middle East, and Europe, leveraging strategic sourcing not only positions your business competitively but also opens doors to innovative product development and market expansion. As global supply chains continue to evolve, staying abreast of emerging trends and building strong relationships with reliable OEM partners will be critical.

Looking forward, it is vital to embrace a proactive approach to sourcing. Engage with suppliers who demonstrate a commitment to quality, sustainability, and adaptability. By doing so, you will not only enhance your product offerings but also contribute to a resilient supply chain that can weather future challenges. Start exploring your OEM options today and unlock the potential for growth in your business.