Master Hydraulics vs Pneumatics: Key Insights for Strategic

Introduction: Navigating the Global Market for hydraulics vs pneumatics

Navigating the complexities of hydraulic and pneumatic systems is essential for B2B buyers aiming to optimize operational efficiency and drive innovation in their industries. Both technologies play pivotal roles in various applications, from manufacturing to construction, offering distinct advantages and challenges. Understanding the critical differences between hydraulics and pneumatics not only influences equipment selection but also impacts overall productivity, safety, and cost management.

This comprehensive guide delves into the nuances of hydraulic and pneumatic systems, covering a wide range of topics essential for informed sourcing decisions. Buyers will find detailed analyses of system types, materials, manufacturing processes, quality control measures, and supplier evaluations. Additionally, the guide addresses cost considerations and market trends, providing insights specifically tailored for international buyers from regions such as Africa, South America, the Middle East, and Europe, including key markets like Saudi Arabia and Turkey.

By equipping B2B buyers with actionable insights and expert knowledge, this guide empowers them to make strategic decisions that align with their operational needs and budgetary constraints. Whether seeking to enhance productivity, reduce downtime, or ensure compliance with safety standards, understanding the dynamics of hydraulics versus pneumatics is vital for achieving competitive advantage in today’s global market.

Understanding hydraulics vs pneumatics Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Hydraulic Systems | Uses incompressible fluids; high force output | Heavy machinery, construction, automotive | Pros: High force, precise control. Cons: Complex maintenance, potential fluid leaks. |

| Pneumatic Systems | Utilizes compressed air; simpler and cleaner operation | Packaging, food processing, automation | Pros: Cost-effective, clean operation. Cons: Lower power density, less precision. |

| Hydrostatic Systems | Operates under constant pressure; efficient for large loads | Marine applications, industrial presses | Pros: High efficiency, stable operation. Cons: High initial costs, requires regular maintenance. |

| Vacuum Pneumatics | Employs negative pressure; ideal for material handling | Electronics, automotive assembly, logistics | Pros: Safe for delicate items, efficient. Cons: Limited to specific applications, potential leaks. |

| Electro-Pneumatic Systems | Combines electrical control with pneumatic actuation | Robotics, automated assembly lines | Pros: High precision, programmable. Cons: Higher complexity, requires skilled operators. |

Hydraulic Systems

Hydraulic systems are characterized by their use of incompressible fluids, typically hydraulic oil, to transmit power. They are essential in applications requiring high force output, such as heavy machinery and construction equipment. When considering hydraulic systems, buyers should evaluate the cost of installation and maintenance, as they can be complex and require specialized knowledge. Additionally, the risk of fluid leakage poses environmental concerns, making it critical to choose high-quality components and ensure proper maintenance.

Pneumatic Systems

Pneumatic systems leverage compressed air for energy transmission, offering a simpler and cleaner operation compared to hydraulic systems. They are widely used in industries such as packaging and food processing, where cleanliness is paramount. For B2B buyers, the lower initial costs and ease of installation are significant advantages. However, buyers must be aware that pneumatic systems typically have lower power density and less precision than hydraulic systems, which may limit their use in high-force applications.

Hydrostatic Systems

Hydrostatic systems maintain constant pressure to operate efficiently, making them ideal for applications involving large loads, such as marine equipment and industrial presses. These systems provide stable operation and high efficiency, which can translate into cost savings over time. However, the initial investment can be substantial, and regular maintenance is necessary to ensure optimal performance. B2B buyers should assess their long-term operational needs and budget when considering hydrostatic systems.

Vacuum Pneumatics

Vacuum pneumatic systems utilize negative pressure to handle materials safely, making them suitable for industries like electronics and automotive assembly. Their ability to manage delicate items without damage is a key feature that appeals to many B2B buyers. While vacuum systems are efficient, they are limited to specific applications and may face challenges related to leaks or maintenance. Buyers should evaluate their specific material handling needs and the compatibility of vacuum systems with their existing processes.

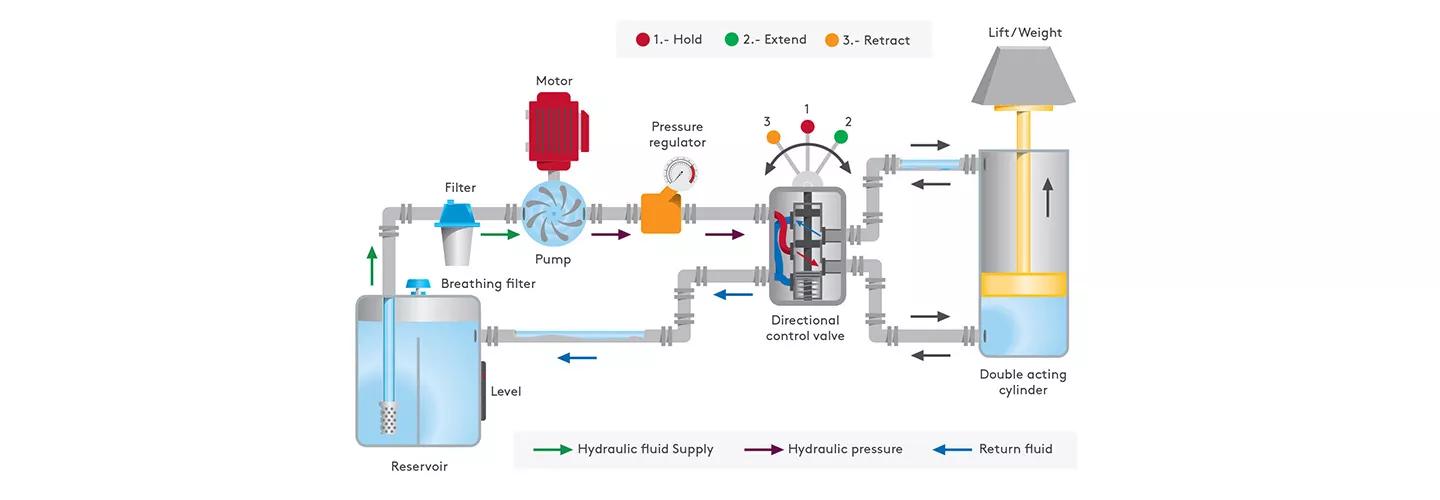

Illustrative Image (Source: Google Search)

Electro-Pneumatic Systems

Electro-pneumatic systems integrate electrical control with pneumatic actuation, allowing for programmable and precise operations. They are commonly found in robotics and automated assembly lines, providing flexibility and efficiency. However, the increased complexity requires skilled operators for maintenance and troubleshooting. B2B buyers should consider the technical capabilities of their workforce and the potential return on investment when exploring electro-pneumatic solutions for their operations.

Key Industrial Applications of hydraulics vs pneumatics

| Industry/Sector | Specific Application of Hydraulics vs Pneumatics | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing | Hydraulic presses for metal forming vs. pneumatic actuators for assembly lines | Hydraulics offer high force for shaping materials, while pneumatics enable rapid assembly and flexibility. | Assess the force requirements, maintenance capabilities, and energy efficiency of systems. |

| Construction | Hydraulic excavators vs. pneumatic tools for demolition | Hydraulics provide powerful digging capabilities, while pneumatics enhance portability and ease of use for lighter tasks. | Evaluate the environmental conditions and availability of hydraulic fluids or compressed air. |

| Agriculture | Hydraulic systems in tractors vs. pneumatic seeders | Hydraulic systems enable heavy lifting and precise control, while pneumatic seeders ensure even planting. | Consider the compatibility of systems with existing machinery and the availability of replacement parts. |

| Oil and Gas | Hydraulic fracturing vs. pneumatic control systems for valves | Hydraulics are essential for fracturing rock formations, while pneumatics control operations safely and efficiently. | Focus on the reliability of components under high pressures and the quality of materials to resist corrosion. |

| Food and Beverage | Hydraulic lifts for processing vs. pneumatic conveying systems | Hydraulics facilitate heavy lifting in processing plants, while pneumatics ensure hygienic material transfer. | Ensure compliance with food safety regulations and assess the cleaning ease of components. |

Detailed Applications

Manufacturing

In manufacturing, hydraulic presses are commonly used for metal forming processes, providing the immense force needed to shape materials accurately. Conversely, pneumatic actuators are employed in assembly lines to facilitate quick and flexible operations. For international B2B buyers, particularly in regions like Africa and South America, sourcing reliable hydraulic pumps and pneumatic components is vital to ensure operational efficiency and reduce downtime. Buyers should consider the power requirements and the ease of maintenance for both systems.

Construction

Hydraulic excavators are indispensable in construction for their ability to dig and move heavy materials. In contrast, pneumatic tools, such as nail guns and impact wrenches, offer portability and ease of use for various demolition tasks. Buyers from the Middle East and Europe must evaluate the environmental conditions where these systems will operate, ensuring that hydraulic fluids or compressed air are readily available and suitable for local climates.

Agriculture

In agriculture, hydraulic systems are integral to tractors, allowing for heavy lifting and precise control of implements. Pneumatic seeders, on the other hand, provide even planting by using air pressure to distribute seeds accurately. Buyers in developing regions should ensure compatibility with existing equipment and consider the availability of replacement parts and service support to minimize operational disruptions.

Oil and Gas

The oil and gas industry relies heavily on hydraulic fracturing for extracting resources, where high-pressure hydraulic systems are used to fracture rock formations. Pneumatic control systems are equally important for managing valves and safety operations. Buyers must focus on sourcing reliable components that can withstand high pressures and corrosive environments, especially in regions like Saudi Arabia and Turkey, where oil extraction is prevalent.

Food and Beverage

In the food and beverage sector, hydraulic lifts are utilized for moving heavy processing equipment, while pneumatic conveying systems ensure the hygienic transfer of ingredients. Compliance with food safety regulations is crucial for buyers, who should assess the ease of cleaning and maintenance of the components to maintain hygiene standards.

Related Video: Pneumatics vs Hydraulics – The Difference Between Gases and Liquids Under Pressure

Strategic Material Selection Guide for hydraulics vs pneumatics

When selecting materials for hydraulic and pneumatic systems, it’s essential to consider various factors that influence performance, durability, and cost. Below is an analysis of four common materials used in these systems, focusing on their properties, advantages, disadvantages, and implications for international B2B buyers.

1. Steel

Key Properties: Steel is known for its high tensile strength and excellent pressure resistance, making it suitable for high-pressure hydraulic applications. It typically has a temperature rating of up to 400°F (204°C) and can withstand significant mechanical stress.

Pros & Cons: Steel is durable and can be easily sourced globally, but it is susceptible to corrosion unless treated. The manufacturing process can be complex, involving welding and machining, which may increase costs.

Impact on Application: Steel is compatible with a wide range of hydraulic fluids but may require additional coatings or treatments when used in corrosive environments, such as offshore applications.

Considerations for International Buyers: Buyers from regions like the Middle East and South America should ensure compliance with local standards (e.g., ASTM A106 for pipes) and consider the availability of corrosion-resistant steel grades.

2. Aluminum

Key Properties: Aluminum is lightweight and has good corrosion resistance, with a temperature rating typically around 300°F (149°C). It is also non-magnetic and has excellent thermal conductivity.

Pros & Cons: The primary advantage of aluminum is its reduced weight, which can lower shipping costs and improve energy efficiency. However, its lower strength compared to steel limits its use in high-pressure applications, and it can be more expensive to manufacture due to specialized machining requirements.

Impact on Application: Aluminum is suitable for pneumatic systems and low-pressure hydraulic applications. Its compatibility with air and non-corrosive fluids makes it ideal for industries such as food and beverage.

Considerations for International Buyers: Buyers in Europe and Africa should check compliance with standards like EN 573 for aluminum alloys and consider the implications of weight in transport and installation.

3. Polymer Composites

Key Properties: Polymer composites, such as reinforced thermoplastics, offer excellent corrosion resistance and can operate at temperatures up to 200°F (93°C). They are lightweight and can be molded into complex shapes.

Pros & Cons: These materials are cost-effective for mass production and provide good insulation properties. However, they may not withstand high pressures as effectively as metals, limiting their application in high-demand environments.

Impact on Application: Polymer composites are ideal for pneumatic systems and applications requiring lightweight components. They are often used in industries such as automotive and consumer goods.

Considerations for International Buyers: Buyers should verify compliance with relevant standards (e.g., ISO 1043 for polymer materials) and assess the local market for availability and performance specifications.

4. Brass

Key Properties: Brass exhibits good corrosion resistance and can withstand temperatures up to 300°F (149°C). It also has excellent machinability and is often used in fittings and connectors.

Pros & Cons: The main advantage of brass is its durability and resistance to corrosion, making it suitable for various applications. However, it is more expensive than steel and aluminum, which may be a concern for budget-sensitive projects.

Impact on Application: Brass is commonly used in pneumatic systems, especially in fittings and valves, where precision and reliability are crucial.

Considerations for International Buyers: Buyers should consider the implications of brass pricing fluctuations and ensure compliance with standards such as ASTM B16 for fittings and valves.

Summary Table

| Material | Typical Use Case for hydraulics vs pneumatics | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | High-pressure hydraulic systems | High tensile strength | Susceptible to corrosion | High |

| Aluminum | Pneumatic systems, low-pressure hydraulics | Lightweight, good corrosion resistance | Lower strength than steel | Medium |

| Polymer Composites | Pneumatic systems, lightweight applications | Cost-effective, good insulation | Limited high-pressure capability | Low |

| Brass | Pneumatic fittings and valves | Excellent corrosion resistance | Higher cost than steel and aluminum | Medium |

This guide provides a comprehensive overview of material selection for hydraulics and pneumatics, enabling international B2B buyers to make informed decisions based on their specific needs and regional considerations.

In-depth Look: Manufacturing Processes and Quality Assurance for hydraulics vs pneumatics

Manufacturing Processes for Hydraulic and Pneumatic Systems

The manufacturing processes for hydraulic and pneumatic systems involve several key stages, which ensure that products meet the stringent performance and safety requirements of various industries. Understanding these processes is critical for B2B buyers looking to source high-quality components.

Main Stages of Manufacturing

-

Material Preparation

– Selection of Raw Materials: For hydraulic systems, materials like steel, aluminum, and specialized alloys are often used for their strength and resistance to corrosion. Pneumatic systems typically utilize lighter materials such as aluminum and plastics for components where weight is a concern.

– Cutting and Machining: Raw materials are cut to specified dimensions using CNC machines, lathes, and milling machines. This stage is crucial for achieving precise tolerances that impact the overall performance of the systems. -

Forming

– Casting and Forging: Components like hydraulic pumps and pneumatic cylinders may be cast or forged to enhance their structural integrity. Forging is particularly useful for high-strength applications where durability is essential.

– Welding and Joining: Various joining techniques, including welding, brazing, and adhesive bonding, are employed to assemble different components. The choice of technique often depends on the material properties and the intended application. -

Assembly

– Component Integration: This stage involves the assembly of various parts such as pumps, actuators, valves, and control systems. For hydraulics, this often includes integrating seals and gaskets to prevent fluid leaks, while pneumatic systems require careful installation of fittings and tubing.

– Testing during Assembly: In-line testing may be performed to ensure that components function correctly before moving on to the finishing stage. This can include pressure tests for hydraulic systems and flow tests for pneumatic systems. -

Finishing

– Surface Treatment: Components may undergo surface treatments such as anodizing, plating, or painting to enhance corrosion resistance and improve aesthetics. This is particularly important in environments where exposure to chemicals and moisture is common.

– Final Assembly and Packaging: After finishing, the final assembly occurs, followed by thorough cleaning and packaging to ensure that products remain uncontaminated during transport.

Quality Assurance in Manufacturing

Quality assurance (QA) is paramount in the manufacturing of hydraulic and pneumatic systems, ensuring that products meet both international and industry-specific standards. B2B buyers must understand these QA processes to make informed purchasing decisions.

Relevant International Standards

- ISO 9001: This standard outlines the criteria for a quality management system, focusing on customer satisfaction and continuous improvement. Manufacturers certified to ISO 9001 demonstrate their commitment to quality and process efficiency.

- CE Marking: Required for products sold within the European Economic Area, CE marking indicates compliance with health, safety, and environmental protection standards. It is crucial for B2B buyers in Europe to verify this certification.

- API Standards: The American Petroleum Institute (API) sets standards for equipment used in the oil and gas industry, which includes hydraulic components. Compliance with API standards is essential for buyers in sectors where reliability and safety are critical.

Quality Control Checkpoints

-

Incoming Quality Control (IQC)

– This initial checkpoint involves inspecting raw materials and components upon arrival at the manufacturing facility. Verification of compliance with specifications and standards is crucial at this stage to prevent defects in the final product. -

In-Process Quality Control (IPQC)

– During the manufacturing process, continuous monitoring of production parameters ensures that components are manufactured within specified tolerances. This may include real-time inspections and the use of statistical process control (SPC) techniques. -

Final Quality Control (FQC)

– Once the assembly is complete, final inspections are conducted to ensure that the products meet all design specifications. This includes functional testing, pressure testing for hydraulic components, and leak testing for pneumatic systems.

Common Testing Methods

- Hydraulic Testing: Involves subjecting hydraulic components to high-pressure conditions to identify leaks and weaknesses.

- Pneumatic Testing: Compressed air is used to test for leaks and verify the integrity of pneumatic systems.

- Dimensional Inspection: Utilizes precision measuring tools to ensure that components meet specified dimensions and tolerances.

Verifying Supplier Quality Control

For international B2B buyers, particularly in Africa, South America, the Middle East, and Europe, ensuring that suppliers adhere to rigorous quality standards is essential. Here are actionable steps to verify supplier quality control:

-

Supplier Audits

– Conduct on-site audits to evaluate the manufacturing processes and quality assurance practices of potential suppliers. This allows buyers to assess compliance with international standards and identify any areas for improvement. -

Request Quality Reports

– Ask suppliers for detailed quality assurance reports, including results from IQC, IPQC, and FQC stages. This documentation provides insight into the supplier’s commitment to quality and any issues encountered during production. -

Third-Party Inspections

– Engage independent inspection agencies to conduct quality checks before shipment. This adds an additional layer of assurance that products meet specified standards and are free from defects.

Quality Control and Certification Nuances for International Buyers

When sourcing from international suppliers, B2B buyers should be aware of specific nuances related to quality control and certification:

- Cultural Differences: Understanding the local business culture can impact negotiations and quality expectations. Buyers should consider language barriers and regional practices in quality assurance.

- Regulatory Compliance: Different regions may have unique regulatory requirements. Buyers must ensure that suppliers comply with local standards in addition to international certifications.

- Supply Chain Transparency: Building relationships with suppliers that prioritize transparency in their manufacturing and quality processes can mitigate risks associated with sourcing.

By understanding the manufacturing processes and quality assurance practices in hydraulic and pneumatic systems, B2B buyers can make informed decisions that enhance operational efficiency and product reliability.

Related Video: Amazing factories | Manufacturing method and top 4 processes | Mass production process

Comprehensive Cost and Pricing Analysis for hydraulics vs pneumatics Sourcing

Understanding the Cost Structure of Hydraulics vs. Pneumatics

When sourcing hydraulic and pneumatic systems, international B2B buyers must consider several cost components that can significantly affect overall pricing. The main cost elements include:

-

Materials: The type of materials used directly influences costs. Hydraulic systems typically require specialized hydraulic fluids, seals, and robust components capable of withstanding high pressures, making them generally more expensive than pneumatic systems, which primarily rely on air and simpler materials.

-

Labor: Installation and maintenance labor costs vary. Hydraulic systems often require specialized technicians due to their complexity, leading to higher labor costs. Conversely, pneumatic systems, being simpler, can be installed and maintained by a broader range of technicians, potentially lowering labor expenses.

-

Manufacturing Overhead: The complexity of hydraulic systems results in higher manufacturing overhead, including costs related to equipment, facilities, and processes. Pneumatic systems generally have lower overhead due to simpler manufacturing processes.

-

Tooling: Custom tooling can be necessary for both systems, especially for specialized applications. However, hydraulic systems often require more intricate tooling, which can increase initial costs.

-

Quality Control (QC): Rigorous QC measures are essential for both systems to ensure safety and reliability. Hydraulic systems may incur higher QC costs due to the potential risks associated with fluid leakage and pressure failures.

-

Logistics: The logistics of transporting hydraulic fluids and larger components can add to costs, especially for international shipments. Pneumatic systems, being lighter and often more compact, may have lower logistics costs.

-

Margin: Supplier margins can vary significantly based on the perceived value and market demand for hydraulics versus pneumatics. Understanding market dynamics is crucial for negotiating favorable terms.

Price Influencers in Sourcing

Several factors can influence the pricing of hydraulic and pneumatic systems:

-

Volume/MOQ: Minimum order quantities (MOQ) can impact pricing. Higher volumes typically lead to lower per-unit costs due to economies of scale. This is particularly relevant for large-scale operations in regions like Africa and South America, where bulk purchasing may be more common.

-

Specifications/Customization: Customized solutions can significantly increase costs. Buyers should evaluate the necessity of customization against the benefits it brings to their operations.

-

Materials: The choice of materials not only affects initial costs but also the longevity and reliability of the systems. Opting for high-quality materials may incur higher upfront costs but can reduce long-term expenses related to maintenance and replacement.

-

Quality/Certifications: Products that meet international standards and certifications often come at a premium. However, investing in certified systems can mitigate risks and enhance operational safety.

-

Supplier Factors: The reputation, reliability, and location of suppliers can influence pricing. Suppliers with extensive experience and robust logistics may charge higher prices but offer better service and product reliability.

-

Incoterms: Understanding Incoterms is crucial for international buyers. Terms such as FOB (Free on Board) or CIF (Cost, Insurance, and Freight) will dictate who is responsible for shipping costs and risks, impacting the total cost of procurement.

Buyer Tips for Cost-Efficiency

-

Negotiate: Engage in negotiations with suppliers to explore volume discounts or flexible payment terms. Building long-term relationships can also lead to better pricing over time.

-

Total Cost of Ownership (TCO): Evaluate not just the purchase price but the TCO, which includes maintenance, operational costs, and potential downtime. Hydraulics may have higher TCOs due to maintenance complexity.

-

Pricing Nuances: Be aware of regional pricing differences. For example, sourcing in Europe may present higher initial costs compared to local suppliers in Africa or South America, but consider factors like delivery time and service availability.

-

Market Research: Conduct thorough market research to understand the price landscape. This helps in making informed decisions and leveraging competitive pricing effectively.

Disclaimer

The prices discussed herein are indicative and can vary based on market conditions, supplier negotiations, and specific project requirements. Always conduct due diligence and obtain quotes from multiple suppliers to ensure competitive pricing.

Spotlight on Potential hydraulics vs pneumatics Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘hydraulics vs pneumatics’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for hydraulics vs pneumatics

When navigating the complexities of hydraulic and pneumatic systems, understanding their technical properties and common trade terminology is crucial for international B2B buyers. This knowledge not only aids in making informed purchasing decisions but also enhances communication with suppliers and manufacturers.

Essential Technical Properties

-

Pressure Rating

The pressure rating indicates the maximum pressure a hydraulic or pneumatic component can handle safely. For hydraulics, this is usually measured in pounds per square inch (psi) or bar, while for pneumatics, it may range from a few psi up to 150 psi or more. B2B buyers must consider pressure ratings to ensure that the components will operate safely and effectively within their system’s requirements. -

Flow Rate

Flow rate, expressed in liters per minute (L/min) or cubic feet per minute (CFM), measures how much fluid or air can move through the system in a given timeframe. For hydraulics, a higher flow rate can lead to quicker actuation, while for pneumatics, it influences the speed of operation. Understanding flow rates is vital for selecting the right components that meet operational efficiency needs. -

Material Grade

The material grade refers to the type of materials used in manufacturing components, such as steel, aluminum, or composite materials. Each material has unique properties concerning strength, weight, and corrosion resistance. Buyers should evaluate the material grade to ensure durability and longevity, particularly in harsh environments typical in regions like Africa or the Middle East. -

Temperature Range

Both hydraulic fluids and pneumatic air can be affected by temperature variations. The specified temperature range indicates the operational limits for each system. Hydraulics often operate in a broader temperature range due to the viscosity of hydraulic oil, while pneumatics are more sensitive to temperature changes. Buyers should ensure that the components selected can withstand the environmental conditions specific to their operational locale.

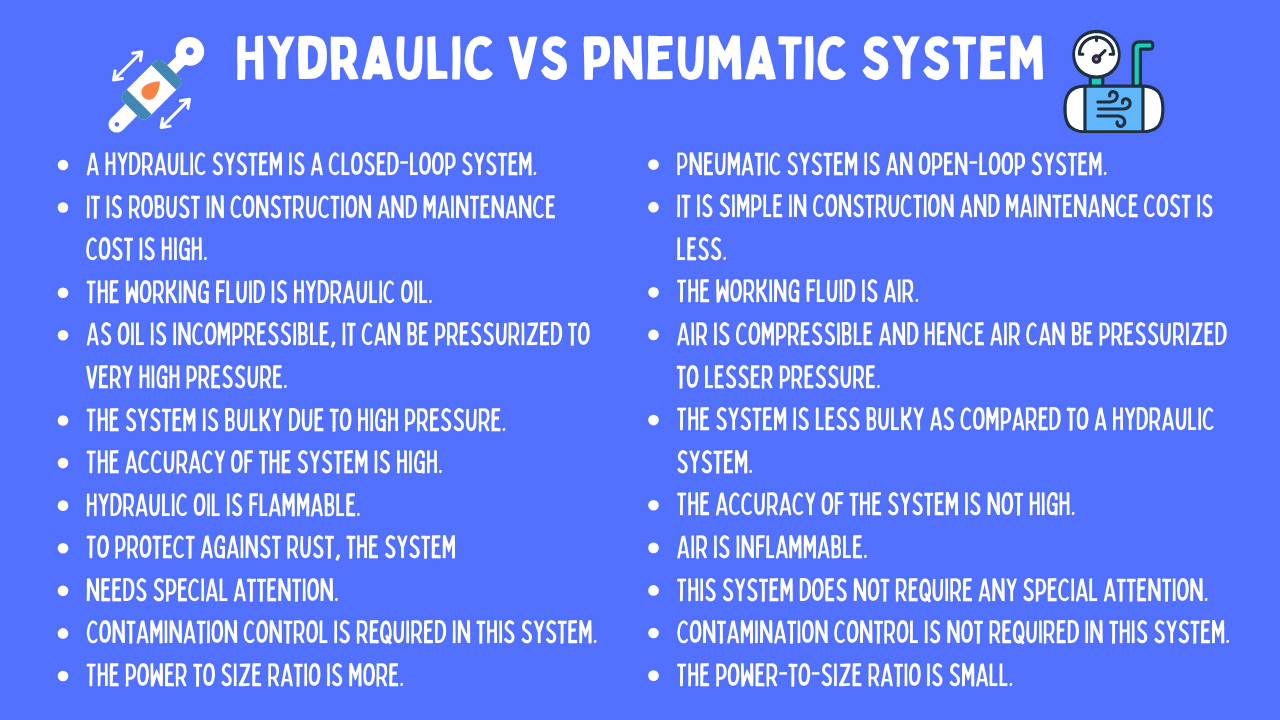

Illustrative Image (Source: Google Search)

- Tolerance

Tolerance refers to the allowable deviation from a specified dimension in manufacturing components. It is crucial for ensuring compatibility and proper functioning within the system. For instance, precise tolerances are more critical in hydraulic systems due to the incompressibility of fluids, while pneumatic systems may allow for slightly looser tolerances. Understanding tolerance specifications can prevent operational failures and reduce downtime.

Common Trade Terminology

-

OEM (Original Equipment Manufacturer)

An OEM is a company that produces parts or equipment that may be marketed by another manufacturer. In the hydraulic and pneumatic sectors, purchasing from OEMs can assure buyers of quality and compatibility. Understanding OEM relationships can help buyers secure reliable components for their systems. -

MOQ (Minimum Order Quantity)

MOQ refers to the smallest number of units a supplier is willing to sell. This term is crucial for B2B buyers to understand because it can affect inventory costs and purchasing strategies. Knowing the MOQ can help buyers negotiate better terms or plan for bulk purchases that optimize cost efficiency. -

RFQ (Request for Quotation)

An RFQ is a document that a buyer submits to suppliers to obtain price quotes for specific products or services. This process is essential for budgeting and comparing supplier offerings. B2B buyers should use RFQs to solicit detailed proposals that align with their technical specifications and budgetary constraints. -

Incoterms

Incoterms are international commercial terms that define the responsibilities of buyers and sellers in international transactions. They clarify who is responsible for shipping, insurance, and tariffs. Understanding Incoterms is vital for B2B buyers, particularly in regions like South America and Europe, as they can significantly impact total landed costs. -

Lead Time

Lead time is the time taken from placing an order to receiving the product. In industries reliant on hydraulic and pneumatic components, understanding lead times is critical for project planning and minimizing downtime. Buyers should factor in lead times when negotiating contracts and scheduling installations.

By familiarizing themselves with these technical properties and trade terms, international B2B buyers can enhance their procurement processes, ensuring they select the right hydraulic or pneumatic systems that meet their operational needs while maintaining cost-effectiveness and efficiency.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hydraulics vs pneumatics Sector

Market Overview & Key Trends

The hydraulics and pneumatics sector is experiencing dynamic shifts influenced by global market trends and technological advancements. One of the primary drivers is the increasing demand for automation in manufacturing and industrial processes. Countries in Africa, South America, the Middle East, and Europe are investing heavily in modernizing their infrastructure, which directly boosts the demand for both hydraulic and pneumatic systems. Notably, industries such as construction, automotive, and aerospace are leading the charge, with a focus on efficiency and productivity.

Emerging technologies like IoT (Internet of Things) and AI (Artificial Intelligence) are also transforming the landscape. These technologies enable predictive maintenance and real-time monitoring, enhancing operational efficiency and reducing downtime. For international B2B buyers, sourcing components that are IoT-enabled or compatible with automation systems can provide a competitive edge.

Furthermore, sustainability is becoming a critical consideration in purchasing decisions. Buyers are increasingly looking for suppliers that adhere to sustainable practices and offer energy-efficient products. With the rise of digital platforms, international sourcing is becoming more accessible, allowing buyers to compare products and suppliers from different regions, thus fostering competitive pricing and innovative solutions.

Sustainability & Ethical Sourcing in B2B

Sustainability is no longer a peripheral concern but a central tenet of business strategy in the hydraulics and pneumatics sector. The environmental impact of hydraulic fluids, which can lead to soil and water contamination, is prompting companies to seek eco-friendly alternatives. Buyers should prioritize suppliers that offer biodegradable hydraulic fluids or those that have implemented closed-loop systems to minimize waste.

Moreover, the importance of ethical supply chains cannot be overstated. International buyers are encouraged to vet suppliers for their sourcing practices and labor conditions, ensuring compliance with global standards. Certifications such as ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety) serve as indicators of a supplier’s commitment to sustainable practices.

In addition, many manufacturers are focusing on lightweight materials and energy-efficient designs, which not only reduce emissions but also lower operational costs. By opting for suppliers that prioritize sustainability, B2B buyers can enhance their brand reputation and align with the growing consumer demand for environmentally responsible products.

Brief Evolution/History

The evolution of hydraulic and pneumatic systems has been marked by significant technological advancements since their inception. Hydraulic systems have been utilized since the ancient Greeks, with notable developments during the Industrial Revolution that enhanced their efficiency and application range. Pneumatic systems gained traction in the late 19th century, particularly in industries requiring rapid actuation and motion control.

Over the past few decades, the integration of electronic controls and automation has transformed both sectors, making them more precise and responsive to modern industrial needs. Today, the focus is shifting towards sustainability and digitalization, shaping the future of hydraulics and pneumatics as essential components of smart manufacturing and eco-friendly practices. This historical context is crucial for B2B buyers as it highlights the ongoing innovation in sourcing and technology within the sector.

Related Video: US-China Trade Truce Signed, Treasury Kills ‘Revenge Tax’ | Bloomberg The Pulse 06/27

Frequently Asked Questions (FAQs) for B2B Buyers of hydraulics vs pneumatics

-

How can I effectively vet suppliers for hydraulic and pneumatic systems?

When vetting suppliers, prioritize those with a proven track record in your industry. Request references from previous clients and check their certifications, such as ISO 9001 for quality management. Evaluate their production capabilities by asking for details about their manufacturing processes and technology used. Additionally, consider their financial stability, responsiveness, and customer service history. For international suppliers, check their compliance with local regulations and standards relevant to your region, particularly in Africa, South America, the Middle East, and Europe. -

What customization options should I look for in hydraulic and pneumatic systems?

Many suppliers offer customization to meet specific operational needs. Inquire about the range of hydraulic fluids or pneumatic components available, as well as the ability to tailor sizes, pressures, and performance specifications. It’s also essential to discuss lead times for custom orders and whether the supplier can accommodate changes during the production process. Ensure that the supplier can provide detailed technical support and documentation for any custom solutions, which is vital for maintenance and future modifications. -

What are the typical minimum order quantities (MOQs) and lead times for hydraulic and pneumatic equipment?

MOQs can vary significantly depending on the supplier and the complexity of the products. Generally, hydraulic systems may have higher MOQs due to the specialized components involved. Lead times can range from a few weeks to several months based on production schedules and customization requirements. Always clarify these details upfront and negotiate terms that align with your project timelines. Consider establishing long-term partnerships with suppliers to potentially reduce MOQs and secure faster lead times. -

What payment terms are commonly accepted for international transactions?

Payment terms can vary, but common options include letters of credit, wire transfers, and payment in advance. For larger orders, consider negotiating partial payments, where a deposit is made upfront and the balance upon delivery. Ensure the payment method offers sufficient protection against fraud and non-delivery, especially for international transactions. Familiarize yourself with any currency conversion fees and international banking regulations that may impact the transaction. -

How can I ensure quality assurance and certification for the products I purchase?

Ask suppliers for documentation of quality certifications relevant to hydraulic and pneumatic systems, such as ISO 9001 or specific industry standards. Request product samples or prototypes to assess quality before placing a full order. Additionally, inquire about their quality control processes, including testing procedures and compliance with safety regulations. For international purchases, ensure that the supplier can provide necessary documentation for customs clearance and compliance with local standards. -

What logistics considerations should I keep in mind when sourcing from international suppliers?

Logistics play a crucial role in international sourcing. Evaluate shipping options, costs, and delivery times, considering both sea and air freight. Discuss the supplier’s experience with exporting goods to your region and their ability to handle customs documentation. Additionally, consider warehousing options in your region to mitigate delays. Collaborate with a reliable logistics provider to ensure efficient handling and transportation of your hydraulic and pneumatic systems. -

How should I handle disputes with suppliers over product quality or delivery issues?

Establish clear communication channels and document all agreements regarding product specifications and delivery timelines. In case of a dispute, initiate discussions promptly to resolve issues amicably. Refer to the contractual terms agreed upon, which should outline procedures for handling disputes. If necessary, consider mediation or arbitration as a means to resolve conflicts without resorting to legal action. Building a strong relationship with suppliers can also help in resolving issues more efficiently. -

What are the best practices for maintaining hydraulic and pneumatic systems after purchase?

Regular maintenance is crucial for the longevity of hydraulic and pneumatic systems. Develop a maintenance schedule that includes routine inspections, fluid checks, and component replacements. Educate your staff on proper operation techniques to minimize wear and tear. Additionally, keep a record of maintenance activities and any issues encountered for future reference. Collaborate with your supplier for ongoing support, including access to spare parts and technical assistance for repairs.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for hydraulics vs pneumatics

In conclusion, understanding the distinctions between hydraulic and pneumatic systems is critical for international B2B buyers looking to optimize their operational efficiencies. Hydraulic systems offer significant force and precision, making them ideal for heavy-duty applications, while pneumatic systems provide a cost-effective and cleaner alternative for lighter tasks. Each system has its unique advantages and challenges, and the choice should align with specific operational needs, industry standards, and environmental considerations.

Strategic sourcing plays a pivotal role in ensuring that businesses procure the right technology at the best value. Buyers should engage with trusted suppliers, conduct thorough market research, and evaluate the total cost of ownership, including maintenance and operational costs.

As industries across Africa, South America, the Middle East, and Europe evolve, the demand for efficient, reliable, and sustainable power solutions will only grow. Investing in the right systems today will not only enhance productivity but also position companies favorably for future advancements. It is imperative to stay informed about technological innovations and market trends to make decisions that will drive long-term success.