Master Sourcing Strategies for High-Quality Diaphram Valves

Introduction: Navigating the Global Market for diaphram valve

In an increasingly interconnected global economy, the diaphragm valve stands out as a critical component across various industries, including chemical processing, pharmaceuticals, and water management. Its ability to provide precise flow control and leak-free operation makes it indispensable for international B2B buyers seeking reliable solutions. As industries expand and diversify, understanding the nuances of diaphragm valves becomes essential for making informed sourcing decisions.

This comprehensive guide delves into the multifaceted world of diaphragm valves, offering insights into various types, materials, manufacturing processes, and quality control standards. We will explore the landscape of suppliers, pricing structures, and emerging market trends, providing actionable intelligence tailored for buyers from Africa, South America, the Middle East, and Europe, including key regions like Italy and Poland.

By equipping yourself with the knowledge contained within this guide, you can navigate the complexities of the global diaphragm valve market with confidence. Whether you’re evaluating suppliers or assessing product specifications, this resource will empower you to make strategic purchasing decisions that align with your operational needs and budgetary constraints. Prepare to unlock the potential of diaphragm valves and enhance your procurement strategy in today’s competitive marketplace.

Understanding diaphram valve Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Diaphragm Valve | Simple design, versatile, suitable for various media. | Water treatment, pharmaceuticals | Pros: Cost-effective, easy maintenance. Cons: Limited pressure and temperature range. |

| Sanitary Diaphragm Valve | Designed for clean applications, often made of stainless steel. | Food and beverage, biopharmaceuticals | Pros: High hygiene standards, easy to clean. Cons: Higher cost due to material and design. |

| Pneumatic Diaphragm Valve | Actuated by air pressure, allows for remote operation. | Chemical processing, oil and gas | Pros: Fast response time, suitable for automation. Cons: Requires compressed air supply. |

| Electric Diaphragm Valve | Operated by electric actuators, precise control. | Water distribution, HVAC systems | Pros: High accuracy, programmable control. Cons: Higher initial investment, may require more complex maintenance. |

| Multi-Port Diaphragm Valve | Multiple inlet/outlet configurations for complex systems. | Industrial processes, gas distribution | Pros: Space-saving, flexible flow control. Cons: More complex installation and potential for leaks. |

Standard Diaphragm Valve

Standard diaphragm valves are characterized by their simple yet effective design, making them suitable for a wide range of applications. They are commonly used in water treatment facilities and pharmaceutical manufacturing, where versatility is essential. For B2B buyers, the main considerations include cost-effectiveness and ease of maintenance, though they may face limitations in terms of pressure and temperature ranges.

Sanitary Diaphragm Valve

These valves are specifically designed for applications that require stringent hygiene standards, such as the food and beverage industry and biopharmaceuticals. Made from materials like stainless steel, they are easy to clean and maintain, ensuring compliance with health regulations. Buyers should weigh the benefits of high hygiene against the higher costs associated with these specialized valves.

Pneumatic Diaphragm Valve

Pneumatic diaphragm valves utilize air pressure for actuation, allowing for rapid and remote operation. They are ideal for chemical processing and oil and gas applications, where quick response times are critical. While they offer the advantage of automation, buyers need to consider the necessity of a compressed air supply, which can add to operational costs.

Electric Diaphragm Valve

These valves are operated by electric actuators, providing precise control over flow and pressure. Commonly used in water distribution and HVAC systems, they allow for programmable control and high accuracy. B2B buyers must consider the higher initial investment and potentially more complex maintenance requirements, which may be justified by the benefits of enhanced control.

Multi-Port Diaphragm Valve

Multi-port diaphragm valves feature multiple inlet and outlet configurations, making them suitable for complex industrial processes and gas distribution systems. Their design allows for space-saving installations and flexible flow control. However, buyers should be aware of the complexities involved in installation and the potential risks of leaks, which necessitate careful consideration during the purchasing process.

Related Video: How Diaphragm Valve Works / Air Operated Valve / Pneumatic Valve / Working Principle / Animation

Key Industrial Applications of diaphram valve

| Industry/Sector | Specific Application of Diaphragm Valve | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Pharmaceutical | Fluid control in sterile environments | Ensures contamination-free processes, maintaining product integrity | Compliance with stringent health regulations and standards |

| Food & Beverage | Ingredient dosing and mixing | Enhances product consistency and quality, reducing waste | Material compatibility with food standards (FDA, EU) |

| Oil & Gas | Control of corrosive fluids and gases | Increases safety and reliability in hazardous environments | Resistance to extreme pressures and temperatures |

| Water Treatment | Regulation of water flow and pressure | Improves efficiency in treatment processes, reducing costs | Durability against chemical corrosion and fouling |

| Chemical Processing | Handling aggressive chemicals in processes | Protects equipment and personnel while optimizing operations | Ability to handle high pressures and varied chemical compositions |

Pharmaceutical Applications

In the pharmaceutical industry, diaphragm valves are crucial for fluid control in sterile environments. They prevent contamination during processes such as drug formulation and packaging. These valves provide a reliable seal, ensuring that no harmful substances enter the system. For international buyers, particularly in regions with strict health regulations like Europe, sourcing diaphragm valves that comply with standards such as FDA or EMA is essential. Buyers must also consider the material properties to prevent leaching or reaction with active pharmaceutical ingredients.

Food & Beverage Applications

Diaphragm valves are extensively used in the food and beverage sector for ingredient dosing and mixing. They ensure precise flow control, which is vital for maintaining product consistency and quality. This application minimizes waste and enhances operational efficiency. For B2B buyers in Africa or South America, it is critical to source valves that meet food safety standards, such as those set by the FDA or European food safety regulations. Additionally, buyers should assess the ease of cleaning and maintenance, as hygiene is paramount in food processing.

Oil & Gas Applications

In the oil and gas industry, diaphragm valves are employed to control the flow of corrosive fluids and gases. Their ability to operate under high pressures and extreme temperatures makes them suitable for this demanding environment. These valves enhance safety and reliability, reducing the risk of leaks and accidents. For buyers in the Middle East, where oil and gas operations are prevalent, it is vital to select diaphragm valves that can withstand harsh conditions and provide long service life, thus minimizing downtime and maintenance costs.

Water Treatment Applications

Diaphragm valves play a significant role in regulating water flow and pressure in treatment facilities. They contribute to improved efficiency in processes such as filtration and disinfection, ultimately reducing operational costs. For international buyers, particularly in regions facing water scarcity, sourcing durable valves that can resist chemical corrosion and fouling is essential. Understanding local water quality and treatment requirements can guide buyers in selecting the appropriate diaphragm valve for their specific applications.

Chemical Processing Applications

In chemical processing, diaphragm valves are used to handle aggressive chemicals safely. They protect both equipment and personnel by providing a secure barrier against leaks and spills. This application is critical for optimizing operations while ensuring safety. Buyers should focus on sourcing diaphragm valves that can handle high pressures and various chemical compositions. Additionally, understanding the specific requirements of the chemicals involved will help in selecting the right materials and designs, ensuring compatibility and longevity.

Related Video: Diaphragm Valve Operation Demonstration

Strategic Material Selection Guide for diaphram valve

When selecting materials for diaphragm valves, it’s essential to consider various factors that influence performance, compatibility, and compliance with industry standards. Below, we analyze four common materials used in diaphragm valves, focusing on their properties, advantages, disadvantages, and specific considerations for international B2B buyers.

1. EPDM (Ethylene Propylene Diene Monomer)

Key Properties:

EPDM is known for its excellent resistance to heat, ozone, and weathering. It typically operates effectively within a temperature range of -40°C to 120°C and can withstand pressures up to 10 bar.

Pros & Cons:

EPDM is durable and cost-effective, making it a popular choice for many applications. However, it is not suitable for use with petroleum-based fluids, which limits its application in certain industries.

Impact on Application:

EPDM is ideal for water treatment and food processing applications due to its non-toxic nature. However, buyers must ensure that the media being handled does not contain oils or hydrocarbons.

Considerations for International Buyers:

EPDM complies with various international standards, including FDA and NSF for food applications. Buyers in regions like Europe and the Middle East should verify compliance with local regulations.

2. PTFE (Polytetrafluoroethylene)

Key Properties:

PTFE is renowned for its exceptional chemical resistance and can handle temperatures up to 260°C and pressures exceeding 20 bar. Its non-stick properties make it ideal for corrosive environments.

Pros & Cons:

While PTFE offers superior durability and versatility, it is more expensive than other materials and can be challenging to manufacture due to its low friction properties.

Impact on Application:

PTFE is suitable for handling aggressive chemicals, making it a preferred choice in the chemical and pharmaceutical industries. Its compatibility with a wide range of media enhances its utility.

Considerations for International Buyers:

PTFE is widely accepted in global markets, including compliance with ASTM and DIN standards. Buyers should ensure that suppliers meet specific certifications relevant to their industry.

3. NBR (Nitrile Butadiene Rubber)

Key Properties:

NBR provides excellent resistance to oils, fuels, and hydrocarbons, with a temperature range of -30°C to 100°C and pressure ratings up to 20 bar.

Pros & Cons:

NBR is relatively inexpensive and offers good mechanical properties. However, its resistance to weathering and ozone is limited, which can lead to degradation over time.

Impact on Application:

NBR is commonly used in automotive and industrial applications where oil compatibility is essential. It is not suitable for applications involving high temperatures or steam.

Considerations for International Buyers:

When sourcing NBR products, buyers should check for compliance with ASTM D2000 standards, especially in the automotive sector. Understanding local regulations regarding material safety is crucial.

4. Silicone

Key Properties:

Silicone can withstand extreme temperatures from -60°C to 200°C and has good pressure ratings, typically around 5 bar. It is also highly resistant to aging and UV exposure.

Pros & Cons:

Silicone is flexible and provides excellent sealing capabilities. However, it is generally more expensive and may not be suitable for all chemical applications.

Impact on Application:

Silicone is often used in food and pharmaceutical applications due to its non-toxic properties. Its flexibility makes it suitable for dynamic applications.

Considerations for International Buyers:

Silicone materials must comply with FDA and other health regulations, particularly in Europe and North America. Buyers should confirm that suppliers adhere to relevant certifications.

Summary Table

| Material | Typical Use Case for diaphragm valve | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| EPDM | Water treatment, food processing | Excellent heat and ozone resistance | Not suitable for petroleum-based fluids | Medium |

| PTFE | Chemical and pharmaceutical industries | Exceptional chemical resistance | Higher cost and manufacturing complexity | High |

| NBR | Automotive and industrial applications | Good oil and fuel resistance | Limited weathering and ozone resistance | Low |

| Silicone | Food and pharmaceutical applications | Excellent flexibility and sealing | Higher cost and chemical limitations | Medium |

This strategic material selection guide provides actionable insights for international B2B buyers, enabling informed decisions based on material properties, application suitability, and compliance with industry standards.

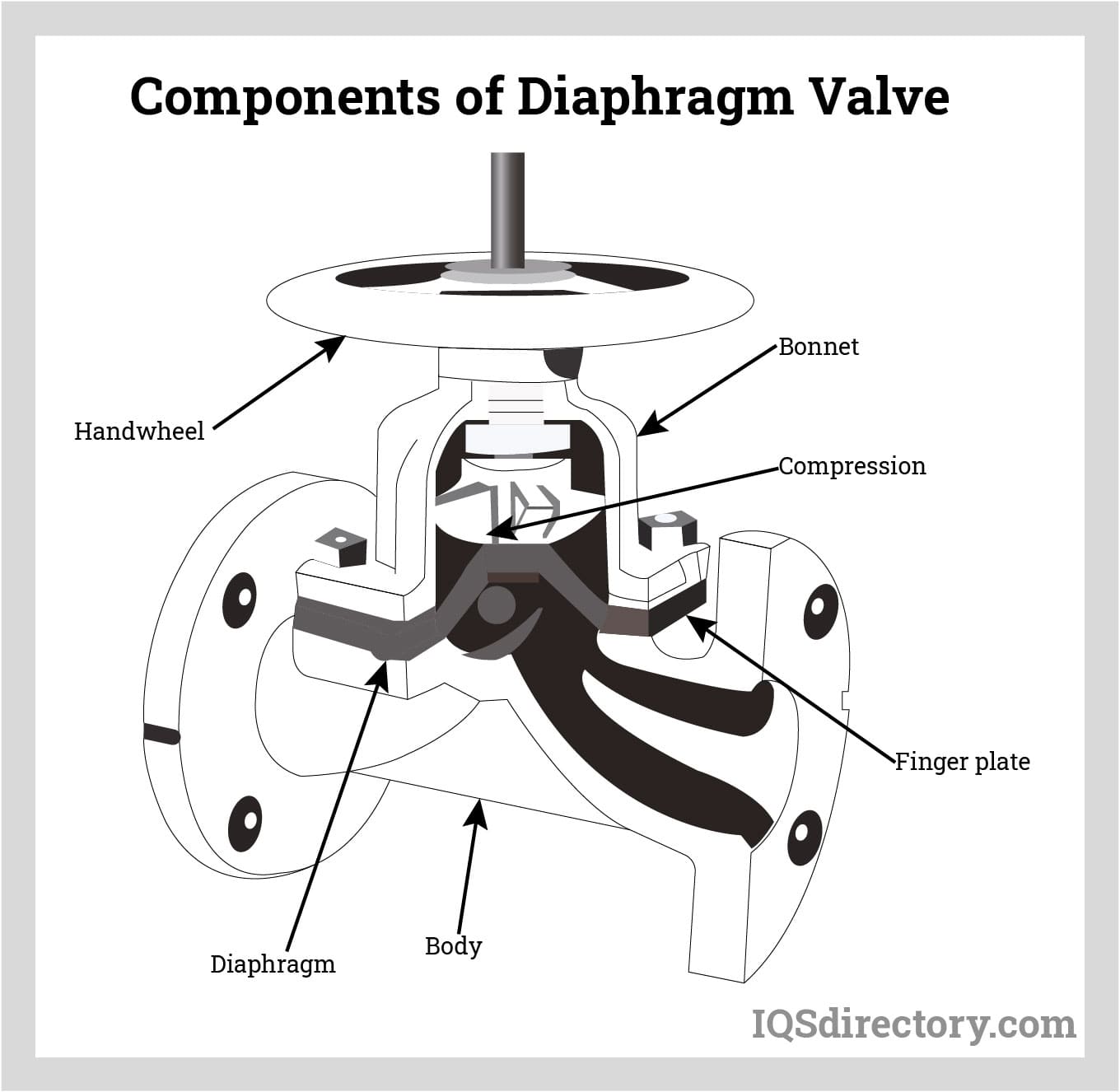

In-depth Look: Manufacturing Processes and Quality Assurance for diaphram valve

Manufacturing Processes for Diaphragm Valves

The manufacturing of diaphragm valves involves several intricate processes that ensure the final product meets industry standards and performs reliably. Understanding these processes can help international B2B buyers make informed purchasing decisions.

Main Stages of Manufacturing

-

Material Preparation

– Selection of Materials: The choice of materials is critical for diaphragm valves, as they must withstand various pressures and corrosive environments. Common materials include stainless steel, brass, and specialized plastics.

– Material Testing: Before production, materials undergo testing for mechanical properties, corrosion resistance, and compatibility with the fluids they will control. -

Forming

– Machining: Components such as bodies, bonnets, and diaphragms are machined using CNC (Computer Numerical Control) machines. This ensures precision and consistency in dimensions.

– Molding: For diaphragm production, materials may be molded or extruded, particularly when using elastomers or thermoplastics. Techniques like compression molding or injection molding are common. -

Assembly

– Component Assembly: After forming, parts are meticulously assembled. This includes fitting the diaphragm, valve seat, and actuator.

– Sealing: Sealing techniques are crucial to prevent leaks. This may involve the use of O-rings, gaskets, or other sealing materials tailored to the application. -

Finishing

– Surface Treatment: Components may undergo surface treatments such as anodizing or plating to enhance durability and resistance to corrosion.

– Final Inspection: Each valve is subjected to a final inspection to ensure that it meets design specifications and quality standards before packaging.

Quality Assurance in Diaphragm Valve Manufacturing

Quality assurance is paramount in the production of diaphragm valves to guarantee performance and safety. This involves adhering to international standards and implementing robust quality control measures.

Relevant International Standards

- ISO 9001: This standard outlines criteria for a quality management system and ensures consistent quality in products and services.

- CE Marking: For products sold within the European Economic Area, CE marking indicates compliance with health, safety, and environmental protection standards.

- API Standards: The American Petroleum Institute (API) has specific standards that diaphragm valves must meet, particularly for applications in the oil and gas industry.

Quality Control Checkpoints

-

Incoming Quality Control (IQC)

– Incoming materials are inspected for quality and compliance with specifications before they enter the production line. This includes verifying material certifications and conducting random sampling. -

In-Process Quality Control (IPQC)

– During manufacturing, processes are monitored to ensure they comply with predetermined standards. This includes dimensional checks and functionality tests at various stages of assembly. -

Final Quality Control (FQC)

– Once assembly is complete, valves undergo comprehensive testing, which may include:- Pressure Testing: Ensures that the valve can withstand its rated pressure without leaking.

- Functional Testing: Checks the operation of the valve under simulated conditions.

- Leak Testing: Identifies any potential leaks using methods like bubble testing or pressure decay.

Common Testing Methods

- Hydraulic Testing: This involves filling the valve with water and pressurizing it to check for leaks and structural integrity.

- Pneumatic Testing: Similar to hydraulic testing but uses air or gas to evaluate leakage and performance.

- Material Testing: Includes tensile strength tests, hardness tests, and corrosion resistance evaluations.

Verifying Supplier Quality Control

B2B buyers should take proactive steps to ensure that their suppliers maintain high quality standards:

- Supplier Audits: Conduct regular audits of potential suppliers to evaluate their manufacturing processes, quality control measures, and compliance with international standards.

- Request Quality Reports: Suppliers should provide detailed quality reports, including inspection and testing results for the products.

- Third-Party Inspections: Engage third-party inspection services to verify compliance with specifications and standards before shipment.

Quality Control Nuances for International Buyers

International buyers, especially from regions like Africa, South America, the Middle East, and Europe, should be aware of several nuances in quality control:

- Regulatory Compliance: Different regions have varying regulatory requirements. Buyers must ensure that products meet local standards, such as the European Union’s directives for CE marking.

- Cultural and Logistical Considerations: Language barriers and logistical challenges may affect communication with suppliers. It’s advisable to work with suppliers who understand the regulatory landscape of the buyer’s region.

- After-Sales Support: Verify that suppliers offer adequate after-sales support, including warranty services and access to spare parts, to maintain product performance over time.

Conclusion

Understanding the manufacturing processes and quality assurance practices for diaphragm valves is crucial for B2B buyers. By focusing on material selection, rigorous testing, and compliance with international standards, buyers can ensure they acquire reliable and high-quality products that meet their operational needs. Engaging in thorough supplier evaluations and audits further strengthens the procurement process, especially in diverse and dynamic markets.

Related Video: Water Quality Testing

Comprehensive Cost and Pricing Analysis for diaphram valve Sourcing

In the realm of diaphragm valve sourcing, understanding the comprehensive cost structure and pricing dynamics is crucial for international B2B buyers. This analysis will break down the essential cost components, price influencers, and provide actionable buyer tips that cater to the unique challenges faced by companies in Africa, South America, the Middle East, and Europe, including Italy and Poland.

Cost Components

-

Materials: The primary cost driver in diaphragm valve manufacturing is the quality of materials used. Common materials include various metals, elastomers, and plastics, which can vary significantly in price based on market conditions and supplier availability. High-performance materials designed for specific applications (e.g., chemical resistance) will typically incur higher costs.

-

Labor: Labor costs can fluctuate based on the manufacturing location. Regions with lower labor costs may offer more competitive pricing, but it’s essential to consider the quality and expertise of the workforce, as these factors impact the final product quality.

-

Manufacturing Overhead: This includes costs related to facilities, utilities, and equipment maintenance. Manufacturers often pass these costs onto buyers, making it vital to evaluate the operational efficiency of potential suppliers.

-

Tooling: Custom tooling for specific diaphragm valve designs can represent a significant upfront investment. While it may lead to lower per-unit costs for larger orders, initial tooling expenses can be a barrier for smaller orders.

-

Quality Control (QC): Rigorous QC processes ensure that diaphragm valves meet required standards. The costs associated with testing and certification can vary, impacting the final price. Buyers should prioritize suppliers with robust QC protocols to minimize risk.

-

Logistics: Shipping costs, including freight and insurance, should be factored into the total cost. International buyers must also consider tariffs and duties, which can significantly affect the overall expenditure.

-

Margin: Suppliers will include a profit margin in their pricing, which can vary widely. Understanding the competitive landscape can help buyers negotiate better terms.

Price Influencers

-

Volume/MOQ: Pricing often decreases with larger order volumes due to economies of scale. Buyers should assess their demand forecasts to negotiate minimum order quantities (MOQs) that align with their needs.

-

Specifications/Customization: Custom specifications can lead to higher costs. Standardized products typically offer better pricing, so buyers should evaluate whether they can compromise on certain features.

-

Quality/Certifications: Valves that meet higher quality standards (e.g., ISO certifications) may command premium prices. Buyers should weigh the benefits of quality against the potential costs, especially in critical applications.

-

Supplier Factors: The reputation and reliability of suppliers can influence pricing. Established suppliers may charge more due to their track record, but they can also offer greater assurance in terms of product quality and service.

-

Incoterms: The chosen Incoterm (e.g., FOB, CIF) affects shipping costs and responsibilities. Buyers should carefully negotiate these terms to optimize their total landed costs.

Buyer Tips

-

Negotiation: Leverage multiple supplier quotes to enhance bargaining power. Establishing long-term relationships can also lead to better pricing and terms.

-

Cost-Efficiency: Focus on the Total Cost of Ownership (TCO), which encompasses initial purchase price, maintenance, and operational costs. A lower upfront cost may not always translate to long-term savings.

-

Pricing Nuances: Be aware of regional differences in pricing. For instance, suppliers in Europe may have different cost structures than those in Africa or South America due to varying labor laws, material availability, and logistics networks.

-

Research and Due Diligence: Conduct thorough research on potential suppliers, including reviews of their production capabilities and quality certifications. This diligence helps ensure that the selected supplier can meet both budgetary and quality expectations.

Disclaimer

Prices for diaphragm valves can vary widely based on the factors discussed above. The information provided is indicative and should be validated through direct communication with suppliers for accurate and current pricing.

Illustrative Image (Source: Google Search)

Spotlight on Potential diaphram valve Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘diaphram valve’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for diaphram valve

Key Technical Properties of Diaphragm Valves

When selecting diaphragm valves, understanding their technical specifications is crucial for ensuring optimal performance in various applications. Below are some essential properties to consider:

-

Material Grade: Diaphragm valves can be constructed from a variety of materials, including PVC, stainless steel, and PTFE. The choice of material affects the valve’s resistance to corrosion, pressure, and temperature. For instance, stainless steel is preferred for high-pressure applications, while PVC is suitable for lower pressure and corrosive fluids. Buyers must assess the compatibility of materials with the specific fluids involved in their processes.

-

Pressure Rating: This specification indicates the maximum pressure the valve can handle. Common ratings include ANSI Class 150 and Class 300. Selecting a valve with an appropriate pressure rating is vital to prevent failures and ensure safety in operations, particularly in industries such as oil and gas, chemicals, and pharmaceuticals.

-

Temperature Range: The operational temperature range defines the limits within which the valve can function effectively. Diaphragm valves may be rated for temperatures from -40°C to 150°C or higher, depending on the design. Understanding this range is essential for applications involving extreme temperatures, as exceeding these limits can lead to material degradation and valve malfunction.

-

Flow Coefficient (Cv): The Cv value measures the flow capacity of the valve and indicates how much fluid can pass through it under a specific pressure drop. A higher Cv value means a larger flow capacity. This parameter is crucial for buyers to ensure that the valve meets the flow requirements of their system, optimizing efficiency and reducing energy costs.

-

Actuation Type: Diaphragm valves can be manually operated or automated using pneumatic or electric actuators. The choice of actuation type impacts the valve’s responsiveness and integration within automated systems. Buyers should consider their operational needs and whether remote operation or manual control is more appropriate for their applications.

Trade Terminology for Diaphragm Valves

Familiarity with industry jargon is essential for effective communication and negotiation in the procurement process. Here are some common terms relevant to diaphragm valves:

-

OEM (Original Equipment Manufacturer): Refers to companies that produce parts or equipment that may be marketed by another manufacturer. Understanding OEM relationships can help buyers identify reliable sources for diaphragm valves that meet specific quality standards and compatibility requirements.

-

MOQ (Minimum Order Quantity): This term denotes the smallest quantity of a product that a supplier is willing to sell. For diaphragm valves, MOQs can vary significantly among manufacturers. Buyers should negotiate these terms to align with their inventory and project needs, avoiding excess stock or supply shortages.

-

RFQ (Request for Quotation): An RFQ is a document that buyers send to suppliers to solicit pricing and terms for specific products. When drafting an RFQ for diaphragm valves, it’s important to include technical specifications, quantities, and delivery timelines to receive accurate and competitive quotes.

-

Incoterms (International Commercial Terms): These are standardized trade terms that define the responsibilities of buyers and sellers in international transactions. Understanding Incoterms is crucial for B2B buyers as they dictate who is responsible for shipping, insurance, and tariffs, which can significantly affect the total cost of acquiring diaphragm valves.

-

Lead Time: This refers to the time taken from placing an order to receiving the product. Lead times can vary based on the manufacturer and the complexity of the diaphragm valve. Buyers should factor in lead times when planning projects to avoid delays in operations.

By understanding these technical properties and industry terminology, B2B buyers can make informed decisions that enhance operational efficiency and minimize risk in their procurement processes.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the diaphram valve Sector

Market Overview & Key Trends

The diaphragm valve market is experiencing significant growth driven by increasing demand across various industries, including oil and gas, pharmaceuticals, and food and beverage. Key trends shaping the market include the adoption of automation and Industry 4.0 technologies, which enhance operational efficiency and reduce human error. International B2B buyers, particularly from Africa, South America, the Middle East, and Europe, are increasingly focused on integrating smart valve technologies that offer real-time monitoring and predictive maintenance capabilities.

Emerging sourcing trends include a shift towards local suppliers to mitigate supply chain disruptions and reduce lead times. Buyers are also prioritizing suppliers who can demonstrate compliance with international standards and certifications, such as ISO 9001 and API standards. The ongoing emphasis on digital transformation is prompting companies to invest in e-procurement platforms that streamline sourcing processes and improve supplier collaboration.

Illustrative Image (Source: Google Search)

The diaphragm valve market is also witnessing a rise in the use of advanced materials, such as PTFE and elastomers, which enhance valve performance and longevity. As global competition intensifies, B2B buyers are urged to conduct thorough market analyses and leverage competitive intelligence to inform their sourcing decisions, ensuring they partner with manufacturers that offer innovative solutions tailored to their specific operational needs.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a critical consideration for B2B buyers in the diaphragm valve sector, with environmental impacts influencing purchasing decisions. The manufacturing processes for diaphragm valves can generate waste and emissions, prompting buyers to seek suppliers with sustainable practices. Implementing eco-friendly production methods, such as utilizing recycled materials or reducing energy consumption, is essential for suppliers aiming to capture market share.

Ethical sourcing is equally important, as buyers are increasingly concerned about the social and environmental implications of their supply chains. Ensuring transparency and traceability in sourcing practices can help buyers mitigate risks associated with unethical labor practices and environmental degradation. Certifications such as ISO 14001 (Environmental Management) and OHSAS 18001 (Occupational Health and Safety) are valuable indicators of a supplier’s commitment to sustainability.

Moreover, adopting ‘green’ materials, such as biodegradable or recyclable components in diaphragm valves, can enhance a company’s brand reputation and appeal to environmentally conscious customers. As the demand for sustainable solutions grows, B2B buyers should prioritize partnerships with manufacturers who prioritize ethical sourcing and sustainability in their operations.

Brief Evolution/History

The diaphragm valve has evolved significantly since its inception in the early 20th century. Initially designed for simple on/off applications, advancements in materials and manufacturing processes have transformed diaphragm valves into versatile components suitable for complex industrial applications. The introduction of advanced sealing technologies and automation has further enhanced their functionality, making them indispensable in critical sectors such as pharmaceuticals and food processing.

As industries continue to evolve, diaphragm valves are now integral to automated systems, driven by the need for precision and reliability. This evolution underscores the importance of selecting suppliers who not only understand the historical context of diaphragm valves but also stay at the forefront of technological innovations, ensuring that buyers can leverage the latest advancements for their operational needs.

Related Video: The Inside Story of the Ship That Broke Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of diaphram valve

-

What key factors should I consider when vetting suppliers of diaphragm valves?

When vetting suppliers, prioritize their industry experience and reputation. Check for certifications such as ISO 9001, which indicates a commitment to quality management. Request references from previous clients and evaluate their responsiveness and customer service. Additionally, consider their production capabilities and whether they can meet your specific requirements in terms of volume and customization. Conduct site visits if possible to assess their manufacturing processes and quality control measures. -

Can diaphragm valves be customized to meet specific operational needs?

Yes, many manufacturers offer customization options for diaphragm valves. This includes variations in materials, sizes, and pressure ratings to suit specific applications. When discussing customization, provide detailed specifications about your operational environment, such as temperature, pressure, and fluid type. Collaborating closely with the supplier can ensure that the final product meets your exact needs, enhancing performance and longevity. -

What are the typical minimum order quantities (MOQs) and lead times for diaphragm valves?

Minimum order quantities can vary significantly between suppliers, typically ranging from 50 to 500 units depending on the manufacturer and product specifications. Lead times also depend on factors such as customization and production schedules, usually ranging from 4 to 12 weeks. It’s crucial to discuss these details upfront to ensure they align with your project timelines and inventory management strategies. -

What payment terms are commonly offered for international B2B transactions involving diaphragm valves?

Payment terms can vary widely among suppliers. Common arrangements include a deposit (typically 30-50%) upon order confirmation, with the balance due before shipment. Some suppliers may offer net payment terms, such as 30 or 60 days post-delivery. It’s advisable to negotiate terms that suit your cash flow requirements and to confirm the accepted payment methods, which may include bank transfers, letters of credit, or payment platforms. -

How can I ensure the quality of diaphragm valves before purchase?

To ensure quality, request detailed product specifications and quality assurance documentation from suppliers. Look for third-party testing certifications and compliance with international standards relevant to your industry, such as API or ASME. Consider requesting sample products for testing before placing a larger order. Additionally, inquire about the supplier’s quality control processes, including inspections and testing protocols throughout the manufacturing cycle. -

What logistics considerations should I keep in mind when sourcing diaphragm valves internationally?

Logistics can significantly impact the total cost and delivery time of diaphragm valves. Ensure you understand the shipping options available, including air freight for faster delivery or sea freight for cost savings. Discuss with your supplier who will handle the shipping and customs clearance. It’s also advisable to factor in potential tariffs, import duties, and local regulations that may affect the delivery and overall cost. -

What steps should I take if I encounter disputes with a supplier?

In the event of a dispute, start by communicating directly with your supplier to resolve the issue amicably. Document all correspondence and agreements to establish a clear record. If direct negotiations fail, refer to the terms outlined in your contract regarding dispute resolution, which may include mediation or arbitration. Having a legal advisor familiar with international trade can provide additional guidance on navigating disputes effectively.

- How important is after-sales support when sourcing diaphragm valves?

After-sales support is critical for the long-term success of your investment in diaphragm valves. Reliable suppliers should offer technical assistance, maintenance guidance, and warranty services. Inquire about the availability of spare parts and the supplier’s response time for support inquiries. A strong after-sales support system can enhance the operational efficiency of your equipment and minimize downtime, ensuring a good return on investment.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for diaphram valve

In summary, the strategic sourcing of diaphragm valves is essential for international B2B buyers looking to enhance operational efficiency and reduce costs. As industries worldwide increasingly prioritize sustainability and reliability, investing in high-quality diaphragm valves becomes imperative. Key takeaways include the importance of selecting suppliers that offer not only competitive pricing but also superior technology and customer support.

Buyers from Africa, South America, the Middle East, and Europe should leverage local market knowledge while also considering global suppliers to ensure they access the best innovations available. By fostering strong relationships with reliable manufacturers, organizations can gain a competitive edge in their respective markets.

Looking ahead, the diaphragm valve market is poised for growth, driven by advancements in technology and increasing demand across sectors such as pharmaceuticals, chemical processing, and water treatment. As you navigate this evolving landscape, prioritize strategic sourcing to align your procurement strategies with your long-term goals. Engage with trusted suppliers to explore the latest solutions and ensure your operations remain efficient and cost-effective.