Your Ultimate Guide to Sourcing Copper Material

Introduction: Navigating the Global Market for copper material

Copper material is an essential component in numerous industries, from electrical engineering to construction, serving as a backbone for infrastructure and technological advancements. As international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding the intricacies of copper sourcing is critical for ensuring successful project outcomes. The global market for copper is characterized by diverse material types, fluctuating costs, and varying supplier capabilities, making it crucial to navigate these complexities effectively.

This comprehensive guide provides a deep dive into the world of copper materials, offering insights into various types and alloys, their specific applications, and the manufacturing processes that underpin their quality. You’ll gain a thorough understanding of manufacturing and quality control standards, enabling you to evaluate potential suppliers rigorously. The guide also addresses cost considerations, equipping you with strategies to manage price volatility and secure competitive terms.

By leveraging this resource, you will be empowered to make informed sourcing decisions that enhance operational efficiency and project reliability. Our FAQ section tackles common challenges and misconceptions, further facilitating your understanding of copper material procurement. Whether you’re sourcing for a high-stakes project in Turkey or a renewable energy initiative in Nigeria, this guide will be your roadmap to success in the global copper market.

Understanding copper material Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Pure Copper (Electrolytic) | 99.9% purity, excellent conductivity, malleable | Electrical wiring, heat exchangers | Pros: Superior conductivity; Cons: Higher cost, less strength. |

| Oxygen-Free Copper | Ultra-pure, minimal oxygen content, high ductility | High-end electronics, vacuum systems | Pros: Optimal for sensitive applications; Cons: Premium priced, less machinable. |

| Tin Bronze | Alloyed with 3-12% tin, strong and corrosion-resistant | Marine hardware, industrial components | Pros: Good wear resistance; Cons: Higher cost than pure copper. |

| Aluminum Bronze | Contains 6-12% aluminum, robust in harsh environments | Pumps, valves, chemical equipment | Pros: High strength and corrosion resistance; Cons: More difficult to machine. |

| Silicon Bronze | Up to 6% silicon, good weldability and strength | Fasteners, architectural applications | Pros: Strong and aesthetically pleasing; Cons: Generally more expensive than brass. |

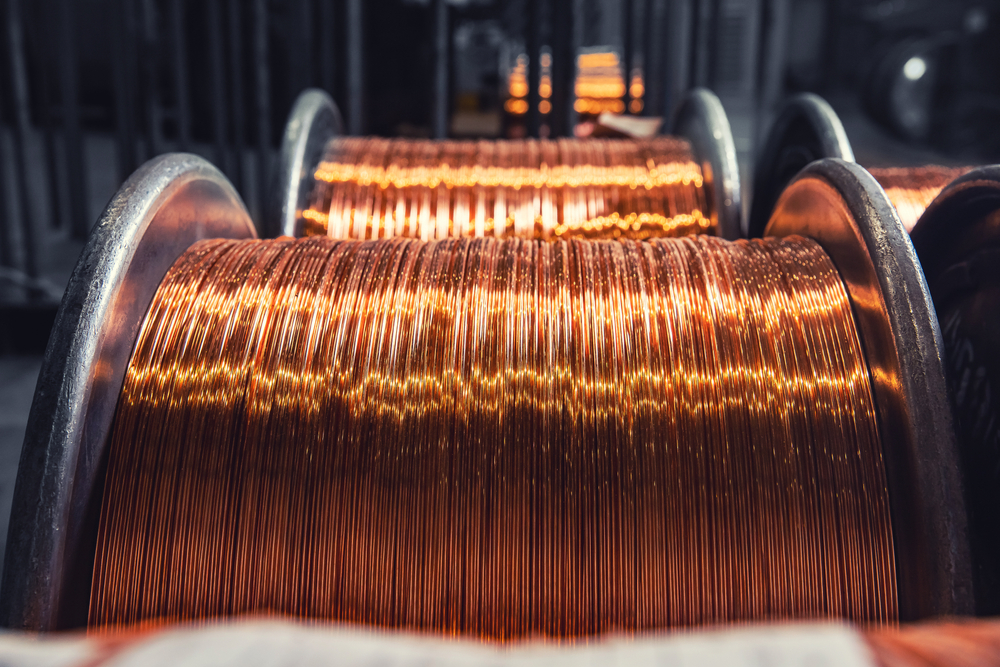

Pure Copper (Electrolytic)

Pure copper, with a purity level of 99.9%, is highly regarded for its exceptional electrical and thermal conductivity. Its malleability makes it suitable for applications such as electrical wiring and heat exchangers, especially critical in infrastructure projects across Europe and Africa. B2B buyers should consider the cost implications and ensure compliance with local standards, as while it offers superior performance, it is more expensive and less durable compared to alloys.

Illustrative Image (Source: Google Search)

Oxygen-Free Copper

Oxygen-free copper is characterized by its ultra-pure composition, with oxygen content reduced to less than 0.001%. This type is crucial for high-end electronics and vacuum systems, where any impurities could compromise performance. Buyers in sectors like telecommunications and aerospace must prioritize supplier certifications to guarantee quality. Although it comes at a premium price, its unparalleled performance in sensitive applications justifies the investment.

Tin Bronze

Tin bronze, made by alloying copper with 3-12% tin, is known for its strength and corrosion resistance, making it ideal for marine hardware and industrial components. This material is particularly sought after in South America’s mining sector. B2B buyers should weigh the higher cost against the material’s longevity and performance in demanding environments, ensuring they source from reputable suppliers who can provide technical support.

Aluminum Bronze

Aluminum bronze, which contains 6-12% aluminum, is designed for high-stress environments and exhibits excellent corrosion resistance. It is commonly used in pumps, valves, and chemical processing equipment. Buyers should consider the material’s machining challenges, as it can be more difficult to work with compared to other copper types. Its strength and durability make it a worthwhile investment for applications in harsh conditions.

Silicon Bronze

Silicon bronze, incorporating up to 6% silicon, offers good weldability and strength, making it suitable for fasteners and architectural applications. Its aesthetic finish is an added advantage for projects where appearance matters. While generally more expensive than brass, the benefits of strength and corrosion resistance make it an appealing choice for B2B buyers looking to balance performance and cost.

Related Video: Plumbing 101, Everything You Need To Know About Copper Fittings!

Key Industrial Applications of copper material

| Industry/Sector | Specific Application of copper material | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Electrical & Electronics | Electrical wiring and components | High conductivity and reliability in power transmission | Compliance with international standards (e.g., IEC) |

| Renewable Energy | Solar panels and wind turbines | Enhanced efficiency and durability in energy generation | Supplier certifications and material traceability |

| Construction | Plumbing and HVAC systems | Corrosion resistance and longevity in infrastructure | Sourcing from reputable manufacturers with quality assurance |

| Transportation | Automotive and aerospace components | Lightweight yet durable materials for improved performance | Material grades and compliance with safety regulations |

| Mining & Heavy Industry | Equipment and machinery parts | High wear resistance and strength for demanding environments | Technical support and alignment with industry standards |

Electrical & Electronics

Copper material is essential in the electrical and electronics industry, particularly for wiring and components. Its high conductivity ensures efficient power transmission, reducing energy loss and improving overall system performance. International B2B buyers must ensure that the copper sourced meets rigorous international standards (e.g., IEC) to guarantee reliability and safety in applications ranging from consumer electronics to industrial machinery.

Renewable Energy

In the renewable energy sector, copper is used extensively in solar panels and wind turbines. Its excellent thermal and electrical conductivity contributes to higher efficiency rates in energy generation, which is critical for reducing operational costs. Buyers in Africa, South America, the Middle East, and Europe should prioritize suppliers that provide certifications to confirm material quality and traceability, ensuring compliance with sustainability initiatives.

Construction

Copper’s corrosion resistance makes it a preferred choice for plumbing and HVAC systems in the construction industry. Its longevity and durability reduce maintenance costs and enhance the lifespan of infrastructure projects. When sourcing copper for construction applications, B2B buyers should focus on reputable manufacturers that adhere to quality assurance standards, as well as local building codes to ensure compliance and performance.

Transportation

In the transportation sector, copper is utilized in various automotive and aerospace components due to its lightweight yet robust characteristics. This material enhances performance and fuel efficiency, making it a vital component in modern vehicles. International buyers must consider specific material grades and ensure compliance with safety regulations and standards to mitigate risks associated with sourcing.

Mining & Heavy Industry

Copper is widely used in mining and heavy industry for manufacturing equipment and machinery parts. Its high wear resistance and strength are crucial for operations in harsh environments, where durability is paramount. B2B buyers should seek suppliers who offer technical support and align with industry standards to ensure that the copper components can withstand the demanding conditions typical in these sectors.

Related Video: Uses of Metal – Gold, Copper, Aluminium & Steel | Properties of Matter| Chemistry | FuseSchool

Strategic Material Selection Guide for copper material

When selecting copper materials for B2B applications, understanding the distinct properties and applications of various copper types is crucial. This guide analyzes four common copper materials, highlighting their key properties, advantages, disadvantages, and specific considerations for international buyers, particularly in Africa, South America, the Middle East, and Europe.

Pure Copper (Electrolytic)

Key Properties: Pure copper, often referred to as electrolytic copper, boasts a conductivity rating of 58 MS/m and is highly malleable. It performs well in temperatures up to 200°C, making it suitable for a variety of electrical applications.

Pros & Cons: The primary advantage of pure copper is its excellent electrical and thermal conductivity, essential for electrical wiring and heat exchangers. However, its softness makes it less suitable for high-stress applications, and it is generally more expensive than copper alloys.

Impact on Application: Pure copper is ideal for electrical components and plumbing systems. Its compatibility with various media, such as water and gases, enhances its utility in diverse applications.

Considerations for International Buyers: Buyers should ensure compliance with regional standards such as ASTM and EN when sourcing pure copper. The higher cost may be justified in applications requiring superior conductivity.

Oxygen-Free Copper

Key Properties: Oxygen-free copper is refined to remove oxygen content to less than 0.001%. This results in enhanced ductility and resistance to hydrogen embrittlement, making it suitable for high-frequency applications.

Pros & Cons: The key advantage of oxygen-free copper is its exceptional performance in sensitive applications, such as telecommunications and aerospace. However, it comes at a premium price and can be less machinable than other copper types.

Impact on Application: This type of copper is particularly effective in high-end electronics and vacuum systems, where trace impurities could compromise performance.

Considerations for International Buyers: Buyers must verify material certifications to ensure purity levels meet stringent requirements. The investment in oxygen-free copper is often justified by its superior performance in critical applications.

Tin Bronze (Phosphor Bronze)

Key Properties: Tin bronze is an alloy of copper with 3-12% tin and phosphorus, providing excellent corrosion resistance and strength. It can withstand temperatures up to 300°C and offers good wear resistance.

Pros & Cons: The primary advantage of tin bronze is its durability and resistance to corrosion, making it suitable for marine applications. However, it is more expensive than pure copper and may require specialized machining.

Impact on Application: Tin bronze is commonly used in bearings, bushings, and marine hardware, where its strength and corrosion resistance are critical.

Considerations for International Buyers: Buyers should ensure that the specifications align with machinery requirements and consider sourcing from reputable suppliers to guarantee quality.

Aluminum Bronze

Key Properties: Aluminum bronze is a copper alloy with 6-12% aluminum, known for its strength and corrosion resistance, especially in harsh environments. It can withstand high temperatures and pressures.

Pros & Cons: The key advantage of aluminum bronze is its robustness in corrosive and abrasive conditions, making it ideal for pumps and valves. However, it is more challenging to machine and typically costs more than other copper alloys.

Impact on Application: This material is well-suited for chemical processing and offshore applications, where durability is paramount.

Considerations for International Buyers: Buyers should be aware of the additional machining requirements and ensure compliance with relevant standards. The higher upfront cost may be offset by the long-term durability and reduced maintenance needs.

Summary Table

| Material | Typical Use Case for copper material | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Pure Copper | Electrical wiring, plumbing | Excellent conductivity | Less strong, higher cost | High |

| Oxygen-Free Copper | High-end electronics, vacuum systems | Exceptional ductility | Premium priced, less machinable | High |

| Tin Bronze | Bearings, marine hardware | Good corrosion resistance | Higher cost than pure copper | Medium |

| Aluminum Bronze | Pumps, valves, chemical equipment | High strength, corrosion resistance | Difficult to machine | Medium to High |

This guide provides B2B buyers with essential insights into copper materials, enabling informed decisions that align with project requirements and regional standards.

In-depth Look: Manufacturing Processes and Quality Assurance for copper material

Manufacturing Processes for Copper Material

The manufacturing of copper materials involves several critical stages that ensure the production of high-quality products suitable for diverse applications. Understanding these processes is essential for B2B buyers to make informed sourcing decisions. Below, we outline the main stages of manufacturing copper, the key techniques employed, and the implications for quality assurance.

Material Preparation

The first stage in the manufacturing process is material preparation, which typically includes the following steps:

-

Raw Material Selection: High-quality copper ore or scrap metal is selected based on desired purity levels. Electrolytic copper (99.9% purity) is commonly used for electrical applications, while alloys may be chosen for their specific properties.

-

Melting and Casting: The selected copper is melted in a furnace at temperatures exceeding 1,100°C. The molten copper is then poured into molds to create ingots or billets, which are subsequently cooled and solidified.

Illustrative Image (Source: Google Search)

- Refining: Depending on the intended application, further refining may be necessary to remove impurities. This step is crucial for ensuring the electrical conductivity and mechanical properties of the final product.

Forming

Once the material is prepared, the next stage involves forming the copper into the desired shape. Key techniques include:

-

Extrusion: This process involves forcing heated copper through a die to create long shapes such as rods, tubes, and profiles. Extrusion is widely used due to its efficiency and ability to produce complex shapes.

-

Rolling: Copper ingots are passed through a series of rollers to reduce thickness and increase length. This technique is essential for producing sheets and strips used in various applications.

-

Drawing: In this technique, copper wire is pulled through a die to decrease its diameter while increasing its length. This is vital for producing electrical wires and cables.

Assembly and Finishing

The final stages of manufacturing involve assembly and finishing processes, which may include:

-

Joining: Techniques such as welding, soldering, or brazing are employed to assemble copper components into final products. The choice of joining method depends on the specific application requirements.

-

Surface Treatment: Finishing processes, including plating, polishing, or coating, enhance the appearance and corrosion resistance of copper products. This step is particularly important for items used in harsh environments.

-

Quality Inspection: Before products are dispatched, they undergo rigorous quality checks to ensure compliance with specifications and standards.

Quality Assurance in Copper Manufacturing

Quality assurance is a fundamental aspect of copper manufacturing that ensures the reliability and safety of the final products. International B2B buyers should be well-versed in relevant standards and inspection processes to safeguard their interests.

Relevant International Standards

Several international and industry-specific standards govern the quality assurance of copper materials:

-

ISO 9001: This standard outlines the requirements for a quality management system (QMS) and is applicable to all organizations, including those in the copper industry. It emphasizes customer satisfaction and continual improvement.

-

CE Marking: Products intended for the European market must comply with the EU’s safety, health, and environmental protection standards. CE marking indicates conformity with these regulations.

-

API Standards: For copper materials used in the oil and gas industry, the American Petroleum Institute (API) provides specific standards that ensure product reliability under demanding conditions.

Quality Control Checkpoints

Quality control (QC) checkpoints are integral to the manufacturing process. Key QC stages include:

-

Incoming Quality Control (IQC): This initial checkpoint involves inspecting raw materials upon arrival to ensure they meet specified standards.

-

In-Process Quality Control (IPQC): Throughout the manufacturing process, ongoing inspections are conducted to monitor quality and detect issues early. This proactive approach helps minimize defects.

-

Final Quality Control (FQC): The last stage involves comprehensive testing and inspection of finished products before shipment. This ensures that all items meet required specifications.

Common Testing Methods

To validate the quality of copper products, various testing methods are employed, including:

-

Chemical Analysis: Determines the composition and purity of copper materials, ensuring they meet specified standards.

-

Mechanical Testing: Assesses properties such as tensile strength, ductility, and hardness to verify performance under operational conditions.

-

Non-Destructive Testing (NDT): Techniques such as ultrasonic testing or X-ray inspection allow for the detection of internal defects without damaging the product.

Verifying Supplier Quality Control

B2B buyers must implement strategies to verify the quality control measures of their suppliers. Here are effective methods:

-

Supplier Audits: Conducting regular audits of potential suppliers’ manufacturing processes and quality control systems provides insights into their operational standards and compliance with international regulations.

-

Requesting Quality Reports: Buyers should ask suppliers for detailed quality reports, including inspection results and certifications, to assess their adherence to standards like ISO 9001.

-

Third-Party Inspections: Engaging independent third-party inspection agencies can provide an unbiased assessment of the supplier’s quality control practices, ensuring transparency and reliability.

-

Understanding Regional Compliance Nuances: Buyers from different regions, such as Africa, South America, the Middle East, and Europe, must be aware of local regulations and standards that may affect quality assurance. Familiarity with these nuances can aid in selecting suppliers who meet specific regional requirements.

Conclusion

A comprehensive understanding of the manufacturing processes and quality assurance protocols for copper materials is essential for B2B buyers. By being informed about material preparation, forming techniques, and rigorous quality control standards, buyers can effectively navigate the complexities of sourcing copper. Ensuring compliance with international standards and conducting thorough supplier evaluations will ultimately lead to reliable partnerships and successful procurement outcomes.

Related Video: Lean Manufacturing – Lean Factory Tour – FastCap

Comprehensive Cost and Pricing Analysis for copper material Sourcing

Understanding the cost structure and pricing dynamics of copper material sourcing is essential for international B2B buyers, particularly those operating in Africa, South America, the Middle East, and Europe. This analysis dissects the key components influencing costs and offers actionable insights to help buyers navigate the complexities of procurement effectively.

Cost Components

-

Materials: The cost of copper itself is the primary driver in the pricing structure. Fluctuations in global copper prices—affected by supply and demand, geopolitical factors, and market speculation—can significantly impact overall costs. Buyers should monitor commodity markets regularly to anticipate price changes.

-

Labor: Labor costs vary by region and can influence the final price of copper products. In regions with higher labor costs, such as Europe, buyers might encounter elevated pricing. Conversely, sourcing from countries with lower labor costs may offer savings but could pose risks related to quality and compliance.

-

Manufacturing Overhead: This includes expenses related to production facilities, utilities, and equipment maintenance. Buyers should inquire about the supplier’s operational efficiencies, as these can affect pricing. Streamlined operations often translate to lower overhead costs, allowing for more competitive pricing.

-

Tooling: Custom tooling for specific products can add to the initial costs. Buyers requiring unique specifications should factor in these expenses. Understanding the tooling lifespan and potential for reuse can help in managing overall costs.

-

Quality Control (QC): Rigorous QC processes ensure compliance with international standards, affecting both material quality and pricing. Buyers should assess the supplier’s QC capabilities, as robust quality assurance can lead to higher upfront costs but reduce long-term risks related to defects.

-

Logistics: Transportation and handling costs are crucial, especially for international shipments. Buyers need to consider the distance from the supplier, shipping methods, and any tariffs or duties applicable in their region. Efficient logistics can mitigate costs and ensure timely delivery.

-

Margin: Supplier margins vary based on market conditions, competition, and the supplier’s positioning. Understanding the margin expectations of potential suppliers can aid in negotiations and help buyers identify the best value for their investments.

Price Influencers

-

Volume/MOQ: Bulk purchases often lead to discounts. Establishing minimum order quantities (MOQs) can provide leverage in negotiations. Buyers should assess their own consumption patterns to optimize order sizes.

-

Specifications/Customization: Custom products may incur higher costs due to additional processing and tooling requirements. Buyers should clearly define their specifications to avoid unexpected costs.

-

Materials and Quality/Certifications: Higher-quality materials or specific certifications (e.g., ISO, ASTM) typically command higher prices. Buyers should weigh the benefits of these certifications against their project requirements.

-

Supplier Factors: The supplier’s reputation, location, and operational scale influence pricing. Established suppliers with proven track records may charge a premium but often provide better reliability and service.

-

Incoterms: The chosen Incoterms (International Commercial Terms) can affect pricing by determining who bears costs and risks during transportation. Understanding these terms is crucial for accurate cost assessment.

Buyer Tips

-

Negotiation: Leverage your purchasing volume and establish long-term relationships with suppliers to negotiate better pricing. Transparency about your needs can foster collaboration and yield favorable terms.

-

Cost-Efficiency: Analyze the Total Cost of Ownership (TCO) rather than just upfront costs. Consider factors such as durability, maintenance, and potential downtime when evaluating suppliers.

-

Pricing Nuances: Be aware of regional pricing differences and currency fluctuations, especially when sourcing from diverse markets like Turkey, Nigeria, or Brazil. Engaging local experts can provide insights into market conditions and help mitigate risks.

-

Disclaimer for Indicative Prices: Prices fluctuate based on market conditions and specific supplier agreements. It’s essential for buyers to seek current quotes and negotiate terms that align with their unique project needs.

By understanding these cost components and price influencers, B2B buyers can make informed decisions, ensuring they secure copper materials that meet both quality standards and budgetary constraints.

Spotlight on Potential copper material Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘copper material’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for copper material

Understanding the technical properties and trade terminology related to copper materials is crucial for international B2B buyers. This knowledge aids in making informed purchasing decisions and optimizing procurement processes.

Key Technical Properties of Copper Material

-

Material Grade

– Definition: Material grades refer to the classification of copper based on its purity, alloying elements, and specific properties. Common grades include C11000 (electrolytic copper) and C36000 (brass).

– B2B Importance: Different grades are suited for varied applications. For instance, C11000 is ideal for electrical applications due to its high conductivity, while C36000 is preferable for mechanical applications due to its machinability. Understanding the appropriate grade ensures that buyers select materials that meet their project specifications. -

Tolerance

– Definition: Tolerance indicates the permissible limits of variation in dimensions and properties of copper products. It is usually specified in millimeters or inches.

– B2B Importance: Tighter tolerances are critical in applications requiring precision, such as in electrical connectors or mechanical components. Buyers must communicate their tolerance requirements clearly to suppliers to ensure product compatibility and performance. -

Conductivity

– Definition: Conductivity measures how well a material allows the flow of electrical current, typically expressed in percentage IACS (International Annealed Copper Standard).

– B2B Importance: High conductivity is essential in electrical applications. For example, copper with 100% IACS is preferred for wiring, while lower conductivity may be acceptable in less demanding applications. Buyers should assess conductivity specifications to avoid performance issues. -

Corrosion Resistance

– Definition: Corrosion resistance refers to the ability of copper to withstand degradation due to environmental factors, including moisture, chemicals, and temperature.

– B2B Importance: In industries like marine and construction, materials must resist corrosion to ensure longevity and reliability. Buyers should consider corrosion resistance ratings to ensure the selected copper material will perform well in the intended environment. -

Mechanical Properties

– Definition: Mechanical properties include tensile strength, yield strength, and elongation, which indicate how a material will perform under stress.

– B2B Importance: Understanding these properties is essential for applications that require strength and durability. For example, a high tensile strength is vital for structural components. Buyers must ensure that the mechanical properties align with their application requirements.

Common Trade Terms in Copper Sourcing

-

OEM (Original Equipment Manufacturer)

– Definition: An OEM is a company that produces parts or equipment that may be marketed by another manufacturer.

– Importance: Understanding OEM relationships helps buyers identify reliable suppliers that provide components meeting specific quality and performance standards. -

MOQ (Minimum Order Quantity)

– Definition: MOQ is the smallest quantity of a product that a supplier is willing to sell.

– Importance: Knowing the MOQ helps buyers plan their orders effectively, especially when managing budgets and inventory levels. -

RFQ (Request for Quotation)

– Definition: An RFQ is a document sent to suppliers requesting pricing and terms for specific quantities of materials.

– Importance: Submitting RFQs allows buyers to compare prices and terms from different suppliers, facilitating better negotiation and selection. -

Incoterms (International Commercial Terms)

– Definition: Incoterms are a set of international rules that define the responsibilities of buyers and sellers in international transactions.

– Importance: Familiarity with Incoterms helps buyers understand shipping costs, risk management, and delivery responsibilities, ensuring smoother logistics and compliance. -

Lead Time

– Definition: Lead time refers to the amount of time between placing an order and receiving the product.

– Importance: Understanding lead times is crucial for project planning and ensuring that materials arrive when needed, avoiding delays in production.

By mastering these technical properties and trade terms, B2B buyers can enhance their procurement strategies, optimize supply chain efficiency, and ensure successful project outcomes in the global copper market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the copper material Sector

Market Overview & Key Trends

The global copper material market is experiencing significant growth, driven by increasing demand from key sectors such as construction, electronics, and renewable energy. In particular, the expansion of electric vehicle (EV) production and renewable energy infrastructure—like solar and wind—has propelled copper’s role as a crucial conductor. B2B buyers from Africa, South America, the Middle East, and Europe should be aware of the ongoing shift towards electrification, which is expected to maintain upward pressure on copper prices and availability.

Emerging technologies, such as blockchain and IoT, are transforming sourcing processes by enhancing transparency and efficiency in the supply chain. These innovations allow buyers to track material provenance, ensuring compliance with industry standards and ethical sourcing practices. Additionally, the rise of online procurement platforms is streamlining supplier selection and contract negotiation, enabling B2B buyers to access a broader range of suppliers and negotiate better terms.

Market dynamics are also influenced by geopolitical factors, including trade tariffs and export restrictions in key producing countries. For instance, fluctuations in copper supply from Chile or Peru can significantly impact global pricing. Buyers must stay informed about these geopolitical developments, as they can affect sourcing strategies and long-term procurement planning. Overall, understanding these market trends is essential for making informed decisions and ensuring supply chain resilience.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a pivotal consideration in the copper material sector, as buyers increasingly prioritize environmentally responsible sourcing practices. The environmental impact of copper mining and processing is significant, contributing to habitat destruction, water pollution, and high energy consumption. Consequently, B2B buyers are urged to choose suppliers committed to sustainable practices, including those that minimize waste and reduce carbon emissions.

Ethical supply chains are critical for maintaining brand reputation and meeting regulatory requirements. Buyers should look for suppliers who hold certifications such as ISO 14001 (Environmental Management) and those that participate in initiatives like the Copper Mark, which promotes responsible production practices. These certifications not only assure buyers of a supplier’s commitment to sustainability but also help mitigate risks associated with environmental compliance.

Moreover, the demand for recycled copper is rising, as it presents a lower environmental impact compared to newly mined copper. Engaging with suppliers who prioritize recycled materials can lead to a more sustainable supply chain while also potentially reducing costs. Overall, integrating sustainability and ethical sourcing into procurement strategies is not only a responsible choice but also a competitive advantage in today’s conscious marketplace.

Brief Evolution/History

Copper has been utilized for thousands of years, with its use dating back to ancient civilizations for tools, ornaments, and currency. The Industrial Revolution marked a turning point, as copper became essential for electrical wiring and plumbing, laying the foundation for modern infrastructure. Over the decades, advancements in mining and refining technologies have enhanced copper extraction efficiency and quality.

In recent years, the focus has shifted towards sustainable practices and the circular economy, with growing emphasis on recycling and responsible sourcing. This evolution reflects the industry’s adaptation to global challenges such as climate change, resource scarcity, and ethical labor practices. For international B2B buyers, understanding this historical context can inform sourcing decisions and highlight the importance of sustainability in the copper material sector.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of copper material

-

What criteria should I use to vet suppliers of copper material?

When vetting suppliers, prioritize their industry experience, reputation, and certifications. Look for suppliers with ISO 9001 or equivalent quality management certifications. Request references from previous clients, especially those within your industry. Additionally, assess their financial stability and production capacity to ensure they can meet your demand consistently. Engaging in site visits, if possible, can provide valuable insights into their operational practices and quality control measures. -

Can I customize copper products to meet specific project requirements?

Yes, many suppliers offer customization options for copper products. This can include specific dimensions, alloy compositions, and surface finishes. When requesting customization, provide detailed specifications and tolerances to avoid miscommunication. Be aware that custom orders may require longer lead times and can impact pricing. Engaging in early discussions with suppliers about your needs will help streamline the process and ensure alignment with production capabilities. -

What are the typical minimum order quantities (MOQ) and lead times for copper materials?

Minimum order quantities for copper materials can vary significantly based on the supplier and product type. Generally, MOQs range from 100 kg to several tons. Lead times typically range from 2 to 8 weeks, depending on the complexity of the order and the supplier’s inventory. For urgent projects, communicate your timeline needs upfront to assess whether suppliers can accommodate expedited processing or smaller orders. -

What quality assurance measures should I look for in copper material suppliers?

Ensure that suppliers conduct rigorous quality assurance checks, including chemical composition analysis and mechanical testing. Request documentation of their quality control processes and certifications, such as ASTM or EN standards. Suppliers should also provide mill test certificates (MTC) that confirm the material’s properties. Regular audits and compliance with international standards can further guarantee the quality and consistency of the copper materials supplied. -

What certifications should I request when sourcing copper materials?

Key certifications to request include ISO 9001 for quality management and ISO 14001 for environmental management. Specific material certifications, such as ASTM B170 for copper wire or EN 1976 for copper alloys, are also essential. These documents assure compliance with industry standards and regulations. If your project requires adherence to local standards (e.g., CE marking in Europe), ensure the supplier can provide relevant certifications. -

How should I manage logistics when importing copper materials?

Logistics management for copper imports involves several steps. First, determine the best shipping method based on cost, speed, and volume. Work with freight forwarders experienced in handling metal materials to navigate customs regulations effectively. Ensure all shipping documentation, including invoices, packing lists, and certificates of origin, is accurate and complete. It’s also prudent to factor in insurance to protect against potential losses during transit. -

What steps should I take if a dispute arises with my copper supplier?

In the event of a dispute, start by reviewing your contract terms, including any clauses related to quality, delivery, and returns. Document all communications with the supplier regarding the issue. Engage in direct discussions to seek a resolution, aiming for a collaborative approach. If necessary, consider mediation or arbitration as outlined in your contract. Having legal counsel familiar with international trade can provide guidance on the best course of action. -

What common challenges do B2B buyers face when sourcing copper materials internationally?

Common challenges include fluctuating prices, varying quality standards, and logistical complexities. Currency volatility can impact cost calculations, while differences in regional standards may lead to compliance issues. Additionally, communication barriers can complicate negotiations. To mitigate these challenges, conduct thorough market research, establish strong relationships with multiple suppliers, and keep abreast of global market trends affecting copper pricing and availability.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for copper material

As the global demand for copper continues to rise, strategic sourcing becomes increasingly vital for international B2B buyers, especially those in Africa, South America, the Middle East, and Europe. Understanding the nuances of copper and its various alloys can significantly impact procurement decisions, ensuring alignment with project specifications and budget constraints. Key takeaways include recognizing the importance of material properties, establishing relationships with reliable suppliers, and keeping abreast of market trends to navigate price volatility effectively.

Investing in strategic sourcing not only reduces risks but also enhances supply chain efficiency and product quality. Buyers should prioritize compliance with regional standards and certifications to avoid costly delays and ensure the integrity of their projects.

Looking ahead, the copper market is poised for growth, fueled by advancements in technology and sustainability initiatives. By leveraging the insights from this guide, B2B buyers can position themselves for success in a competitive landscape. Embrace strategic sourcing today to secure your supply chain and capitalize on emerging opportunities in the copper market.