Your Ultimate Guide to Sourcing Hardware Industries

Introduction: Navigating the Global Market for hardware industries

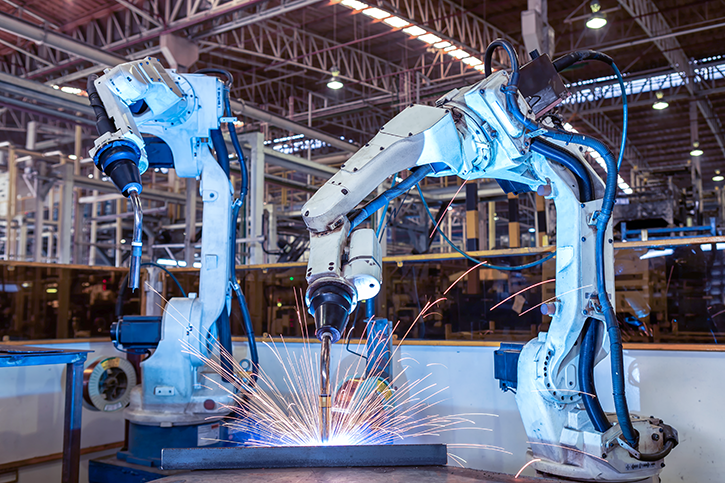

In today’s interconnected economy, the hardware industry stands as a cornerstone of global manufacturing and innovation. As international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, understanding the nuances of this sector is crucial for making informed sourcing decisions. Hardware components—ranging from fasteners and fittings to specialized machinery—are not merely functional; they underpin the quality and reliability of finished products across various industries, including construction, automotive, and consumer goods.

This comprehensive guide delves into the multifaceted landscape of the hardware industry. It covers essential topics such as types of hardware components, materials used, manufacturing processes, and quality control standards. Buyers will also gain insights into navigating the global supplier market, evaluating cost structures, and understanding market dynamics that can impact sourcing strategies.

By equipping B2B buyers with critical knowledge and actionable insights, this guide empowers businesses to enhance their sourcing effectiveness, mitigate risks, and foster strong supplier relationships. Whether you are sourcing for a large-scale manufacturing operation or a niche project, the information herein is designed to elevate your purchasing acumen and ensure that you secure the best quality hardware to meet your specific needs. Embrace the power of informed sourcing and unlock new opportunities in the global hardware marketplace.

Understanding hardware industries Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Industrial Hardware | Heavy-duty components, often customized for specific machinery | Manufacturing, construction, energy sectors | Pros: High durability, tailored solutions. Cons: Longer lead times, higher costs. |

| Consumer Hardware | Standardized products, designed for mass-market use | Retail, home improvement, electronics | Pros: Cost-effective, readily available. Cons: Limited customization options. |

| Custom Hardware | Tailored components, designed to meet unique specifications | Specialized manufacturing, bespoke projects | Pros: Meets exact specifications, enhances product uniqueness. Cons: Potentially higher costs and longer sourcing times. |

| Electronic Hardware | Components like circuit boards and connectors | Tech industry, automotive, aerospace | Pros: Essential for modern applications, wide range of options. Cons: Quality control can vary significantly. |

| Construction Hardware | Fasteners, fittings, and tools used in building projects | Construction, infrastructure, and real estate | Pros: Critical for safety and compliance, durable. Cons: Price fluctuations due to market demand. |

Industrial Hardware

Industrial hardware encompasses robust components used in heavy machinery and manufacturing processes. These products are often customized to fit specific applications, ensuring optimal performance and safety. Buyers in sectors like construction and energy must consider lead times, as customized solutions can take longer to produce. However, the durability and reliability of industrial hardware often justify the investment, as they reduce the need for frequent replacements.

Consumer Hardware

Consumer hardware refers to standardized products that cater to mass-market needs, such as tools and home improvement items. These products are typically produced in large volumes, making them readily available at competitive prices. Buyers looking for cost-effective solutions for retail or personal use will find consumer hardware advantageous. However, the trade-off is often a lack of customization, which might not meet specific design or functional requirements.

Custom Hardware

Custom hardware is designed to meet the unique specifications of a business, enabling companies to differentiate their products in the market. This type of hardware is crucial for specialized manufacturing and bespoke projects where standard components may not suffice. While the benefits of tailored solutions are significant, including enhanced product performance and aesthetic appeal, buyers should prepare for potentially higher costs and longer sourcing times, which can impact project timelines.

Electronic Hardware

Electronic hardware includes essential components such as circuit boards, connectors, and sensors that are critical in technology-driven industries. The versatility of electronic hardware allows for applications across various sectors, including automotive and aerospace. Buyers must prioritize quality control when sourcing these components, as variations in manufacturing standards can affect performance. Despite the challenges, the integration of electronic hardware is vital for developing modern solutions.

Construction Hardware

Construction hardware consists of fasteners, fittings, and tools necessary for building and infrastructure projects. This category is essential for ensuring safety and compliance in construction activities. Buyers in the real estate and infrastructure sectors should be aware of the potential for price fluctuations due to market demand. Nevertheless, the durability and critical nature of construction hardware make it a necessary investment for successful project completion.

Related Video: CS 198-126: Lecture 12 – Diffusion Models

Key Industrial Applications of hardware industries

| Industry/Sector | Specific Application of Hardware Industries | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing | Custom fasteners and fittings for machinery | Enhanced machinery performance and longevity | Quality standards, material specifications, and customization options |

| Construction | Structural hardware components (beams, brackets) | Increased safety and structural integrity of buildings | Compliance with local regulations, durability, and load-bearing capacity |

| Automotive | Specialized components for vehicle assembly | Improved vehicle performance and safety | Supplier reliability, adherence to safety standards, and delivery timelines |

| Aerospace | Precision hardware for aircraft assembly | Enhanced safety and compliance with stringent regulations | Certifications, rigorous quality control, and traceability of materials |

| Furniture | Custom hinges, locks, and handles | Unique design features and improved functionality | Design compatibility, aesthetics, and material quality |

Manufacturing

In the manufacturing sector, hardware industries provide custom fasteners and fittings that are crucial for machinery assembly and maintenance. These components not only ensure the efficient operation of machinery but also extend its lifespan. For international buyers, especially in regions like Africa and South America, understanding local material standards and sourcing high-quality components is essential. Buyers should prioritize suppliers who offer customization options to meet specific machinery requirements while ensuring compliance with international quality standards.

Construction

The construction industry heavily relies on structural hardware components such as beams and brackets, which play a vital role in ensuring the safety and integrity of buildings. These components must meet local building codes and regulations, especially in regions prone to natural disasters. For B2B buyers in Europe and the Middle East, it is crucial to partner with suppliers who can provide durable materials that can withstand environmental stresses. Thorough documentation and proof of compliance with local standards are key considerations during sourcing.

Automotive

In the automotive sector, specialized components are essential for vehicle assembly, impacting both performance and safety. Hardware industries supply items like bolts, brackets, and specialized fittings that contribute to the overall vehicle structure. International buyers need to ensure that their suppliers can meet safety and quality certifications required in their markets. Timely delivery and the ability to adapt to changing designs or specifications are also critical factors when sourcing automotive hardware.

Aerospace

The aerospace industry demands precision hardware for aircraft assembly, where safety is paramount. Components must meet strict regulatory standards and undergo rigorous testing to ensure reliability. Buyers in this sector should focus on suppliers with proven track records in aerospace manufacturing and strong quality control processes. Additionally, understanding the supply chain dynamics and ensuring traceability of materials are crucial for compliance with international aerospace standards.

Furniture

In the furniture industry, custom hardware such as hinges, locks, and handles significantly enhances product design and functionality. These components allow manufacturers to offer unique solutions that appeal to consumers seeking both aesthetics and practicality. For buyers in regions like Europe and Africa, sourcing high-quality, durable hardware that aligns with design specifications is essential. Consideration of lead times and the ability to provide tailored solutions can greatly influence supplier selection.

Related Video: Advantages and Uses of ICT devices || Applications of ICT devices || Computer Basics

Strategic Material Selection Guide for hardware industries

When selecting materials for hardware applications, international B2B buyers must consider several factors, including the properties of the materials, their suitability for specific applications, and compliance with regional standards. Below is an analysis of four common materials used in the hardware industry, focusing on their key properties, advantages, disadvantages, and specific considerations for buyers from Africa, South America, the Middle East, and Europe.

1. Steel

Key Properties:

Steel is known for its high tensile strength, durability, and resistance to deformation. It can withstand high temperatures and pressures, making it suitable for heavy-duty applications. Depending on the alloy composition, steel can also exhibit varying degrees of corrosion resistance.

Pros & Cons:

Steel’s primary advantage is its strength and versatility, making it ideal for a wide range of applications, from construction to automotive components. However, it can be prone to rusting if not properly coated or treated, which may increase maintenance costs. Additionally, manufacturing processes for steel can be complex and energy-intensive.

Impact on Application:

Steel is commonly used in structural components, fasteners, and tools. Its compatibility with various media, including water and oil, makes it suitable for many industrial applications.

Considerations for International Buyers:

Buyers should ensure compliance with standards such as ASTM (American Society for Testing and Materials) or DIN (Deutsches Institut für Normung) to guarantee quality. In regions like Africa and South America, sourcing from local suppliers can mitigate import costs and support regional economies.

2. Aluminum

Key Properties:

Aluminum is lightweight, corrosion-resistant, and has excellent thermal and electrical conductivity. Its low density allows for easy handling and installation, making it a popular choice in various industries.

Pros & Cons:

The main advantage of aluminum is its resistance to corrosion, which extends the lifespan of products. However, it is less strong than steel, which may limit its use in high-stress applications. The cost of aluminum can also be higher than that of steel, depending on market fluctuations.

Impact on Application:

Aluminum is often used in applications requiring lightweight materials, such as aerospace components, consumer electronics, and automotive parts. Its compatibility with various environmental conditions makes it a versatile choice.

Considerations for International Buyers:

Buyers should be aware of the specific grades of aluminum and their respective standards, such as JIS (Japanese Industrial Standards). In Europe, compliance with REACH regulations (Registration, Evaluation, Authorisation and Restriction of Chemicals) is crucial for sourcing aluminum products.

3. Plastic

Key Properties:

Plastics are characterized by their lightweight nature, resistance to corrosion, and versatility in molding. They can be engineered to withstand various temperatures and pressures, depending on the type of plastic used.

Pros & Cons:

Plastics offer significant advantages in terms of cost-effectiveness and ease of manufacturing. They can be molded into complex shapes, reducing the need for additional machining. However, plastics may not be suitable for high-load applications and can degrade under UV exposure unless treated.

Impact on Application:

Plastics are widely used in consumer goods, electrical housings, and automotive components where weight reduction is essential. Their chemical resistance makes them suitable for applications involving aggressive media.

Considerations for International Buyers:

Buyers should consider the environmental impact of plastic sourcing, especially in regions with strict regulations on plastic use. Compliance with ISO standards for material safety is essential, particularly in the European market.

4. Brass

Key Properties:

Brass is an alloy of copper and zinc, known for its excellent corrosion resistance, machinability, and aesthetic appeal. It has good thermal and electrical conductivity, making it suitable for various applications.

Pros & Cons:

Brass is favored for its durability and low friction properties, making it ideal for fittings and valves. However, it can be more expensive than other materials and may require more complex manufacturing processes.

Impact on Application:

Brass is commonly used in plumbing, electrical connectors, and decorative hardware due to its attractive appearance. Its compatibility with water and various chemicals enhances its application range.

Considerations for International Buyers:

Buyers should ensure compliance with local standards regarding lead content in brass, particularly in regions like Europe where regulations are stringent. Understanding the sourcing capabilities of local suppliers can also aid in cost management.

| Material | Typical Use Case for hardware industries | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Structural components, fasteners | High tensile strength | Prone to rust without treatment | Medium |

| Aluminum | Aerospace, automotive parts | Lightweight and corrosion-resistant | Less strong than steel | High |

| Plastic | Consumer goods, electrical housings | Cost-effective and versatile | Not suitable for high-load applications | Low |

| Brass | Plumbing, electrical connectors | Excellent corrosion resistance | Higher cost and complex manufacturing | Medium |

In summary, selecting the right material for hardware applications involves a careful analysis of properties, advantages, and limitations, alongside compliance with regional standards. By understanding these factors, international B2B buyers can make informed decisions that align with their specific needs and market conditions.

In-depth Look: Manufacturing Processes and Quality Assurance for hardware industries

In the hardware industry, the manufacturing processes and quality assurance (QA) protocols are critical to ensuring that products meet both performance standards and customer expectations. This section provides an in-depth look at the typical manufacturing stages, key techniques employed, and the quality assurance measures that B2B buyers, especially from Africa, South America, the Middle East, and Europe, should consider.

Manufacturing Processes in Hardware Industries

The manufacturing process for hardware typically involves several key stages, each crucial for producing high-quality components. Understanding these stages can help international buyers make informed sourcing decisions.

1. Material Preparation

The first step in manufacturing hardware components is material preparation. This stage involves:

- Selection of Raw Materials: Choosing the right materials—such as metals, plastics, or composites—based on the desired properties of the final product.

- Material Treatment: Processes like annealing or tempering to enhance the material’s characteristics, such as strength and durability.

2. Forming

Once the materials are prepared, the next stage is forming. This can involve various techniques, including:

- Casting: Pouring molten material into a mold to create a specific shape. Common in producing complex parts.

- Machining: Removing material from a solid block to create precise dimensions, often using CNC (Computer Numerical Control) machines for accuracy.

- Stamping and Forging: Using dies to shape metal sheets or forging to deform metal under high pressure, ensuring strength and resilience.

3. Assembly

After individual components are formed, the next step is assembly. This involves:

- Joining Techniques: Methods like welding, riveting, or using adhesives to connect parts securely.

- Sub-assembly: Creating smaller units that can be easily integrated into larger systems, streamlining the final assembly process.

4. Finishing

The final stage in the manufacturing process is finishing, which enhances both the aesthetics and functionality of the product. This includes:

- Surface Treatment: Processes such as plating, anodizing, or powder coating to improve corrosion resistance and appearance.

- Quality Checks: Conducting preliminary inspections to ensure that all components meet specified tolerances before packaging.

Quality Assurance (QA) in Hardware Manufacturing

Quality assurance is a vital component of the manufacturing process, ensuring that products not only meet regulatory standards but also perform reliably in the field.

Relevant International Standards

B2B buyers should be aware of various international quality standards that impact hardware manufacturing:

- ISO 9001: A widely recognized standard for quality management systems that emphasizes customer satisfaction and continual improvement.

- CE Marking: Required for products sold in the European Economic Area, indicating compliance with health, safety, and environmental protection standards.

- API Standards: Relevant for hardware used in the oil and gas industry, ensuring equipment meets specific performance criteria.

Quality Control Checkpoints

To maintain quality, manufacturers implement several quality control checkpoints throughout the production process:

- Incoming Quality Control (IQC): Inspecting materials and components upon arrival to ensure they meet specified standards.

- In-Process Quality Control (IPQC): Ongoing checks during the manufacturing process to identify defects early and minimize waste.

- Final Quality Control (FQC): Comprehensive inspection of the finished product before it is shipped, ensuring it meets all requirements.

Common Testing Methods

Testing is an integral part of quality assurance, with various methods employed, including:

- Dimensional Inspection: Verifying the physical dimensions of components against specifications.

- Functional Testing: Ensuring that the hardware performs its intended function under various conditions.

- Durability Testing: Simulating real-world conditions to assess how well a product withstands wear and tear.

Verifying Supplier Quality Control

To ensure that suppliers maintain high-quality standards, B2B buyers should adopt several verification strategies:

- Conduct Audits: Periodically auditing suppliers to evaluate their manufacturing processes and quality control systems.

- Request Quality Reports: Suppliers should provide detailed reports on quality metrics, including defect rates and compliance with standards.

- Third-Party Inspections: Engage independent inspectors to assess the quality of products before shipment, providing an unbiased evaluation of compliance with specifications.

Quality Control and Certification Nuances for International Buyers

International B2B buyers face unique challenges when sourcing hardware components, particularly regarding quality control and certification:

- Understanding Local Regulations: Buyers must familiarize themselves with the regulatory landscape in their own countries, as certification requirements may differ significantly.

- Language and Cultural Barriers: Navigating negotiations and quality assurance processes can be complicated by language differences and cultural nuances, making clear communication vital.

- Supply Chain Disruptions: Global events, such as geopolitical tensions or pandemics, can impact quality control processes. Buyers should establish contingency plans and maintain close communication with suppliers to mitigate risks.

Conclusion

In summary, understanding the manufacturing processes and quality assurance protocols in the hardware industry is essential for international B2B buyers. By focusing on material preparation, forming, assembly, and finishing, alongside rigorous quality control measures, buyers can ensure they source high-quality components that meet their needs. Leveraging international standards and verification strategies will further enhance the reliability of their supply chain, ultimately contributing to their business success.

Related Video: Top 5 Mass Production Techniques: Manufacturing Process

Comprehensive Cost and Pricing Analysis for hardware industries Sourcing

Understanding the cost structure and pricing dynamics in the hardware industry is crucial for international B2B buyers, especially those from diverse regions such as Africa, South America, the Middle East, and Europe. By dissecting the cost components and price influencers, buyers can make informed decisions that align with their business strategies.

Cost Components

-

Materials: The quality and type of materials significantly influence costs. For instance, sourcing raw materials like steel or aluminum may vary based on global market prices, regional availability, and import tariffs. Buyers should consider local sourcing options to mitigate costs.

-

Labor: Labor costs can vary widely depending on the region. For example, manufacturing in countries with lower labor costs may offer significant savings, but it’s essential to assess the quality and skill level of the workforce to avoid compromising product standards.

-

Manufacturing Overhead: This includes costs related to factory operations such as utilities, equipment maintenance, and administrative expenses. Understanding the overhead rates of potential suppliers can provide insights into their pricing strategies.

-

Tooling: Initial tooling costs for custom parts can be significant. Buyers should evaluate whether the tooling costs are amortized over larger order volumes, which can reduce per-unit costs.

-

Quality Control (QC): Investing in robust QC processes ensures that products meet specifications, which can prevent costly reworks and returns. Buyers should inquire about a supplier’s QC practices to assess their reliability.

-

Logistics: Shipping and handling costs can add considerable expenses, especially for international transactions. Consideration of Incoterms (International Commercial Terms) is crucial, as they define the responsibilities of buyers and sellers in the shipping process.

-

Margin: Supplier margins can vary based on competition, market demand, and the uniqueness of the products. Understanding the typical margin expectations in your target market can help in negotiations.

Price Influencers

-

Volume/MOQ (Minimum Order Quantity): Larger orders often lead to lower per-unit costs due to economies of scale. Buyers should negotiate MOQs that balance inventory needs with cost efficiency.

-

Specifications/Customization: Customized products generally come with higher costs due to additional design and manufacturing complexities. Clear communication of requirements can help manage these costs.

-

Materials: The choice of materials not only affects the price but also impacts the final product’s durability and performance. Buyers should consider the long-term benefits of higher-quality materials versus the initial cost.

-

Quality and Certifications: Products that meet specific industry standards or certifications may command higher prices. However, these certifications often lead to greater reliability and customer trust.

-

Supplier Factors: The reputation and reliability of suppliers can influence pricing. Established suppliers may charge a premium for their experience and proven track record.

-

Incoterms: The choice of Incoterms affects logistics costs and responsibilities. Buyers should select terms that minimize their exposure to unexpected costs and delays.

Buyer Tips

-

Negotiation: Always negotiate prices and terms. Understanding the supplier’s cost structure can provide leverage in discussions, allowing for better deals.

-

Cost-Efficiency: Look beyond the initial price. Consider the Total Cost of Ownership (TCO), which includes purchase price, operational costs, and potential savings from quality improvements.

-

Pricing Nuances: Be aware of regional pricing differences. For example, suppliers in Europe may have different pricing strategies compared to those in Africa or South America due to varying economic conditions and demand levels.

-

Cultural Sensitivity: When sourcing internationally, understanding cultural nuances can aid in building relationships and facilitating smoother negotiations.

Disclaimer

Prices and cost structures are indicative and can vary significantly based on market conditions, supplier negotiations, and specific buyer requirements. Always conduct thorough due diligence and consider obtaining multiple quotes to ensure competitive pricing.

Spotlight on Potential hardware industries Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘hardware industries’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for hardware industries

Understanding the technical properties and terminology in the hardware industry is crucial for international B2B buyers to make informed purchasing decisions. Below, we outline essential specifications and common trade terms that can significantly impact sourcing and procurement processes.

Illustrative Image (Source: Google Search)

Key Technical Properties

-

Material Grade

– Definition: Material grade refers to the classification of materials based on their mechanical and physical properties, such as strength, ductility, and corrosion resistance.

– B2B Importance: Selecting the right material grade is critical for ensuring product durability and performance. For instance, using stainless steel for components exposed to moisture can prevent rust and prolong lifespan, reducing long-term costs. -

Tolerance

– Definition: Tolerance indicates the allowable variation in a physical dimension of a component. It is typically expressed in terms of a range (e.g., ±0.01 mm).

– B2B Importance: Precise tolerances are essential for ensuring that parts fit together correctly in assemblies. Poor tolerance can lead to malfunctions and increased manufacturing costs due to rework or scrap. -

Finish

– Definition: Finish refers to the surface treatment of a component, which can include processes like polishing, coating, or anodizing.

– B2B Importance: The finish affects both aesthetics and functionality. For example, a powder-coated finish may enhance corrosion resistance, making it ideal for outdoor applications, while a polished finish may be necessary for aesthetic components in consumer products. -

Load Capacity

– Definition: Load capacity is the maximum load a component can safely bear without failure.

– B2B Importance: Understanding load capacity is crucial for safety and reliability in applications such as construction or machinery. Choosing components with inadequate load capacity can lead to catastrophic failures and liability issues. -

Lifecycle Cost

– Definition: Lifecycle cost encompasses all costs associated with a product from acquisition through disposal, including maintenance and operational costs.

– B2B Importance: Evaluating lifecycle costs helps businesses understand the total investment required for a component, enabling better budgeting and financial planning.

Common Trade Terms

-

OEM (Original Equipment Manufacturer)

– Definition: An OEM is a company that produces parts or equipment that may be marketed by another manufacturer.

– B2B Importance: Understanding OEM relationships is vital for buyers seeking high-quality, reliable components that are compatible with existing systems. -

MOQ (Minimum Order Quantity)

– Definition: MOQ refers to the smallest quantity of a product that a supplier is willing to sell.

– B2B Importance: Knowing the MOQ is essential for budgeting and inventory management. Buyers must ensure they can meet the MOQ without overcommitting resources. -

RFQ (Request for Quotation)

– Definition: An RFQ is a document issued by a buyer to solicit price quotes from suppliers for specific products or services.

– B2B Importance: RFQs help buyers compare pricing and terms from multiple suppliers, enabling informed decision-making and cost savings. -

Incoterms (International Commercial Terms)

– Definition: Incoterms are a set of predefined international trade terms published by the International Chamber of Commerce (ICC) that define the responsibilities of buyers and sellers.

– B2B Importance: Familiarity with Incoterms is crucial for managing shipping costs, delivery timelines, and risk allocation. For instance, “FOB (Free on Board)” indicates that the seller is responsible for the goods until they are loaded onto a shipping vessel. -

Lead Time

– Definition: Lead time is the time taken from the initiation of a process until its completion, particularly in manufacturing and delivery.

– B2B Importance: Understanding lead times helps buyers plan their inventory and production schedules effectively. Long lead times can disrupt operations, so buyers must account for this in their procurement strategies.

Illustrative Image (Source: Google Search)

By mastering these technical properties and trade terms, B2B buyers can enhance their sourcing strategies, negotiate more effectively, and ultimately secure better deals that align with their operational needs.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hardware industries Sector

Market Overview & Key Trends

The global hardware industry is undergoing transformative changes driven by technological advancements, evolving consumer preferences, and geopolitical factors. Digital transformation is reshaping how businesses source and manage their supply chains. Tools such as artificial intelligence and machine learning are increasingly utilized for predictive analytics, enabling buyers to make informed decisions based on real-time data. Additionally, the rise of e-commerce platforms facilitates easier access to suppliers, particularly for international buyers from regions like Africa, South America, the Middle East, and Europe, enhancing market reach and reducing barriers to entry.

Emerging sourcing trends include a shift towards custom sourcing solutions, where companies seek tailored hardware components to differentiate their products. This trend is particularly pronounced among manufacturers in furniture and construction sectors, where unique designs are crucial for competitive advantage. Moreover, supply chain resilience is a key focus, with businesses diversifying their supplier bases to mitigate risks associated with geopolitical tensions and natural disasters. As international buyers navigate these dynamics, understanding local market conditions and regulatory environments becomes essential for effective sourcing strategies.

Sustainability & Ethical Sourcing in B2B

In the context of the hardware industry, sustainability is not just a buzzword; it has become a critical factor influencing purchasing decisions. The environmental impact of hardware production, including resource depletion and pollution, necessitates a shift towards sustainable practices. B2B buyers are increasingly prioritizing suppliers who demonstrate a commitment to ethical sourcing and sustainable manufacturing processes. This includes using recycled materials, minimizing waste, and ensuring energy-efficient production methods.

Additionally, certifications such as FSC (Forest Stewardship Council) for wood products and ISO 14001 for environmental management systems are becoming essential criteria for supplier evaluation. These certifications not only enhance a company’s reputation but also align with the growing demand from consumers and businesses alike for responsible sourcing practices. By partnering with suppliers who prioritize sustainability, international B2B buyers can contribute to a more environmentally friendly industry while also meeting regulatory requirements and consumer expectations.

Brief Evolution/History

Historically, the hardware industry has evolved from a predominantly local market to a globalized sector characterized by complex supply chains. The advent of the Industrial Revolution marked a significant turning point, introducing mechanization and mass production techniques. Over the years, technological innovations such as computer-aided design (CAD) and automated manufacturing processes have further streamlined production.

In recent decades, the rise of global trade agreements and advancements in logistics have facilitated international sourcing, allowing businesses to tap into diverse markets for hardware components. This evolution underscores the importance of adaptability and strategic sourcing as key drivers for success in the contemporary hardware landscape, particularly for international B2B buyers looking to navigate an increasingly competitive environment.

Related Video: Global value chains: The production revolution of the 21st century

Frequently Asked Questions (FAQs) for B2B Buyers of hardware industries

-

How can I effectively vet suppliers in the hardware industry?

Vetting suppliers is crucial for ensuring quality and reliability. Start by researching their background, including years of operation, customer reviews, and industry certifications. Request references and visit their facilities if possible. Evaluate their production capabilities and quality control processes. Additionally, consider their responsiveness and willingness to provide detailed information. Utilizing third-party verification services can also help assess their legitimacy and compliance with international standards. -

What options are available for customizing hardware components?

Customization options vary by supplier but typically include tailored designs, materials, and specifications to meet your unique requirements. Engage with suppliers early in the sourcing process to discuss your needs, such as specific measurements, finishes, or functionalities. It’s beneficial to share prototypes or detailed drawings to ensure clarity. Suppliers with experience in custom sourcing can also advise on feasible modifications and lead times. -

What are the common minimum order quantities (MOQs) and lead times in hardware sourcing?

MOQs can vary widely based on the supplier and the type of hardware. Typically, they range from a few dozen to several thousand units. Lead times also depend on factors such as production schedules and shipping logistics, generally ranging from 4 to 12 weeks. Discuss these factors upfront with potential suppliers to align your expectations and plan your inventory accordingly. Understanding these parameters will help avoid production delays. -

What quality assurance certifications should I look for in hardware suppliers?

Look for suppliers with recognized quality certifications, such as ISO 9001 for quality management systems, ISO 14001 for environmental management, and specific industry-related certifications. These certifications indicate a commitment to maintaining high standards in production and quality control. Request documentation of these certifications and inquire about their quality assurance processes, including testing methods and defect rates. -

How can I ensure smooth logistics when sourcing hardware internationally?

To ensure smooth logistics, collaborate with suppliers who have established logistics networks and experience in international shipping. Discuss shipping terms (Incoterms), customs documentation, and delivery timelines upfront. Utilize freight forwarders to navigate complex shipping processes and mitigate risks. Additionally, keep an open line of communication with suppliers to address any logistical challenges as they arise. -

What should I do if a dispute arises with a supplier?

In the event of a dispute, start by reviewing the contract terms to understand your rights and obligations. Communicate directly with the supplier to resolve the issue amicably, providing evidence and documentation to support your position. If informal discussions fail, consider mediation or arbitration as alternative dispute resolution methods. Ensure that your contracts include clear terms regarding dispute resolution to facilitate a smoother process. -

What payment options are typically available, and what are the risks associated with them?

Common payment options include letters of credit, wire transfers, and payment platforms like PayPal. Each method has its risks; for instance, wire transfers offer speed but lack buyer protection, while letters of credit provide security but can be complex and costly. Assess your comfort level with each option and consider using escrow services for large transactions to protect your interests. -

How can I stay updated on market trends and supplier reliability in the hardware industry?

Staying informed requires regular engagement with industry publications, trade shows, and networking events. Subscribe to newsletters from reputable sources and join industry associations to access valuable insights. Utilize platforms like LinkedIn to connect with industry professionals and gather feedback on supplier performance. Regularly reviewing supplier performance metrics and customer feedback can also help you make informed sourcing decisions.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for hardware industries

In the rapidly evolving landscape of the hardware industry, strategic sourcing emerges as a crucial driver for success. International B2B buyers, particularly from Africa, South America, the Middle East, and Europe, must recognize the importance of sourcing high-quality components tailored to their unique needs. Leveraging custom sourcing solutions enables businesses to enhance product offerings while maintaining competitive pricing and quality standards.

Key takeaways include the necessity of building robust supplier relationships, implementing rigorous quality control measures, and navigating the complexities of global logistics. By prioritizing these elements, companies can mitigate risks associated with supply chain disruptions and ensure timely delivery of essential hardware components.

Looking ahead, businesses that embrace strategic sourcing will be better positioned to capitalize on emerging market opportunities and innovations. As the demand for customized and sustainable hardware solutions continues to grow, now is the time for international buyers to invest in strategic partnerships that align with their vision for future success. Take action today to explore tailored sourcing options and elevate your competitive edge in the hardware industry.