Your Ultimate Guide to Sourcing Hardware Manufacturers

Introduction: Navigating the Global Market for hardware manufacturers

In today’s interconnected world, hardware manufacturers play a pivotal role in driving innovation and efficiency across various industries. As businesses increasingly rely on advanced technologies, understanding the landscape of hardware manufacturing becomes essential for international B2B buyers. This guide serves as a comprehensive resource, tailored to empower decision-makers from Africa, South America, the Middle East, and Europe, including key markets such as France and Indonesia.

Navigating the global market requires insight into diverse hardware types, ranging from consumer electronics to industrial components. This guide delves into crucial aspects such as materials used in manufacturing, quality control processes, and the dynamics of supplier relationships. With fluctuating costs and evolving market trends, being well-informed is vital for optimizing procurement strategies and minimizing operational disruptions.

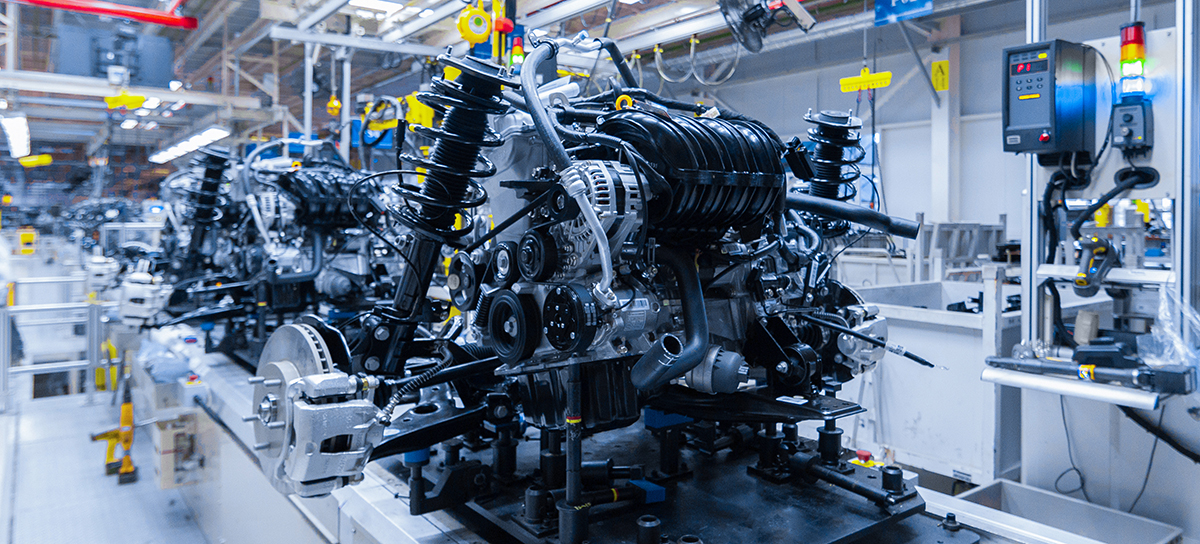

Illustrative Image (Source: Google Search)

By exploring frequently asked questions and providing actionable insights, this guide equips B2B buyers with the knowledge necessary for informed sourcing decisions. Whether you are looking to enhance supplier partnerships, streamline your procurement process, or understand the implications of global supply chains, this resource offers a roadmap to success in hardware procurement. Embrace the opportunity to transform your sourcing approach and secure the best hardware solutions for your business needs.

Understanding hardware manufacturers Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Produces components that are used in another company’s end products. | Consumer electronics, automotive, computing | Pros: High-quality components; reliable. Cons: Potentially higher costs; less customization. |

| ODM (Original Design Manufacturer) | Designs and manufactures products based on another company’s specifications. | Electronics, appliances, machinery | Pros: Custom designs; lower costs. Cons: Longer lead times; potential quality variability. |

| CEM (Contract Electronics Manufacturer) | Provides manufacturing services to design, build, and deliver products for other companies. | Telecommunications, industrial equipment | Pros: Flexible production; scalability. Cons: Dependency on CEM for quality control; communication challenges. |

| Component Suppliers | Supplies individual parts that are integrated into larger systems. | Various industries, including automotive and aerospace | Pros: Specialized products; often lower costs. Cons: Requires integration expertise; may lack support. |

| Value-Added Resellers (VARs) | Resells hardware with additional services like installation and support. | IT infrastructure, networking | Pros: Comprehensive solutions; ongoing support. Cons: Higher overall costs; may not offer the latest tech. |

OEM (Original Equipment Manufacturer)

OEMs are pivotal in the hardware manufacturing landscape, producing components that are integral to the final products of other companies. These manufacturers are characterized by their ability to deliver high-quality components that meet rigorous industry standards. For B2B buyers, selecting an OEM often means investing in reliability and quality assurance, although this can come at a premium price. Buyers should consider their budget and the level of customization required, as OEMs typically offer limited options for personalization.

ODM (Original Design Manufacturer)

ODMs specialize in both the design and manufacturing of products, often creating items based on the specifications provided by another company. This model is particularly beneficial for businesses looking to bring custom products to market without the overhead of design and production facilities. While ODMs can offer lower costs due to their integrated services, B2B buyers should be aware of the potential for longer lead times and variability in quality. Ensuring robust communication and quality checks is essential when engaging with an ODM.

CEM (Contract Electronics Manufacturer)

CEMs provide a flexible manufacturing solution, offering a range of services from design to production. They are especially valuable for companies needing to scale production quickly or those with fluctuating demand. While CEMs can enhance efficiency and reduce costs, B2B buyers must consider the potential risks associated with quality control and the importance of clear communication. Establishing a strong partnership with a CEM can mitigate these risks and lead to successful outcomes.

Component Suppliers

These manufacturers focus on producing individual parts that other companies integrate into larger systems. They are crucial in industries such as automotive and aerospace, where specialized components are necessary. B2B buyers benefit from the specialized nature of component suppliers, often finding lower costs for high-quality parts. However, integrating these components requires expertise and may lack the support services offered by larger manufacturers. Buyers should assess their in-house capabilities before engaging with component suppliers.

Value-Added Resellers (VARs)

VARs enhance the hardware procurement process by reselling products along with additional services such as installation, maintenance, and support. This model is particularly advantageous for businesses seeking comprehensive IT infrastructure solutions. While VARs provide the convenience of a single point of contact for hardware and services, buyers should be mindful of potentially higher costs and the risk of not having access to the latest technology. Evaluating the total cost of ownership and the specific needs of the organization is crucial when considering VARs.

Related Video: CS 198-126: Lecture 12 – Diffusion Models

Key Industrial Applications of hardware manufacturers

| Industry/Sector | Specific Application of Hardware Manufacturers | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing | Industrial Machinery Components | Enhanced operational efficiency and reduced downtime. | Quality assurance, supplier reliability, and lead times. |

| Healthcare | Medical Equipment and Devices | Improved patient care and compliance with health regulations. | Certifications, maintenance support, and compatibility. |

| Information Technology | Networking and Server Hardware | Robust data management and cybersecurity. | Scalability, vendor support, and warranty terms. |

| Construction | Heavy Equipment and Tools | Increased productivity and reduced project timelines. | Equipment durability, after-sales service, and financing options. |

| Energy | Power Generation Equipment | Enhanced energy efficiency and reduced operational costs. | Technological innovation, compliance with regulations, and sourcing local suppliers. |

Manufacturing

In the manufacturing sector, hardware manufacturers provide critical components for industrial machinery. These components are essential for maintaining operational efficiency and minimizing downtime. International B2B buyers must consider factors such as quality assurance and supplier reliability, as any failure in machinery can lead to significant production losses. Moreover, understanding lead times is crucial to ensure that machinery is operational without unnecessary delays.

Healthcare

In healthcare, hardware manufacturers supply vital medical equipment and devices, which are essential for delivering high-quality patient care. The reliability of these devices is paramount, as they must comply with stringent health regulations. Buyers from international markets should prioritize suppliers with appropriate certifications and a proven track record in maintenance support to ensure continuous operation. Compatibility with existing systems is also a key consideration to avoid integration issues.

Information Technology

The IT sector relies heavily on hardware manufacturers for networking and server hardware. This equipment is crucial for robust data management and cybersecurity measures. For international buyers, scalability is a significant factor, as businesses often require solutions that can grow with their needs. Vendor support and warranty terms are also essential, as they ensure that any issues can be resolved quickly to maintain business continuity.

Construction

In the construction industry, hardware manufacturers provide heavy equipment and tools that are vital for project execution. These tools enhance productivity and can significantly reduce project timelines, making them invaluable for contractors. Buyers should focus on equipment durability to withstand harsh working conditions and consider after-sales service to address any issues that may arise post-purchase. Additionally, financing options can be a determining factor for many construction firms.

Energy

The energy sector benefits from advanced power generation equipment provided by hardware manufacturers. This equipment is designed to enhance energy efficiency and reduce operational costs, which is critical in a sector facing increasing regulatory pressures. Buyers should look for technological innovations that comply with local regulations and consider sourcing from local suppliers to reduce logistics costs and support regional economies.

Related Video: What is a Pneumatic Actuator? | Types & Applications

Strategic Material Selection Guide for hardware manufacturers

When selecting materials for hardware manufacturing, international B2B buyers must consider various factors that impact product performance, durability, and compliance. This section analyzes four common materials used in hardware manufacturing, focusing on their properties, advantages, disadvantages, and implications for global buyers, particularly from Africa, South America, the Middle East, and Europe.

1. Steel

Key Properties:

Steel is known for its high tensile strength and durability, making it suitable for applications requiring structural integrity. It can withstand high temperatures and pressures, and its corrosion resistance can be enhanced through galvanization or alloying.

Pros & Cons:

Steel’s primary advantage is its strength and versatility, making it ideal for a wide range of applications, from machinery to structural components. However, it can be heavy and may require additional processing to prevent corrosion, which can increase manufacturing complexity and cost.

Impact on Application:

Steel is often used in environments where mechanical stress is high, such as in construction equipment and automotive parts. Its compatibility with various media, including water and oils, makes it a reliable choice for many applications.

Considerations for International Buyers:

Steel must comply with local and international standards such as ASTM (American Society for Testing and Materials) or DIN (Deutsches Institut für Normung). Buyers should also consider the availability of specific grades and the implications of tariffs or trade agreements in their regions.

2. Aluminum

Key Properties:

Aluminum is lightweight, corrosion-resistant, and has excellent thermal and electrical conductivity. It can be easily shaped and formed, making it suitable for various manufacturing processes.

Pros & Cons:

The main advantage of aluminum is its low weight, which can lead to reduced shipping costs and improved energy efficiency in applications like transportation. However, it has lower tensile strength compared to steel and may be more expensive, especially for high-grade alloys.

Impact on Application:

Aluminum is commonly used in aerospace, automotive, and consumer electronics due to its lightweight nature and resistance to corrosion. It is particularly effective in applications requiring heat dissipation, such as heat sinks.

Considerations for International Buyers:

Buyers should be aware of the specific aluminum grades and their compliance with standards such as JIS (Japanese Industrial Standards). Additionally, understanding the recycling capabilities and environmental regulations in their regions can influence material selection.

3. Plastic

Key Properties:

Plastics are versatile materials that can be engineered to exhibit various properties, including flexibility, impact resistance, and chemical resistance. They can be molded into complex shapes, which is advantageous for manufacturing.

Pros & Cons:

The primary advantage of plastics is their lightweight nature and cost-effectiveness, making them suitable for mass production. However, they may have lower thermal stability and can degrade under UV exposure, limiting their use in certain environments.

Impact on Application:

Plastics are widely used in consumer electronics, automotive components, and packaging due to their adaptability. They are compatible with a variety of chemicals, but buyers must consider the specific type of plastic for their intended application.

Considerations for International Buyers:

Compliance with environmental regulations, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, is crucial. Buyers should also evaluate the sustainability of plastic materials, including recycling options and the use of bioplastics.

4. Copper

Key Properties:

Copper is known for its excellent electrical and thermal conductivity, making it a preferred choice for electrical components and heat exchangers. It also has good corrosion resistance, particularly in non-oxidizing environments.

Pros & Cons:

The key advantage of copper is its superior conductivity, which is essential for electrical applications. However, it is relatively expensive compared to other materials and can be prone to corrosion in certain environments.

Impact on Application:

Copper is predominantly used in electrical wiring, connectors, and plumbing. Its compatibility with various media, such as water and gases, makes it suitable for a range of applications in both industrial and commercial settings.

Considerations for International Buyers:

Copper must meet specific standards, such as ASTM B170 for electrical applications. Buyers should also consider the geopolitical factors affecting copper prices and availability, especially in regions with fluctuating supply chains.

Summary Table

| Material | Typical Use Case for hardware manufacturers | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Structural components, machinery | High strength and durability | Heavy and corrosion-prone | Medium |

| Aluminum | Aerospace, automotive, electronics | Lightweight and corrosion-resistant | Lower tensile strength | High |

| Plastic | Consumer electronics, packaging | Cost-effective and versatile | Lower thermal stability | Low |

| Copper | Electrical wiring, plumbing | Excellent conductivity | Expensive and corrosion-prone | High |

This guide provides a comprehensive overview of material selection considerations for hardware manufacturers, enabling international B2B buyers to make informed decisions that align with their operational needs and compliance requirements.

In-depth Look: Manufacturing Processes and Quality Assurance for hardware manufacturers

Manufacturing Processes for Hardware Manufacturers

Understanding the manufacturing processes involved in hardware production is essential for B2B buyers, particularly those sourcing from diverse regions like Africa, South America, the Middle East, and Europe. Hardware manufacturing typically consists of several key stages, each employing various techniques and technologies to ensure the final product meets quality and performance standards.

Main Stages of Manufacturing

-

Material Preparation

– This initial stage involves selecting and preparing raw materials, which may include metals, plastics, and electronic components. Materials must be sourced from reputable suppliers to guarantee quality.

– Key Techniques: Cutting, shaping, and conditioning of materials using processes such as laser cutting, CNC machining, and extrusion. -

Forming

– Forming transforms raw materials into specific shapes and sizes required for the final product. Techniques used can vary widely based on the material and product type.

– Key Techniques:- Stamping: Commonly used for metal components, where sheets of metal are shaped using dies.

- Injection Molding: Essential for producing plastic parts, where molten plastic is injected into molds.

- Casting: Used for metals, where liquid metal is poured into molds and allowed to solidify.

-

Assembly

– This stage involves putting together various components to create the finished product. It can be manual or automated, depending on the scale of production.

– Key Techniques:- Manual Assembly: Skilled workers assemble components, which is common in low-volume production.

- Automated Assembly: Robotic systems are employed for high-volume production, ensuring speed and consistency.

-

Finishing

– The final stage focuses on enhancing the appearance and performance of the product. This may include processes like painting, plating, and polishing.

– Key Techniques:- Surface Treatment: Techniques such as anodizing for metals and powder coating for plastics improve durability and aesthetics.

- Quality Finishing: Ensures that the product meets specific standards before it is shipped to customers.

Quality Assurance in Hardware Manufacturing

Quality assurance (QA) is a critical component of hardware manufacturing, ensuring that products meet industry standards and customer expectations. For B2B buyers, understanding the QA process and relevant standards is vital for making informed purchasing decisions.

International Standards and Certifications

-

ISO 9001

– The most recognized quality management standard globally, ISO 9001 ensures that organizations meet customer and regulatory requirements consistently. It focuses on continuous improvement and customer satisfaction. -

Industry-Specific Standards

– Depending on the hardware being manufactured, additional certifications may apply:- CE Marking: Indicates compliance with European health, safety, and environmental protection standards.

- API Standards: Relevant for manufacturers in the oil and gas industry, ensuring quality and reliability in products.

Quality Control Checkpoints

Quality control (QC) is performed at various stages of the manufacturing process to identify and rectify issues before they escalate. Key checkpoints include:

-

Incoming Quality Control (IQC)

– Raw materials and components are inspected upon arrival to verify their compliance with specifications. -

In-Process Quality Control (IPQC)

– Ongoing inspections during manufacturing ensure that processes are adhered to and that defects are caught early. -

Final Quality Control (FQC)

– The finished product undergoes thorough testing and inspection to confirm it meets all required standards before shipping.

Common Testing Methods

- Functional Testing: Ensures that the hardware performs as intended under various conditions.

- Environmental Testing: Assesses the product’s durability against environmental factors like temperature, humidity, and vibration.

- Safety Testing: Confirms that the product meets safety standards to prevent hazards during use.

Verifying Supplier Quality Control

For international B2B buyers, verifying a supplier’s quality assurance practices is crucial to ensure reliable partnerships. Here are actionable steps:

-

Supplier Audits

– Conducting on-site audits helps assess the supplier’s manufacturing processes and quality control systems. This provides firsthand insight into their operations. -

Quality Assurance Reports

– Request regular QC reports that detail inspection results, testing methods, and compliance with relevant standards. This documentation is essential for transparency. -

Third-Party Inspections

– Engaging third-party inspection services can provide an unbiased evaluation of the supplier’s quality practices. This is particularly important when sourcing from regions with varying compliance levels.

Navigating Quality Control Nuances for International Buyers

B2B buyers from diverse regions must be aware of the nuances in quality control that can affect their procurement processes:

- Cultural Differences: Understanding cultural attitudes towards quality and compliance can help foster better relationships with suppliers.

- Regulatory Compliance: Different regions may have varying regulations regarding product standards. Buyers should ensure that suppliers are well-versed in these requirements.

- Logistics and Supply Chain: Delays and issues can arise in international shipping, affecting product quality. Establishing clear communication and expectations with suppliers can mitigate these risks.

Conclusion

For B2B buyers in Africa, South America, the Middle East, and Europe, understanding the manufacturing processes and quality assurance measures in hardware production is essential for making informed purchasing decisions. By focusing on reliable suppliers who adhere to international standards and maintaining rigorous quality control practices, buyers can ensure they receive high-quality products that meet their needs.

Related Video: Mercedes C-Class CAR FACTORY – HOW IT’S MADE Assembly Production Line Manufacturing Making of

Comprehensive Cost and Pricing Analysis for hardware manufacturers Sourcing

When sourcing hardware from manufacturers, understanding the cost structure and pricing dynamics is crucial for international B2B buyers. The following analysis breaks down the main cost components, price influencers, and offers actionable insights for buyers, particularly those from Africa, South America, the Middle East, and Europe.

Cost Components

-

Materials: The cost of raw materials is often the largest portion of the total cost. Prices can fluctuate based on market demand, availability, and geopolitical factors. Buyers should consider sourcing from regions with stable material supplies to mitigate risks.

-

Labor: Labor costs vary significantly across regions. For instance, manufacturing in Asia might offer lower labor rates compared to Europe or North America. Understanding local labor laws and wage standards is essential for accurate cost estimation.

-

Manufacturing Overhead: This includes expenses related to utilities, rent, equipment maintenance, and administrative costs. Efficient factories often have lower overheads, so evaluating a manufacturer’s operational efficiency can provide insights into their pricing.

-

Tooling: Initial setup costs for specialized tooling can be substantial. Buyers should inquire about tooling fees, especially for custom orders, as these can impact the overall price significantly.

-

Quality Control (QC): Ensuring product quality through rigorous QC processes can add to the cost. Manufacturers with certifications (e.g., ISO) may charge higher prices but can provide assurance regarding product quality.

-

Logistics: Transportation costs, including shipping and customs duties, can dramatically affect the final price. Understanding Incoterms and choosing the right shipping method can help manage these costs effectively.

-

Margin: Manufacturers will add a profit margin on top of their costs. This margin can vary widely based on the manufacturer’s market position, brand reputation, and the competitive landscape.

Price Influencers

-

Volume/MOQ (Minimum Order Quantity): Larger orders often attract discounts. Buyers should evaluate their needs and consider consolidating orders to take advantage of bulk pricing.

-

Specifications/Customization: Customized products typically come at a premium. When possible, standardizing specifications can lead to cost savings.

-

Materials and Quality/Certifications: Higher quality materials and certifications can increase costs. However, investing in quality can reduce long-term operational costs due to fewer failures and replacements.

-

Supplier Factors: Strong relationships with suppliers can lead to better pricing and terms. Engaging in long-term contracts or partnerships may provide leverage in negotiations.

-

Incoterms: Understanding the implications of various Incoterms (e.g., FOB, CIF) is crucial for cost management. Different terms affect who bears the cost and risk during transport, impacting the overall price.

Buyer Tips

-

Negotiation: Always negotiate pricing and terms. Use market research to inform discussions and be prepared to walk away if the terms do not meet your budgetary constraints.

-

Cost-Efficiency: Focus on the Total Cost of Ownership (TCO), which includes purchase price, maintenance, and operational costs. Sometimes, a higher upfront cost can result in lower TCO if the product is more durable or efficient.

-

Pricing Nuances: Be aware that international buyers may face additional costs such as tariffs and taxes. Understanding local regulations and market conditions can help in budgeting accurately.

-

Local Insight: Leverage local market insights, especially in emerging markets in Africa and South America, where cost structures and supplier reliability can vary greatly.

Disclaimer

The prices and cost structures discussed herein are indicative and can fluctuate based on market conditions, regional factors, and specific agreements with manufacturers. Buyers are encouraged to conduct thorough market research and consult with multiple suppliers to obtain accurate pricing.

Spotlight on Potential hardware manufacturers Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘hardware manufacturers’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for hardware manufacturers

When engaging with hardware manufacturers, understanding essential technical properties and industry terminology can significantly enhance your procurement process. Below are critical specifications and trade terms that every international B2B buyer should be familiar with.

Key Technical Properties

-

Material Grade

– Definition: Material grade refers to the classification of materials based on their physical and chemical properties. Common grades include stainless steel, aluminum, and plastic composites.

– Importance: Selecting the appropriate material grade is crucial for ensuring product durability, performance, and compliance with industry standards. For example, using a higher-grade steel can improve a product’s resistance to corrosion and wear. -

Tolerance

– Definition: Tolerance specifies the allowable deviation in dimensions during manufacturing. It can be expressed as a range (e.g., ±0.01 mm) or as a percentage.

– Importance: Tolerances are vital for ensuring that parts fit together correctly in assemblies. Inaccurate tolerances can lead to assembly issues, increased waste, and higher costs. Understanding tolerances allows buyers to specify their needs clearly and avoid potential production delays. -

Finish

– Definition: Finish refers to the surface treatment of a product, which can include processes like polishing, anodizing, or coating.

– Importance: The finish affects not only the aesthetic appeal but also the functional performance of the hardware, such as resistance to corrosion and friction. Buyers should specify the required finish to ensure the hardware meets both functional and aesthetic requirements. -

Load Capacity

– Definition: Load capacity indicates the maximum load a hardware component can support without failure.

– Importance: Understanding load capacity is essential for ensuring that the hardware will perform adequately under expected operational conditions. This is particularly crucial in industries like construction and manufacturing, where equipment must meet strict safety standards. -

Compatibility

– Definition: Compatibility refers to the ability of hardware components to work together effectively, including factors like electrical specifications and physical dimensions.

– Importance: Ensuring compatibility reduces the risk of operational failures and enhances the efficiency of hardware systems. Buyers should assess compatibility during the procurement process to avoid costly modifications or replacements.

Common Trade Terms

-

OEM (Original Equipment Manufacturer)

– Definition: An OEM is a company that produces parts or equipment that may be marketed by another manufacturer.

– Importance: Understanding the distinction between OEM and aftermarket parts is crucial for buyers who need reliable components that meet original specifications. -

MOQ (Minimum Order Quantity)

– Definition: MOQ refers to the smallest quantity of a product that a supplier is willing to sell.

– Importance: Knowing the MOQ can help buyers plan their purchases and manage inventory effectively. Buyers should negotiate MOQs that align with their operational needs to avoid excess inventory costs. -

RFQ (Request for Quotation)

– Definition: An RFQ is a document sent to suppliers requesting a price quote for specific products or services.

– Importance: Utilizing RFQs can streamline the procurement process by providing a structured way to compare pricing and terms from multiple suppliers, enabling better decision-making. -

Incoterms (International Commercial Terms)

– Definition: Incoterms are a set of predefined international trade terms that clarify the responsibilities of buyers and sellers regarding shipping, insurance, and tariffs.

– Importance: Familiarity with Incoterms helps buyers understand their obligations and risks in international transactions, leading to more informed negotiations and smoother logistics. -

Lead Time

– Definition: Lead time is the amount of time it takes from placing an order until the product is delivered.

– Importance: Understanding lead times is essential for planning and managing supply chains effectively. Buyers should account for lead times when placing orders to avoid delays in project timelines.

By grasping these technical properties and trade terms, B2B buyers can enhance their negotiation strategies, ensure compliance with specifications, and ultimately make more informed purchasing decisions in the hardware manufacturing sector.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the hardware manufacturers Sector

Market Overview & Key Trends

The hardware manufacturing sector is experiencing transformative shifts driven by technological advancements, global supply chain dynamics, and evolving consumer demands. International B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, should be aware of several key trends shaping the market.

1. Digital Transformation: Businesses are increasingly investing in IT hardware to support their digital transformation initiatives. Companies are not only upgrading their existing systems but also adopting cloud-based solutions, which require a robust hardware backbone. This trend highlights the necessity for buyers to align procurement strategies with technological advancements.

2. Sustainability Integration: As environmental concerns rise, hardware manufacturers are incorporating sustainability into their operations. Buyers are urged to consider suppliers that prioritize eco-friendly practices and offer sustainable products. This shift is not merely a trend; it’s becoming a crucial differentiator in vendor selection.

3. Supply Chain Resilience: The recent disruptions in global supply chains have emphasized the importance of diversifying sourcing strategies. Buyers should look for suppliers who demonstrate agility and reliability in their delivery capabilities. Establishing strong relationships with multiple vendors can mitigate risks associated with reliance on a single source.

4. Cost Management: With inflationary pressures affecting production costs, buyers must adopt strategic sourcing practices. This includes negotiating long-term contracts and exploring bulk purchasing options to optimize budgets and secure favorable pricing.

5. Enhanced Vendor Relationships: Strong supplier partnerships are essential for ensuring timely access to quality hardware. Buyers should invest time in developing relationships that foster collaboration and transparency, enabling better responsiveness to market changes.

Sustainability & Ethical Sourcing in B2B

Sustainability and ethical sourcing are no longer optional considerations for hardware manufacturers; they are essential to maintaining competitive advantage and brand reputation. The environmental impact of hardware production, including resource depletion and e-waste, necessitates a shift towards more sustainable practices.

1. Importance of Ethical Supply Chains: Buyers should prioritize suppliers with ethical sourcing practices that ensure fair labor conditions and responsible resource management. This commitment not only enhances brand loyalty but also mitigates risks associated with reputational damage from unethical practices.

2. Green Certifications and Materials: The growing demand for ‘green’ certifications (e.g., Energy Star, EPEAT) signifies a shift towards environmentally responsible products. Buyers should seek manufacturers that utilize recycled materials and energy-efficient processes. This not only reduces the ecological footprint but also aligns with the increasing regulatory pressures on environmental performance.

3. Circular Economy Practices: Embracing circular economy principles, such as product lifecycle management and take-back programs, can significantly reduce waste. Buyers can advocate for suppliers that implement these practices, ensuring that products are designed for longevity, repairability, and recyclability.

Brief Evolution/History

The hardware manufacturing sector has evolved significantly over the past few decades, driven by technological innovations and shifting market demands. Initially dominated by large corporations focused on mass production, the industry has transformed with the rise of specialized manufacturers catering to niche markets.

The introduction of digital technologies in the 1990s sparked a wave of innovation, leading to the miniaturization of components and the development of more complex systems. Today, the focus has shifted towards integration, sustainability, and the adoption of smart technologies, emphasizing the need for hardware manufacturers to adapt continuously to remain competitive in a globalized economy.

This evolution offers B2B buyers a wealth of options and opportunities to leverage advanced technologies while embracing sustainable practices in their procurement strategies.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of hardware manufacturers

-

What criteria should I use to vet hardware manufacturers?

When vetting hardware manufacturers, consider their industry experience, reputation, and certifications. Look for manufacturers with a proven track record in your specific hardware needs. Request references from existing clients and check online reviews. It’s also essential to evaluate their production capabilities, quality control processes, and compliance with international standards. Establishing a clear communication channel can help gauge their responsiveness and willingness to collaborate. -

Can I customize hardware according to my business needs?

Most hardware manufacturers offer customization options, but the extent depends on their capabilities and resources. Discuss your specific requirements during the initial negotiations. Be clear about the features you need, as well as any design elements. Keep in mind that customization may impact costs and lead times, so ensure you have a comprehensive understanding of any potential implications before proceeding. -

What are the typical minimum order quantities (MOQ) and lead times for hardware procurement?

Minimum order quantities (MOQ) can vary significantly among manufacturers, often influenced by production processes and the type of hardware. Generally, MOQs can range from a few units for standard products to hundreds for custom solutions. Lead times also depend on factors like production schedules and shipping logistics; they can range from a few weeks to several months. Always inquire about these terms upfront to manage your procurement timeline effectively. -

How can I ensure quality assurance and certifications from manufacturers?

To ensure quality assurance, request documentation of relevant certifications such as ISO 9001 or industry-specific standards. Ask about their quality control processes, including testing protocols and inspection methods. Visiting the manufacturing facility, if possible, can provide additional insights into their commitment to quality. Establishing a quality assurance agreement can also help enforce standards throughout the production process. -

What logistics considerations should I keep in mind when sourcing hardware internationally?

Logistics plays a critical role in international procurement. Consider shipping options, costs, and transit times, as these can affect your overall budget and timeline. Understand the import/export regulations and tariffs applicable in your country and the manufacturer’s location. Collaborate with a logistics partner familiar with international shipping to ensure smooth delivery and compliance with all regulations. -

How can I address potential disputes with manufacturers?

To mitigate disputes, establish clear contractual terms regarding product specifications, delivery timelines, and payment terms. Include clauses for conflict resolution, such as mediation or arbitration, to provide a structured approach if issues arise. Maintain open communication throughout the procurement process to address concerns promptly. Document all communications and agreements to support your position if disputes occur. -

What payment terms are common in international hardware procurement?

Payment terms can vary widely, but common practices include upfront deposits, letters of credit, and payment upon delivery. Assess the manufacturer’s payment flexibility and negotiate terms that align with your cash flow needs. Consider using escrow services for large transactions to protect both parties. Understanding the risks associated with different payment methods will help you make informed decisions that safeguard your investment. -

How do I keep track of my hardware assets effectively?

Implementing a robust hardware asset management system is essential for tracking your inventory. Utilize asset management software that allows you to monitor usage, maintenance schedules, and replacement timelines. Regular audits of your hardware can help identify underutilized assets and inform future procurement decisions. Establish clear guidelines for asset maintenance to prolong the lifespan of your hardware and optimize your overall procurement strategy.

Illustrative Image (Source: Google Search)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for hardware manufacturers

In today’s rapidly evolving technological landscape, strategic sourcing has emerged as a pivotal component for hardware manufacturers aiming to maintain competitive advantages. By establishing a well-defined procurement strategy, companies can streamline their processes, enhance supplier relationships, and effectively manage the lifecycle of their assets. These practices not only optimize costs but also minimize downtime, thus ensuring operational efficiency.

Key takeaways for international B2B buyers include the importance of robust supplier management, which fosters trust and reliability, and the need for proactive asset lifecycle planning to mitigate risks associated with hardware failure. Moreover, understanding the financial aspects of procurement can significantly aid in budgeting and forecasting, ensuring that companies are prepared for unforeseen expenses.

Looking forward, it is essential for buyers from Africa, South America, the Middle East, and Europe to embrace these strategic sourcing principles. By doing so, they can position their organizations for long-term success in a competitive market. Now is the time to assess and refine your sourcing strategies, ensuring that your hardware procurement not only meets current needs but also anticipates future demands. Engage with suppliers who can offer tailored solutions and foster partnerships that drive innovation and growth.