Your Ultimate Guide to Sourcing Lubrication System

Introduction: Navigating the Global Market for lubrication system

In today’s competitive industrial landscape, the efficiency and longevity of machinery hinge significantly on the effectiveness of lubrication systems. As global supply chains become more interconnected, international B2B buyers must prioritize the selection of appropriate lubrication solutions to mitigate operational risks and enhance equipment performance. Poor lubrication practices can lead to costly downtime and equipment failures, with studies indicating that nearly 40% of premature bearing failures are linked to inadequate lubrication.

This guide is crafted specifically for discerning buyers from Africa, South America, the Middle East, and Europe, aiming to equip you with essential insights into the diverse types of lubrication systems available in the market. We delve into system classifications, including manual and automatic solutions, and explore the materials used, manufacturing processes, and quality control measures that ensure reliability and efficiency.

Moreover, we provide a comprehensive overview of leading suppliers, cost considerations, and market trends, along with a dedicated FAQ section to address common concerns. By navigating this guide, B2B buyers will be empowered to make informed sourcing decisions that align with their operational needs and regional challenges, ensuring optimal performance and sustainability of their machinery.

Understanding lubrication system Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Manual Lubrication Systems | Human-operated; low initial cost; high labor intensity | Small operations, non-critical machinery | Pros: Cost-effective; Cons: Labor-intensive, inconsistent lubrication leads to potential equipment damage. |

| Automatic Cyclic Systems | Delivers lubricant at set intervals; medium complexity | Medium operations, semi-critical equipment | Pros: Reduces labor; Cons: Initial costs higher than manual, requires regular maintenance. |

| Automatic Continuous Systems | Provides uninterrupted lubrication; high precision | Large operations, critical machinery | Pros: Excellent for high-speed applications; Cons: Higher initial investment and complex design. |

| Single-Line Parallel Systems | Delivers lubricant to multiple points via a single line | Manufacturing, construction equipment | Pros: Simplifies maintenance; Cons: Can be less precise for individual lubrication needs. |

| Timer-Actuated Pneumatic Systems | Uses compressed air for lubrication; adjustable cycling | Hazardous environments, remote locations | Pros: Safe in explosive atmospheres; Cons: Requires air supply and may face pressure variations. |

Manual Lubrication Systems

Manual lubrication systems are operated by personnel who apply lubricant directly to machinery. These systems are cost-effective and straightforward, making them suitable for small operations or non-critical machinery. However, the labor-intensive nature of manual systems can lead to inconsistent lubrication, increasing the risk of equipment failure. Buyers should consider the long-term costs associated with potential machinery damage due to improper lubrication practices.

Automatic Cyclic Systems

Automatic cyclic lubrication systems deliver lubricant at predetermined intervals, reducing the need for manual intervention. These systems are ideal for medium-sized operations and semi-critical machinery, striking a balance between cost and efficiency. While they do save labor and improve consistency, buyers must account for the higher initial investment and ongoing maintenance requirements, which can affect ROI.

Automatic Continuous Systems

Automatic continuous lubrication systems provide a steady flow of lubricant to machinery, ensuring optimal performance and minimal wear. These systems are best suited for large operations and critical machinery, particularly in high-speed applications. Although they offer significant efficiency gains, the initial costs can be substantial, and precise system design is crucial to avoid operational issues. Buyers should evaluate the long-term benefits against upfront costs.

Single-Line Parallel Systems

Single-line parallel lubrication systems utilize a single supply line to deliver lubricant to multiple points, controlled individually through metering valves. This system is commonly found in manufacturing and construction equipment. While it simplifies maintenance and reduces labor costs, it may not provide the precision required for all lubrication points. Buyers should assess whether the trade-off in precision is acceptable for their specific applications.

Timer-Actuated Pneumatic Systems

Timer-actuated pneumatic lubrication systems are designed for hazardous environments, using compressed air to deliver lubricant with adjustable cycling. These systems are particularly useful in locations where electrical systems pose risks. Although they provide safety and robustness, buyers must ensure a reliable compressed air supply is available, as pressure variations can affect performance. Proper assessment of the working environment is critical for effective implementation.

Related Video: What are the types of lubrication system?

Key Industrial Applications of lubrication system

| Industry/Sector | Specific Application of Lubrication System | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Manufacturing | CNC Machine Tools | Enhances precision and reduces wear | Compatibility with machine specs and lubricant type |

| Mining | Conveyor Systems | Minimizes downtime and maintenance costs | Resistance to extreme conditions and easy maintenance |

| Automotive | Assembly Line Robots | Increases efficiency and reduces friction | Reliability and scalability of lubrication systems |

| Agriculture | Tractors and Heavy Equipment | Extends equipment life and enhances productivity | Availability of local support and service options |

| Oil & Gas | Offshore Drilling Equipment | Ensures reliability in harsh environments | Compliance with safety and environmental regulations |

Manufacturing: CNC Machine Tools

In the manufacturing sector, CNC machine tools require precise lubrication to maintain accuracy and prolong tool life. Automatic lubrication systems ensure consistent oil delivery, reducing wear on moving parts and minimizing the risk of machine failure. For international buyers, especially in Africa and South America, sourcing systems that can operate under varied local conditions, such as temperature fluctuations and humidity, is essential. Compatibility with existing machinery and ease of maintenance are also critical factors to consider.

Mining: Conveyor Systems

Conveyor systems in mining operations are pivotal for transporting materials. Effective lubrication systems reduce friction and wear, significantly lowering maintenance costs and preventing unexpected downtime. International buyers from the Middle East and Europe should prioritize sourcing robust systems that can withstand harsh mining environments, including dust and extreme temperatures. Additionally, systems that offer remote monitoring capabilities can enhance operational efficiency by providing real-time data on lubrication performance.

Automotive: Assembly Line Robots

In the automotive industry, assembly line robots rely on precise lubrication to operate efficiently. Automatic lubrication systems minimize human error and ensure that all moving parts receive the necessary lubrication at the right intervals. For B2B buyers in Europe and South Africa, selecting systems that are scalable and compatible with various robotic models is crucial. Moreover, considering the availability of local service and support can significantly reduce potential downtime.

Agriculture: Tractors and Heavy Equipment

Agricultural machinery, such as tractors and harvesters, benefit greatly from effective lubrication systems. These systems help reduce wear and tear on components, leading to longer equipment life and improved productivity. Buyers in regions like South America must consider the availability of lubricants that can perform well in diverse agricultural conditions, including dust and moisture. Additionally, ease of access to maintenance services can greatly enhance the value of the lubrication systems sourced.

Oil & Gas: Offshore Drilling Equipment

In the oil and gas sector, offshore drilling equipment operates under some of the most challenging conditions. Reliable lubrication systems are essential for preventing equipment failure and ensuring safety. International buyers in this industry should focus on sourcing lubrication systems that comply with stringent safety and environmental regulations. Furthermore, systems designed for easy monitoring and maintenance can provide significant operational benefits, helping to avoid costly downtime in remote locations.

Related Video: Automatic Lubrication System

Strategic Material Selection Guide for lubrication system

When selecting materials for lubrication systems, it is crucial to consider the specific properties and performance characteristics that will impact the system’s overall effectiveness. Below, we analyze four common materials used in lubrication systems, focusing on their key properties, advantages, disadvantages, and implications for international B2B buyers.

1. Steel

Key Properties: Steel is known for its high tensile strength and durability. It typically has a temperature rating up to 250°C and can withstand high pressures, making it suitable for heavy-duty applications. However, it is prone to corrosion unless treated.

Pros & Cons: Steel’s primary advantage is its strength and resistance to deformation, which is critical in high-load applications. The downside is that untreated steel can corrode, especially in humid or chemically aggressive environments, leading to potential system failures.

Impact on Application: Steel is compatible with a wide range of lubricants, including oils and greases. However, in corrosive environments, buyers must consider protective coatings or stainless steel alternatives.

Considerations for International Buyers: Buyers in regions with high humidity or corrosive conditions (e.g., coastal areas in Africa or South America) should prioritize corrosion-resistant treatments. Compliance with international standards, such as ASTM A36 for structural steel, is essential.

2. Aluminum

Key Properties: Aluminum is lightweight and has a good strength-to-weight ratio, with a temperature rating up to 150°C. It exhibits excellent corrosion resistance, particularly when anodized.

Pros & Cons: The lightweight nature of aluminum makes it ideal for applications where weight is a concern, such as in automotive lubrication systems. However, it is less durable under high loads compared to steel, which may limit its use in heavy machinery.

Impact on Application: Aluminum is compatible with many lubricants but may react with certain oils, particularly those with high acidity. This requires careful selection of lubricants to avoid degradation.

Considerations for International Buyers: Buyers should ensure that aluminum components meet relevant standards, such as ASTM B221 for extruded aluminum. In regions with high temperatures (like the Middle East), the thermal limits of aluminum should be carefully considered.

3. Polypropylene

Key Properties: Polypropylene is a thermoplastic polymer with excellent chemical resistance and a temperature rating up to 100°C. It is lightweight and has good impact resistance.

Pros & Cons: The primary advantage of polypropylene is its resistance to a wide range of chemicals, making it suitable for various lubricant formulations. However, it has lower mechanical strength compared to metals, which can limit its application in high-stress environments.

Impact on Application: Polypropylene is ideal for use in lubrication systems that handle aggressive chemicals or in environments where corrosion is a concern. Its compatibility with various media makes it versatile.

Considerations for International Buyers: Compliance with standards such as ASTM D638 for tensile properties is important. Buyers in regions with diverse chemical applications (like South America) should ensure that polypropylene components are suitable for their specific media.

4. Nitrile Rubber

Key Properties: Nitrile rubber is known for its excellent oil resistance and can operate effectively in temperatures ranging from -40°C to 120°C. It is commonly used for seals and gaskets in lubrication systems.

Pros & Cons: The key advantage of nitrile rubber is its ability to withstand exposure to oils and fuels, making it ideal for sealing applications. However, it is less resistant to heat and can degrade in high-temperature environments.

Impact on Application: Nitrile rubber seals are crucial for preventing lubricant leakage, which can lead to system inefficiencies. Proper selection based on temperature and oil compatibility is vital.

Considerations for International Buyers: Buyers should ensure that nitrile rubber meets relevant standards, such as ASTM D2000 for rubber materials. In regions with extreme temperatures (like Africa), selecting the right grade of nitrile is critical for performance.

Summary Table

| Material | Typical Use Case for lubrication system | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Heavy-duty machinery components | High strength and durability | Prone to corrosion | Medium |

| Aluminum | Lightweight automotive systems | Excellent corrosion resistance | Lower durability under high loads | Medium |

| Polypropylene | Chemical handling applications | Excellent chemical resistance | Lower mechanical strength | Low |

| Nitrile Rubber | Seals and gaskets | Excellent oil resistance | Less heat resistance | Low |

This analysis provides a comprehensive overview of common materials used in lubrication systems, enabling international B2B buyers to make informed decisions based on their specific application needs and regional considerations.

In-depth Look: Manufacturing Processes and Quality Assurance for lubrication system

Manufacturing Processes for Lubrication Systems

The manufacturing of lubrication systems involves a series of well-defined stages, each crucial for ensuring the final product meets industry standards and customer expectations. Understanding these processes can help B2B buyers from diverse regions—such as Africa, South America, the Middle East, and Europe—make informed decisions when selecting suppliers.

Illustrative Image (Source: Google Search)

1. Material Preparation

The first step in manufacturing lubrication systems is the preparation of raw materials. Common materials include metals (such as steel and aluminum), plastics, and elastomers.

- Material Selection: Choose materials that meet specific operational requirements, such as corrosion resistance, thermal stability, and mechanical strength.

- Quality Control: Ensure that materials undergo rigorous testing for quality and compliance with international standards (e.g., ISO, ASTM).

2. Forming Techniques

Once materials are prepared, various forming techniques are employed to shape the components of lubrication systems. Key techniques include:

- Machining: Processes such as turning, milling, and drilling are used to create precise components. CNC (Computer Numerical Control) machines are often utilized for high accuracy.

- Injection Molding: This technique is commonly used for producing plastic parts, such as housings and seals, allowing for complex shapes and high-volume production.

- Casting: Metal components may be created through casting processes, where molten metal is poured into molds.

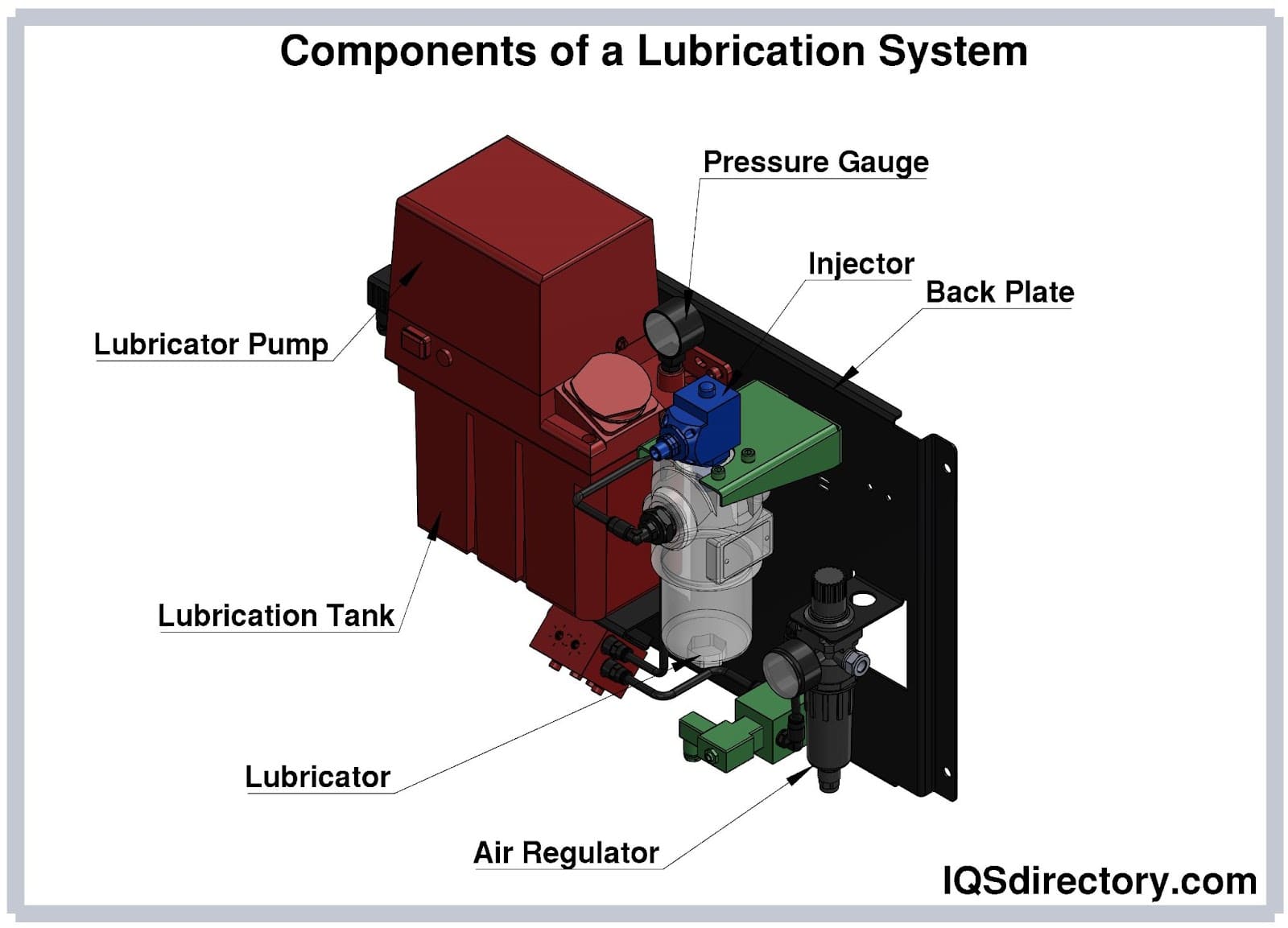

3. Assembly

The assembly stage is where individual components come together to form the complete lubrication system.

- Component Assembly: This involves the integration of various parts, such as pumps, valves, and piping. Automated assembly lines may be utilized to enhance efficiency and reduce labor costs.

- System Integration: During this stage, the lubrication system is assembled according to specific configurations that meet the operational requirements of the intended machinery.

4. Finishing

Finishing processes are essential for enhancing the durability and aesthetics of lubrication systems.

- Surface Treatment: Techniques such as anodizing, plating, or powder coating may be applied to protect against corrosion and wear.

- Final Inspection: Each unit undergoes a thorough inspection to ensure it meets design specifications and quality standards.

Quality Assurance in Manufacturing

Quality assurance (QA) is critical in the manufacturing of lubrication systems to ensure reliability and performance. B2B buyers should be aware of the following aspects of QA:

Relevant International Standards

Adherence to established standards is crucial for manufacturers looking to compete in the global market. Key standards include:

- ISO 9001: A widely recognized standard for quality management systems, ensuring consistent quality in manufacturing processes.

- CE Marking: Required for products sold in the European Economic Area, indicating compliance with health, safety, and environmental protection standards.

- API Standards: The American Petroleum Institute (API) sets standards specifically for lubrication products, ensuring they meet industry-specific requirements.

Quality Control Checkpoints

A robust quality control process typically includes several checkpoints:

- Incoming Quality Control (IQC): Raw materials are inspected upon arrival to ensure they meet specified requirements.

- In-Process Quality Control (IPQC): Continuous monitoring during the manufacturing process to identify and rectify issues in real-time.

- Final Quality Control (FQC): A comprehensive assessment of the finished product, ensuring it meets all specifications before shipment.

Common Testing Methods

To ensure the quality and performance of lubrication systems, various testing methods are employed:

- Pressure Testing: Verifies the integrity of seals and connections under operational pressure.

- Flow Rate Testing: Measures the efficiency of lubricant delivery to ensure it meets operational requirements.

- Durability Testing: Assesses the lifespan and performance of components under simulated operational conditions.

Verifying Supplier Quality Control

B2B buyers should implement strategies to verify the quality control practices of potential suppliers:

- Supplier Audits: Conduct regular audits of suppliers to assess their compliance with quality standards and manufacturing processes.

- Quality Reports: Request detailed quality reports that outline the results of testing and inspections conducted throughout the manufacturing process.

- Third-Party Inspections: Engage independent inspection agencies to perform unbiased assessments of the manufacturing facility and products.

Navigating Quality Control Nuances for International Buyers

International B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, should be cognizant of the unique challenges in verifying quality control:

- Regulatory Compliance: Different countries have varying regulations regarding product standards. Ensure that suppliers understand and comply with local regulations in your region.

- Cultural Differences: Communication and expectations may vary across cultures. Establish clear guidelines and expectations for quality standards and reporting.

- Supply Chain Transparency: Seek suppliers who provide transparency in their supply chain processes, allowing for better traceability and accountability.

Conclusion

Understanding the manufacturing processes and quality assurance measures for lubrication systems is essential for B2B buyers aiming to make informed purchasing decisions. By focusing on material preparation, forming techniques, assembly, and finishing, alongside robust quality control practices, buyers can ensure they select reliable and high-quality lubrication systems that meet their operational needs.

Comprehensive Cost and Pricing Analysis for lubrication system Sourcing

Understanding the cost structure and pricing dynamics of lubrication systems is essential for international B2B buyers, particularly those operating in Africa, South America, the Middle East, and Europe. Here’s a detailed analysis of the cost components, price influencers, and actionable tips for effective sourcing.

Cost Components

-

Materials: The primary cost driver, materials include various components such as pumps, hoses, fittings, and control systems. The choice of materials affects both durability and performance, which can impact the overall cost significantly.

-

Labor: Labor costs encompass not only the assembly of lubrication systems but also the installation and maintenance services. These costs can vary widely based on regional wage standards and the complexity of the installation.

-

Manufacturing Overhead: This includes expenses related to factory operations, such as utilities, rent, and equipment depreciation. Efficient manufacturing processes can help reduce these costs, ultimately affecting pricing.

-

Tooling: Initial tooling costs can be substantial, especially for custom solutions. These costs are often amortized over the production run, so higher volume orders can lead to lower per-unit costs.

-

Quality Control (QC): Ensuring product quality through rigorous testing and quality assurance processes adds to the overall cost. Certifications, such as ISO standards, can further increase QC expenses but may also enhance product reliability.

-

Logistics: Transportation, warehousing, and distribution costs can significantly affect the final price. International shipping considerations, including customs duties and tariffs, should also be factored into the overall cost analysis.

-

Margin: Suppliers typically include a profit margin that can vary based on market conditions, competition, and the perceived value of their products. Understanding this margin is crucial for effective negotiation.

Price Influencers

Several factors can influence the pricing of lubrication systems:

-

Volume/MOQ (Minimum Order Quantity): Larger orders often qualify for volume discounts, making them more cost-effective. Buyers should assess their needs to optimize order sizes.

-

Specifications/Customization: Custom-built systems generally incur higher costs due to additional design and engineering efforts. Buyers should clearly define their requirements to avoid unnecessary expenses.

-

Materials: The choice of high-performance or specialized materials can drive up costs. Assessing the trade-off between material quality and performance needs is essential.

-

Quality/Certifications: Higher-quality systems with certifications may command premium prices but can lead to reduced maintenance and longer service life, thus providing better value in the long run.

-

Supplier Factors: Supplier reputation, reliability, and after-sales support can influence pricing. Established suppliers may charge more but often provide better service and reliability.

-

Incoterms: Understanding the International Commercial Terms (Incoterms) can help buyers manage shipping costs and responsibilities effectively. Terms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) can significantly impact overall costs.

Buyer Tips

-

Negotiation: Engage suppliers in discussions regarding pricing flexibility. Highlighting your potential for repeat business can leverage better pricing.

-

Cost Efficiency: Conduct a thorough analysis of the Total Cost of Ownership (TCO), which includes purchase price, maintenance, and operational costs. This approach provides a clearer picture of long-term value.

-

Pricing Nuances for International Buyers: Be aware of currency fluctuations and local economic conditions that might affect pricing. Establishing relationships with local distributors can also mitigate some costs.

-

Supplier Assessment: Conduct due diligence on suppliers, assessing their financial stability, product quality, and customer service. A reliable supplier can save costs associated with delays and product failures.

-

Benchmarking: Compare prices from multiple suppliers to establish a competitive baseline. This can help identify whether a quote is reasonable and assist in negotiations.

Disclaimer

Prices and cost structures are indicative and can vary based on market conditions, specific requirements, and supplier negotiations. Buyers are encouraged to conduct thorough research and obtain multiple quotes to ensure they are getting the best value for their investment in lubrication systems.

Spotlight on Potential lubrication system Manufacturers and Suppliers

This section looks at several manufacturers active in the ‘lubrication system’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct extensive due diligence before any transaction. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for lubrication system

Key Technical Properties of Lubrication Systems

Understanding the essential technical properties of lubrication systems is crucial for international B2B buyers. These specifications ensure compatibility, performance, and reliability in various applications.

1. Material Grade

The material grade refers to the quality and type of materials used in the construction of lubrication components, such as pumps, hoses, and fittings. Common materials include stainless steel, brass, and high-density polyethylene. Selecting the right material is vital for durability, especially in harsh environments, as it affects the system’s resistance to corrosion, wear, and temperature variations.

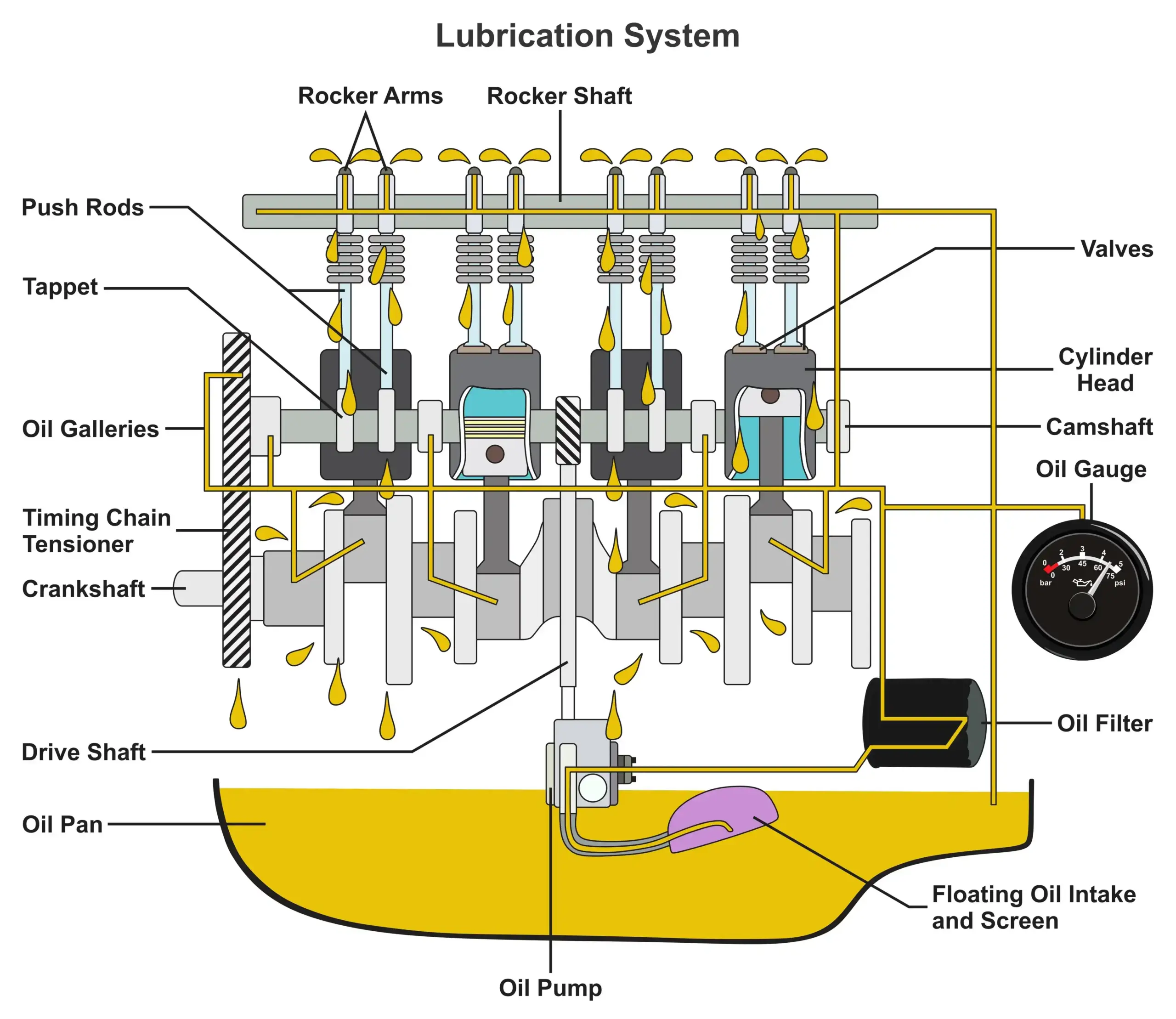

2. Flow Rate

Flow rate indicates the volume of lubricant that can be delivered by the system over a specified time (typically measured in liters per minute). This specification is critical for ensuring that machinery receives adequate lubrication, which is essential for preventing overheating and reducing wear. A mismatch in flow rates can lead to equipment failure, increased downtime, and higher maintenance costs.

3. Pressure Rating

The pressure rating of a lubrication system defines the maximum pressure the system can safely handle. This specification is particularly important for systems that operate under high load conditions. Understanding pressure ratings helps buyers select appropriate components and avoid failures that can result from over-pressurization.

4. Temperature Range

Temperature range indicates the operational limits within which a lubrication system can function effectively. Different lubricants have varying viscosities and performance characteristics at different temperatures. Buyers must ensure that the chosen system can maintain performance across the expected temperature fluctuations in their operational environment.

5. Tolerance

Tolerance refers to the allowable deviation from specified dimensions in the manufacturing of lubrication components. High tolerance levels are crucial for ensuring that parts fit together correctly, which is necessary for preventing leaks and maintaining system efficiency. Poor tolerance can lead to increased wear and premature failure.

6. Lubricant Viscosity

Viscosity measures a lubricant’s resistance to flow at a given temperature. It is a critical property that affects lubrication efficiency and is vital for machinery performance. Buyers should consider the viscosity of lubricants to ensure optimal performance under varying operational conditions.

Common Trade Terms in Lubrication Systems

Familiarizing oneself with industry-specific terminology can facilitate smoother transactions and better decision-making.

1. OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts and equipment that may be marketed by another manufacturer. In the lubrication industry, understanding OEM specifications ensures that replacement parts are compatible with existing systems, thereby maintaining performance and reliability.

2. MOQ (Minimum Order Quantity)

MOQ is the smallest quantity of a product that a supplier is willing to sell. For buyers, knowing the MOQ is essential for budgeting and inventory management. It can also affect the overall cost, as ordering below the MOQ may lead to higher unit prices.

3. RFQ (Request for Quotation)

An RFQ is a document that buyers send to suppliers to request pricing and terms for specific products or services. Using an RFQ can help buyers compare offers from multiple suppliers, ensuring they secure the best price and terms for their lubrication system needs.

4. Incoterms (International Commercial Terms)

Incoterms are a set of predefined commercial terms used in international trade. They clarify the responsibilities of buyers and sellers regarding shipping, insurance, and tariffs. Understanding Incoterms is critical for buyers to manage risks and costs associated with international procurement of lubrication systems.

5. Lead Time

Lead time refers to the period between placing an order and receiving the goods. Understanding lead times helps buyers plan their inventory and maintenance schedules effectively. Longer lead times can impact operational efficiency, especially in industries that rely on just-in-time inventory practices.

6. Compatibility

Compatibility in lubrication systems refers to the ability of different components (e.g., lubricants, seals, pumps) to work together without causing damage or inefficiency. Ensuring compatibility is vital to prevent equipment failures and to maximize the lifespan of machinery.

By mastering these technical properties and trade terms, B2B buyers can make informed decisions that enhance operational efficiency and cost-effectiveness in their lubrication systems.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the lubrication system Sector

Market Overview & Key Trends

The lubrication system sector is experiencing significant transformation driven by technological advancements, sustainability mandates, and evolving market dynamics. Global demand for efficient lubrication solutions is largely fueled by the need to enhance machinery lifespan, reduce downtime, and optimize operational efficiency. Emerging technologies such as IoT-enabled automatic lubrication systems are gaining traction, allowing for real-time monitoring and predictive maintenance. This trend is particularly relevant for international buyers in regions like Africa and South America, where machinery uptime is critical to economic growth.

In addition, the emphasis on automation and smart technologies is reshaping procurement strategies. B2B buyers are increasingly favoring suppliers that offer integrated solutions combining lubrication systems with advanced data analytics. The shift from traditional manual systems to more sophisticated automatic systems is not only about efficiency but also about reducing labor costs and minimizing human error. As companies across Europe and the Middle East adopt these technologies, the market is witnessing a convergence of traditional lubrication techniques with modern digital solutions.

Moreover, sustainability is becoming a crucial consideration in sourcing decisions. Buyers are now more inclined to partner with manufacturers who demonstrate a commitment to eco-friendly practices, such as using biodegradable lubricants and recyclable packaging. This trend is particularly pronounced in Europe, where regulatory frameworks are stringent, pushing companies to adopt more sustainable operations. As a result, the lubrication system market is evolving into a more competitive arena, where technological innovation and environmental responsibility are key differentiators.

Sustainability & Ethical Sourcing in B2B

Sustainability and ethical sourcing have emerged as paramount concerns in the lubrication system sector. The environmental impact of lubricants, particularly those derived from petroleum, has led to increased scrutiny from regulators and consumers alike. B2B buyers are now tasked with not only ensuring the efficiency of their lubrication systems but also evaluating the lifecycle of the products they source. This involves assessing the carbon footprint of lubricants, the biodegradability of materials, and the overall sustainability of the supply chain.

The importance of ethical supply chains cannot be overstated. Buyers are increasingly seeking suppliers who adhere to strict environmental standards and demonstrate transparency in their sourcing practices. Certifications such as ISO 14001 for environmental management and eco-labels for green products serve as essential indicators of a supplier’s commitment to sustainability. Moreover, the use of bio-based lubricants and synthetic alternatives that meet rigorous environmental standards is gaining momentum. These products not only minimize environmental impact but can also enhance performance in demanding applications, offering a dual advantage for buyers.

By prioritizing sustainability, companies can not only comply with regulatory requirements but also align with the values of their customers, fostering brand loyalty and enhancing their market reputation. This strategic focus on ethical sourcing and sustainability will likely differentiate successful B2B buyers in a competitive landscape.

Brief Evolution/History

The evolution of lubrication systems can be traced back to ancient civilizations that utilized natural oils and fats for machinery. However, the modern lubrication system sector began to take shape during the Industrial Revolution, with the introduction of more sophisticated machinery and the need for reliable lubrication to prevent wear and tear.

Throughout the 20th century, advancements in petroleum refining led to the development of synthetic lubricants, which offered superior performance and longer service intervals. In recent years, the focus has shifted towards automation and sustainability, reflecting broader industrial trends. Today, the lubrication system market is characterized by a blend of traditional practices and cutting-edge technologies, positioning it as a critical component in the operational strategies of businesses worldwide. This historical context is vital for B2B buyers, as understanding the evolution of lubrication technologies can inform better sourcing decisions and strategic partnerships.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of lubrication system

-

How can I effectively vet suppliers of lubrication systems?

When vetting suppliers, prioritize those with a proven track record in your industry. Request references and case studies to evaluate their experience and reliability. Check for certifications such as ISO 9001, which indicates adherence to quality management standards. Engage in direct communication to assess their responsiveness and willingness to provide technical support. Utilize platforms like LinkedIn or industry forums to gather feedback from other users about their experiences with the supplier. -

Are lubrication systems customizable to fit specific operational needs?

Yes, many suppliers offer customization options for lubrication systems to meet the unique demands of your operations. Customization can include adjustments in capacity, control mechanisms, and integration with existing machinery. When discussing your needs, be clear about your operational challenges and the environment in which the system will operate. Request detailed proposals from suppliers that outline how they can tailor solutions specifically for your application. -

What are typical minimum order quantities (MOQs) and lead times for lubrication systems?

Minimum order quantities (MOQs) can vary significantly based on the supplier and the complexity of the lubrication system. Generally, MOQs might range from one unit for standard systems to larger quantities for customized solutions. Lead times can also vary; expect anywhere from a few weeks to several months depending on the customization level and supplier location. Always clarify these terms upfront to align with your project timelines and budget. -

What payment terms are standard when sourcing lubrication systems internationally?

Payment terms for international transactions often include options such as letters of credit, advance payments, or net payment terms (e.g., net 30 or net 60 days). It’s essential to establish clear terms that protect both parties. Ensure that any agreements are documented in contracts to avoid disputes. Additionally, consider the implications of currency fluctuations and fees associated with international transactions, which could affect the overall cost.

-

What quality assurance measures should I look for in lubrication system suppliers?

Look for suppliers who implement rigorous quality assurance (QA) protocols, including testing and inspection procedures for their products. Inquire about certifications such as ISO 9001 or other relevant industry standards. Request documentation of quality control practices and any third-party audits. Understanding how they monitor and maintain quality will help ensure the reliability and performance of the lubrication systems you purchase. -

How can I ensure smooth logistics when sourcing lubrication systems?

Effective logistics management is crucial for timely delivery and installation of lubrication systems. Discuss shipping options and timelines with your supplier, and consider using logistics partners experienced in handling industrial equipment. Ensure that all necessary customs documentation is prepared in advance to avoid delays. Also, plan for potential local regulations regarding equipment installation, which might affect the logistics process. -

What steps should I take in case of a dispute with a supplier?

In the event of a dispute, first attempt to resolve the issue through direct communication with the supplier. Document all communications and agreements related to the dispute for reference. If necessary, escalate the matter to higher management within the supplier’s organization. If resolution remains elusive, consider mediation or arbitration as outlined in your contract. It’s advisable to consult legal counsel familiar with international trade laws to understand your rights and options. -

What certifications should lubrication systems have for international compliance?

Depending on your region and industry, look for certifications such as CE marking for European markets, UL certification for safety standards, or ISO certifications for quality management. These certifications ensure that the lubrication systems meet specific safety, environmental, and performance standards. Always verify that the supplier can provide documentation for these certifications, as this is vital for compliance and regulatory approvals in your country.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for lubrication system

In the ever-evolving landscape of lubrication systems, strategic sourcing emerges as a critical factor for international B2B buyers. By understanding the various types of lubrication systems—manual, automatic cyclic, and automatic continuous—buyers can tailor their choices to fit specific operational needs and budget constraints. The potential to reduce maintenance costs and extend equipment life by up to 30% emphasizes the importance of investing in the right lubrication technology.

Moreover, leveraging data-driven insights to map lubrication points and calculate precise oil requirements can significantly enhance operational efficiency. As global markets shift, particularly in regions like Africa, South America, the Middle East, and Europe, the demand for reliable and efficient lubrication solutions is likely to increase.

Illustrative Image (Source: Google Search)

B2B buyers should not only focus on the initial cost but also consider long-term ROI, including reduced downtime and improved machinery performance. Embracing advanced automatic lubrication systems can lead to substantial gains in productivity and safety.

As we look ahead, the integration of innovative technologies and sustainable practices in lubrication systems will become paramount. Now is the time for buyers to engage with suppliers who prioritize these advancements, ensuring a competitive edge in their respective markets.